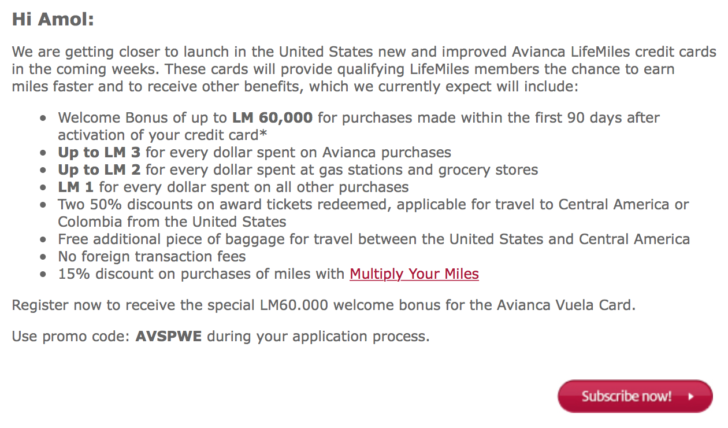

Earlier this year, Avianca LifeMiles dropped US Bank as their credit card partner in the United States. They released details of a future product with an unknown bank, noted below:

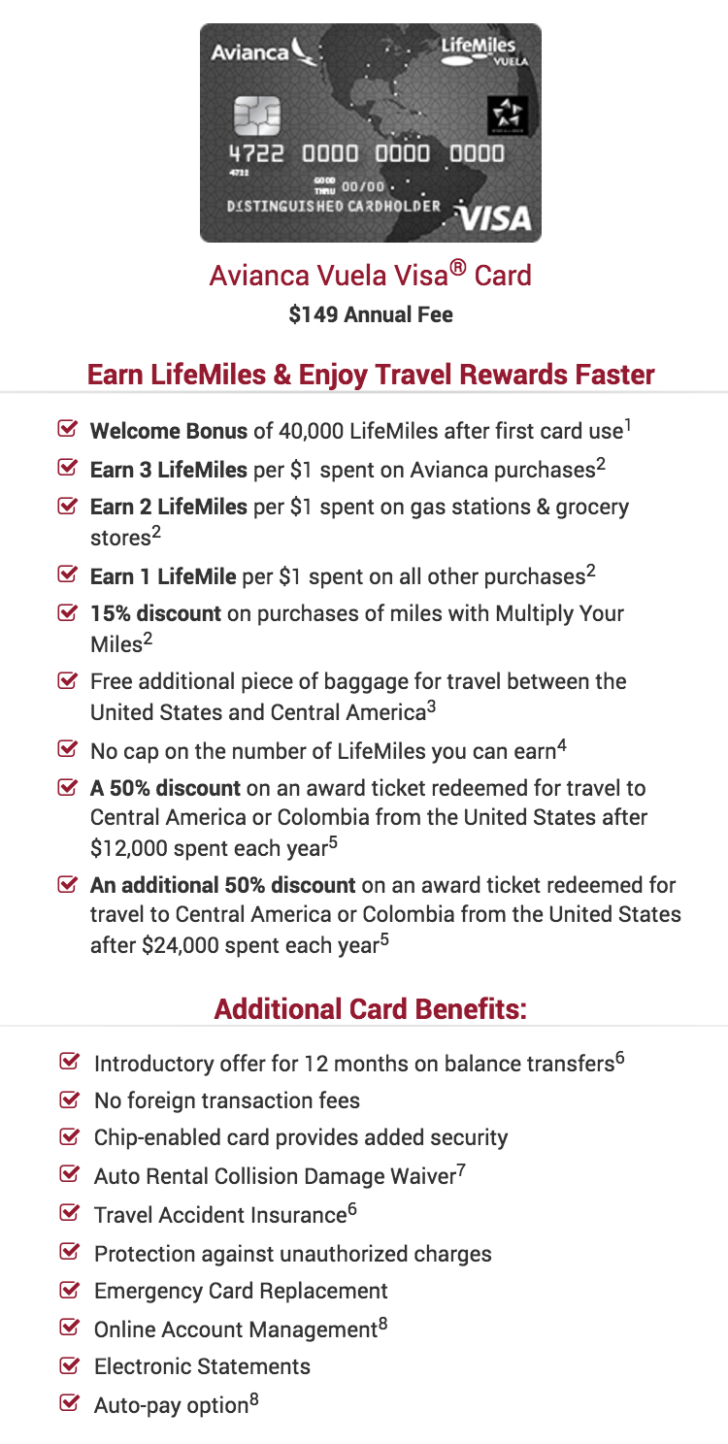

- Welcome Bonus of up to 60,000 LifeMiles for purchases made within the first 90 days after activation of your credit card

