I’m faced with my first real dilemma in the world of credit cards. Do I keep or cancel my MileagePlus Club credit card? This is the United co-branded card that includes a complimentary membership to the United Club — pretty much the only way to gain access to United’s domestic lounges. Although Star Alliance Gold members do have access to international lounges, a membership is needed to get access to domestic lounges.

One workaround is to get Star Gold status with a foreign carrier like Turkish or Aegean. Then, your “domestic” flights in the U.S. would really be international. I’ll talk more about these later this week. But I’ll cut to the chase and say I’ve decided the MileagePlus Club card is a much easier path for me.

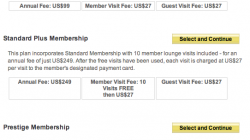

Discounted United Club Membership

For $395, I get a United Club annual membership with all the same guest privileges. Due to recent membership fee increases, a club membership can cost up to $500 a year with a few minor discounts if you have elite status. But still, the $395 credit card fee is the cheapest option. On top of that, Premier 1K members receive a $60 annual credit on their co-branded credit cards. So this is really only a $335 annual fee for me.

On this basis alone, I feel the $335 might be worthwhile. It comes out to less than $30 a month, and I do travel at least once a month. I like the showers when I connect in Houston or Newark. I like being able to take Megan with me.

I like my American Express Platinum Card for many reasons, but the lounge benefit is not one of them. Although I can use my Platinum Card for access to Alaska’s Board Room even when I’m flying with someone else, I would have to pay each time I guest in Megan. Once United moves its Seattle gates to the opposite side of the airport, it will be even more inconvenient to use a different carrier’s lounge.

Primary Benefits of the MileagePlus Club Visa

There are several other benefits that make this a superior card for the frequent traveler compared to the cheaper MileagePlus Explorer:

- Premier Access (including priority check-in, security screening, and boarding)

- First and second bag free for you and one companion

- No close-in booking fees on award tickets

- Award tickets are eligible for Complimentary Premier Upgrades (CPUs) if you have elite status

The first three don’t apply to me as a Premier 1K since I already get them. The upgrades on award tickets, however, are nice. Friends and family benefit from them more than I do, since I’ll use my miles to book their award and leave my MileagePlus number on the reservation. But it still earns me some bonus points when they arrive. Usually these are people who never or rarely fly in first class.

If you are Premier Silver, the MileagePlus Club credit card might make more sense than the MileagePlus Explorer. You’d have to really like the Club membership because it’s harder to justify the cost, but I know a few infrequent business travelers who have still decided it makes sense for them. On the other hand, the other three benefits are a step up from what you get through your United elite status. At best, the MileagePlus Explorer card matches many low-tier benefits.

The Explorer card does share the upgrades on award tickets. My perspective is this: I’m not going to pay the annual fee on a card just for upgrades, so the Explorer is out for me. But if I get upgrades AND lounge membership, that sounds more enticing despite paying more. I’m almost always willing to pay more as long as I get something worthwhile. Paying less and get something you don’t really want is a waste.

1.5X Bonus MileagePlus Miles

You also get 1.5 miles on every dollar spent anywhere. With no foreign transaction fees. The MileagePlus Explorer card only offers 2 miles per dollar on United purchases. Those infrequent business travelers I mentioned above had a lot of expenses, but not all on flights. Getting a lower bonus on more purchases made more sense for them. I think the Sapphire Preferred card might be even better with 2.14 points on all travel purchases, but it does not come with a club membership.

I described in last week’s post how the MileagePlus Club card might be a reasonable candidate for manufactured spend, although if you are able to buy lots of $200 gift cards with an Ink Bold or Ink Plus business card, that is still a cheaper route to earning miles with United.

Random Benefits

Finally, the MileagePlus Club card offers free Gold Passport Platinum status with Hyatt and free Avis First status when renting cars. You can get Platinum status more easily, and get a free night each year, by paying a $75 annual fee for the Hyatt Visa (which I recommend). But Avis First is a downgrade from the previous offer of Avis President’s Club — not so easy to obtain through other means. I already have Diamond status with Hyatt and don’t rent from Avis, so these don’t matter to me.

One thing that might be worthwhile is primary coverage for rental cars when you charge them to this card. Most credit cards offer secondary coverage, which means your own insurance kicks in first. Primary coverage means your own insurance may never need to get involved, or if it does the credit card issuer could pay the deductible. You can get the same benefit from the MileagePlus Explorer card if you don’t want a lounge membership.

Conclusion

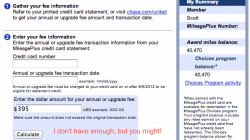

What it comes down to, I guess, is that I’ve identified lots of ways this card makes sense for me, with a discounted lounge membership, bonus miles, and a few perks when I use my miles for award travel. It really isn’t that expensive, after my elite discount, when compared to the full advertised cost without the card. I can even redeem my miles through the United Choices program to pay the card’s annual fee — the only way I know to use miles for a United Club membership.

But it’s still darn expensive. I’ve never had a card that cost this much before, and I’ve always been happy in the past to just cancel a card if I’m not offered a retention bonus. This is the first time I will want to keep it either way, and I’ll be happy if they throw another $100 my way as they do now for new cardholders.

Am I completely off my rocker? Some people cancel cards with a $50 annual fee, and here I want to keep one that will cost $335. I’m interested to hear your thoughts.