I’ve discussed how great points like Chase Ultimate Rewards are — they are flexible points that can transfer to partners like United and Hyatt so you don’t need to make those commitments in advanced. If you foresee yourself needing United miles in the future, getting a 40,000-point bonus Chase Sapphire Preferred or 50,000-point bonus Chase Ink card is a good way to start out.

But many people tend to forget that Chase offers a branded United MileagePlus Explorer card. While it normally has a paltry 30,000-mile bonus, there are ways to get at least a 50,000-mile bonus with United for both the consumer and the business cards.

I got a 55,000-mile bonus last year for the consumer United MileagePlus Explorer Card by finding a link that worked with my United MileagePlus mileage account.

Logging into my United account today, I saw that they were offering me 55,000 miles for the consumer card as well as 50,000 miles for the business card. I already have the consumer card, so I’m not eligible for that bonus, but I am eligible for the business United MileagePlus Explorer card since it is a different card product from the consumer card.

Finding the Offers for 55,000 Miles (Consumer) and 50,000 Miles (Business)

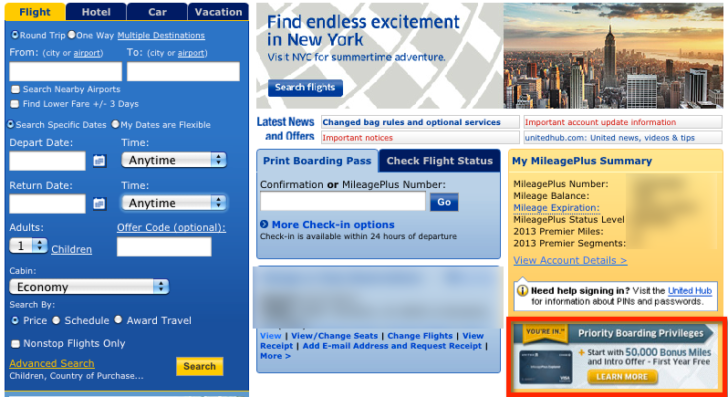

To replicate this, log in to your United.com MileagePlus account.

Below the yellow area with your mileage information on the right side of the screen, click the credit card advertisement. For those who care, I’m not sure if that’s United’s affiliate link 😉

If you are interested in the consumer card offer, click on the MileagePlus Explorer Card tab and see what bonus you get. The 55,000-mile offer looks like this. (Update: This offer is no longer available. You can find a list of all current offers on our credit card page.)

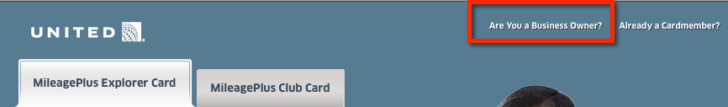

If you are interested in the business card offer, click “Are You a Business Owner?” in the top right corner.

The 50,000-mile business offer looks like this:

If you don’t get the offer, try clearing your cookies or use another browser. I was able to see the 50K/55K offers in Google Chrome, but not Firefox (my primary browser). Chase has also usually allowed people to send a Secure Message asking to be bumped up to the better bonus offer if you have a screenshot of the better offer.

Each card requires $2,000 of spending in 90 days, which is pretty doable for most people, especially with some help from Amazon Payments or other spending techniques.

On top of all this, the United MileagePlus Explorer card is a great card to keep for the first year. For one thing, the $95 annual fee is waived. You also get primary CDW coverage on car rentals when using the card, which is a great reason to use it over cards like the Sapphire Preferred with 2x points. You get a free checked bag on United, a better boarding group, and two club passes as well. Lastly, no foreign transaction fees (this is a fairly new benefit).

Consumer Card Benefits

The consumer United MileagePlus Explorer card also offers a 5,000-mile bonus if you add an authorized user to your card account and have them make a purchase (bringing the total bonus to 55,000 miles). Purchases made by an authorized user count toward the $2,000 minimum spend for the signup bonus. It’s free to get an authorized user card, so you should definitely get one for your spouse, relative, or friend.

Getting an authorized user card for someone else does not preclude them from also getting the bonus.

Business Card Benefits

If you get the business version, you won’t be able to get the 5,000-mile authorized user bonus. However, it does have other perks.

The business card offers the standard 1 mile per dollar and the standard 2 miles dollar on United purchases.

However, you also get 2 miles/dollar on purchases at restaurants, gas stations, and office supply stores.

To compare, the Chase Sapphire Card gets 2x at restaurants and the Chase Sapphire Preferred gets 2.14x on travel/dining if you keep your card through the calendar year. The Chase Ink Plus and Bold get 2x at gas stations and 5x at office-supply stores. It’s funny how Chase’s own credit cards are as good or better on earning United miles than the United-branded card for the same purchases.

Big Spender Bonus

Lastly, if you are a big spender, don’t overlook the 10,000 mile bonus for spending $25,000 in a calendar year. Think of it this way — you have to spend $2,000 to get the 50,000-mile bonus (plus the 2,000 miles you get from spending).

If you have a business with large purchases, you only need to spend an additional $23,000 by December 31st to get an additional 33,000 miles. You end up getting about 1.435 United miles per dollar on the incremental spend past the required $2,000 if you hit exactly $25,000 of spending by December 31st, with a grand total of 85,000 United miles. 85,000 United miles is more that enough for a one-way First Class redemption to any part of Asia. You can repeat the $25,000 of spending in 2014 to get an additional 35,000 United miles (1.4 miles per dollar) before your annual fee is due.

Yes, the Chase Ink Plus and Bold does offer 5X at office supply stores and on cell phone bills, and you should still use the Chase Ink at those categories. But the United card is still good for 1x purchases if you can hit $25,000.

Keep in mind that you need to hit $25,000 spending by December 31st to get that bonus, so it would suck to spend only $24,950 and not get the 10,000 bonus miles. In addition, you only get a bonus at the $25,000 threshold — you still earn 1 mile on every dollar after that, and the marginal benefit decreases as you spend more than $25,000. But there are people with businesses that spend that much money each year, so it’s worth considering if you can spend exactly $25,000. Also, the United Club Credit card itself gives 1.5 United miles per dollar, but that also has a hefty fee (and no signup bonus).

As always, take a screenshot of the landing page for your application. We can’t guarantee the bonus, but at least the landing page can.

The links to this credit card are public links and do not earn an affiliate commission.

H/T to this Flyertalk thread.