- Up to LM 3 for every dollar spent on Avianca purchases

- Up to LM 2 for every dollar spent at gas stations and grocery stores

- LM 1 for every dollar spent on all other purchases

- Two 50% discounts on award tickets redeemed, applicable for travel to Central America or Colombia from the United States

- Free additional piece of baggage for travel between the United States and Central America

- No foreign transaction fees

- 15% discount on purchases of miles with Multiply Your Miles

I just received an email detailing that the card is arriving soon, as well as a link to apply.

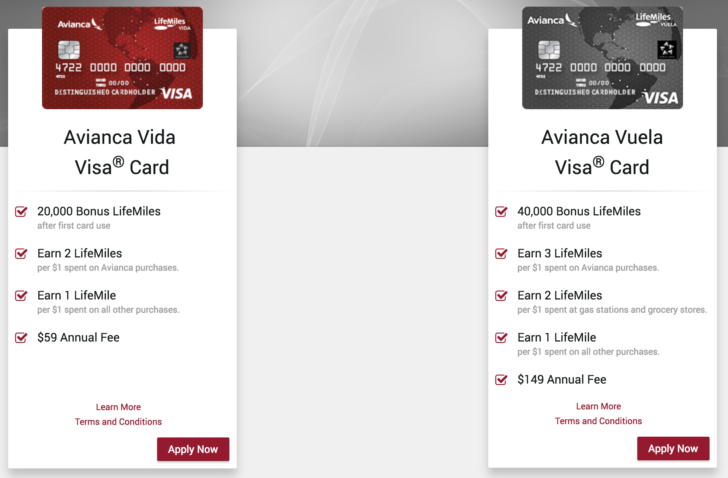

This is the link when I click on “Subscribe now!” It takes me to a page that looks like this:

This page gives us one new tidbit of information, in that the annual fee for the card described in the e-mail is $149. There doesn’t seem to be any language that this fee is waived for the first year.

It’s also interesting that if you are someone who uses LifeMiles to travel to Central America or Colombia, you can earn a 50% discount on a roundtrip award ticket from the United States if you spend $12,000 in a calendar year, with the opportunity for another award discount after $24,000 spending. It does have a restriction on economy class awards, so that could be as much as 20,000 LifeMiles discount on a roundtrip economy class ticket to Colombia, or 18,000 miles to Central America.

Through some more digging on the page, it turns out the card will be offered through Popular Credit Service, which is a division of Banco Popular based in Puerto Rico.

This is certainly an interesting turn: I doubt many readers have cards with this bank. I surmise that they will be getting plenty of new business.

While the email states that the card is still on its way to launch, it provides a promotion code AVSPWE for a 60,000-mile offer. The website also points to an application page, which looks to be live. I haven’t applied for this card myself, but if anybody would like to try, please report back.

So what about this new LifeMiles card?

This is certainly an exciting card. It has a large 60,000-mile bonus, which is great for anyone who wants to build miles towards a premium cabin award on Star Alliance airlines. For example, according to the reward chart, it takes just 63,000 miles for a one-way business class award from North America to Europe. This bonus will get you almost all the way there! Remember that LifeMiles also does not charge fuel surcharges, so taxes/fees are reasonable.

If you have plans to use LifeMiles to travel to Central America or Colombia, and can spend $12,000 in a calendar year, this card could be worth your while to get a 50% discount. As mentioned above, that points to a roundtrip economy class award for just 18,000 miles to Central America or 20,000 miles to Colombia.

The card also earns 2 LifeMiles per dollar at gas stations and grocery stores – these are stores that sell gift cards of various kinds, which can make earning LifeMiles through a credit card a lot easier. Keep in mind, though, that LifeMiles frequently sells miles at a deep discount. In fact, this week, they are selling for ~1.375 cents per mile. This is a fantastic deal, but other deals in the past have hovered around 1.43 cents to 1.50 cents per mile. That means that this wouldn’t be a good card to use if you have another credit card that earns ~3 cents per dollar cash-back or better at gas stations or grocery stores. Just something to ponder.

The way I view this bonus: if the annual fee isn’t waived, you’re basically using a credit inquiry + $149 fee to earn 60,000 miles, or 0.25 cents per mile.

I am very tempted to apply for this card, although I am not in a rush. What do you all think?