Nearly every blog has been talking about the SPG American Express for the last month because of the ridiculously “high” sign-up bonus. Everywhere you look, bloggers are pushing the SPG American Express for the 35,000-point sign-up bonus, which ends April 4, 2017. The card itself is not even that great nor does the card demand the attention it’s actually getting. It’s probably a card most will be cancelling after the first year, as there are few reasons other than the sign-up bonus to keep this card in your wallet.

Why are bloggers really pushing this card? If you don’t know by now, most bloggers only write about cards which they have affiliate links for. Everyone wants the referral income for each new approval. It is how they support their blogs. After all, have you seen many Korean Air Skypass, Virgin America Elevate, or Cathay Pacific Asia miles credit card blog posts lately? Probably not, as they don’t pay, or not as well. Yes, I am guilty of writing about the SPG card too, not for money, but for referral points. Yet, now I’m going to tell you why you should not get the card.

35,000 points – So What?

The draw to the SPG American express right now is the sign-up bonus. The current bonus is 35,000 Starpoints. That is 10,000 points more than normal. These points do equate to 105,000 Marriott points, but even if transferred to Marriott, the points do not count towards lifetime status. If Marriott lifetime status is your goal, you will still be 105,000 points short. 105,000 points is A LOT of points, but then again, most hotel stays cost A LOT with Marriott! 105,000 points is only worth one night at a top tier hotel or two nights at a top level hotel. If you leave them with SPG, it’s only one night at a top end hotel.

Even if you maximize the value of this card and push yourself to rack up $5,000 in debt to earn the 35,000 points, the most you are going to get out of it, is a night or two at a top end resort. Imagine that, $5,000 in debt to save a couple hundred dollars.

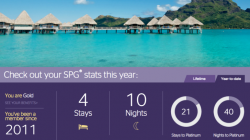

If you use this sign-up bonus for a high end stay, you might save some money. For example for 35,000 points you can get one night at the St. Regis Bora Bora. One night is $1,075! So yes you can save $1000, but who only goes to Bora Bora for one night? A location such as Bora Bora demands a longer stay than a night. So plan to drop another $5,000+ in the process. If you can afford that, are you truly worried about saving $1,000? Just saying.

For me, hotels are cheap compared to the cost of a plane ticket or other expenses. I travel nearly every week for work and pleasure. When I’m traveling for work I earn points to burn for personal travel. Yet, usually when traveling for pleasure I can find MUCH cheaper rooms and lodging options through locally own hotels instead of mega chains. Staying at a bed and breakfast, VRBO, AirBnB or a locally own hotel can save hundreds if not thousands on hotel stays. In Asia, locally owned places are often $10-$75 a night whereas corporate hotels are well over $100 a night. I have similar experiences across Europe. Is dropping 30,000 points or hundreds of dollars really worth it?

Transfer the Points

If hotel stays are not what you are after, then transfer the Starpoints to partner airlines. 35,000 points + the $5,000 you will spend means you will now have 40,000 Starpoints. When transferred to airline partners, that is up to 50,000 miles. That’s a one way ticket somewhere in a premium cabin or maybe a round trip in economy. Where do you want to go? Europe? South America? Or maybe you can find a round trip first class ticket in the lower 48. Yet there is still a problem, SPG transfers are not instant and can take up to three weeks!

If you are getting this card because of the 25% bonus when transferred to airline partners, buyer beware! By the time the points transfer your dream flight award space may be gone! Unlike American Express Membership reward points or Chase Ultimate Rewards which transfer almost instantaneously to most programs, SPG can take days if not weeks! If you’re seeking an easy 50,000 airline miles, there are other cards and other options. After all, once you transfer the points, there is no way to get them back. They will be locked into the program the points are transferred to.

Lack of Benefits

These days credit cards come with a lot of benefits. That is except for the SPG American Express. This credit card has the typical purchase protection, travel benefits, and roadside assistant which is found on nearly every credit card; however, there really are no “extras” with this card. The only real benefit of this card is the 2 points per dollar spent at SPG and Marriott hotel. Everywhere else, the card only earns 1 point per dollar.

No matter how I spin it, earning 1 point per dollar is horrible. There are several credit cards that offer 1.5% to 10% cash back or double and triple points on nearly everything. Most credit cards have bonus categories. The SPG simply does not. There are also other credit card which earn 2 or 3 points per dollar spent at hotels. There’s nothing to see here folks, the SPG American Express is a buzz kill!

If you want a hotel credit card, explore other options! The IHG, Marriott and Hyatt credit cards offer bonus points for other expenses outside the hotel chain. All those hotel credit cards earn bonus points on everything from gas stations to grocery stores depending on the card. Several hotel credit cards also offer a free hotel stay each year. Once again the SPG card does not.

Final Thoughts on the SPG Card

If you already signed up for the SPG credit card, good for you! You took advantage of mass marketing by all the other bloggers, including myself. You essentially now have 35,000 points for free because the SPG card does not cost anything for the first year. Hopefully you will spend responsibly and maximize the points you earned. For those of you who haven’t signed up for the card, don’t! Or at least seriously think about it first.

Mile and point bloggers will always point you towards credit cards they are invested in. Yet think, are you equally invested? Will you use the points or will they expire? The bonus is just another gimmick by the banks to bury you in debt and make you a slave to the system. Can you spend responsibly and make the most of this bonus, or in the end will the bank play you, instead of you playing them? Be responsible.

I am guilty as I took advantage of this card bonus. After spending $5,000 on this card, I quickly paid it off. Since then, I have shredded the card to never use it again. Come the end of the year, I will be one of thousands of people who opt to cancel the card instead of paying the $95 annual fee. Thank you American Express for the bonus points, but seriously this card is not that great! The benefits are not there and the long term earning potential is truly minimal.

Disclaimer: I purposely am playing devils advocate in this post to make you think before getting this card. As I mentioned before, I wrote a post about why you should get the card. Want to see why you should get the SPG American Express, please read my opposing view point! Thanks for reading!