If you subscribe to the “new year, new you,” mantra, then you should consider adopting new habits in order to earn more points and dollars towards air travel in 2018 and beyond. It is worth taking the time to familiarize yourself with all of the tools, deals, offers, and resources available on the web to help you accumulate points and miles because you can do all of these without stepping a foot onto an airplane.

I’ve compiled some things that you should do immediately in order to start the new year off on the right note. It is important to know that that there are hundreds of ways to maximize your mileage accrual through passive (aka non-flying) activity, and while I obviously cannot list them all, here are some of the easiest ways in which I plan to reap additional rewards through everyday spending.

Use Your $200 Airline Reimbursement Fee from American Express Platinum to Purchase Gift Cards

In a separate post, I have outlined how you can get reimbursed for purchasing gift cards on American Airlines by using the American Express Platinum card. In my example, I used American Airlines (since I am DFW-based, it makes the most sense for me to purchase gift cards) but according to FlyerTalk, there are ways to do it on other U.S. carriers as well. Even if you are not based in the United States, if you have upcoming travel on a U.S. carrier, or are based in a city where you can purchase a ticket on a U.S. carrier that will be operated by a partner alliance member, this is definitely a deal worth considering.

The key takeaway here is that the $200 reimbursement resets every calendar year, so if you recently acquired the American Express Platinum Card in late 2017, you are eligible to take advantage of this perk right now.

American AAdvantage Redemption: 10% Back

People with the American Airlines AAdvantage Aviator Card, as well as the American Airlines Citi Platinum Card, are eligible to earn 10% of redeemed miles back, up to 10,000 miles. Per valuations from January 2018 by The Points Guy, this is worth about $150 worth of AAdvantage miles, so it is definitely a good perk. Right now, the AAdvantage Aviator Card is still offering its 60,000 miles bonus after one expenditure within 90 days of opening, and payment of the $95 annual fee.

I recently redeemed an AAdvantage ticket which cost me a little less than 60,000 miles, but in premium cabins on OneWorld partners from Europe to the U.S. with stopovers. Based on the calculation, this award redemption is worth about $900, but I’ll receive 6,000 back, which is $90. This means that the entire trip only cost me $5 out of pocket when factoring in the $95 annual fee (plus a few dollars in taxes and surcharges). Plus, the card comes with additional benefits like first checked bag fees waived, reduced award saver availability, 25% off in-flight purchases, and waiver of carry-on luggage and boarding restrictions for basic economy tickets.

Now, the AAdvantage Citibank Card is also offering a 60,000-mile bonus, but after $3,000 spending within 90 days. If you possess both cards, which many people do, unfortunately, you are capped at receiving back only 10,000 miles for each calendar year. In other words, having two cards will not allow you up to 20,000 points back if you redeem 100,000 miles through one card and 100,000 through the other. However, as TPG points out in this article, you can spend with whichever card and everything will be linked to one AAdvantage account.

United Club Card

When I lived in a United hub and traveled frequently for work, I found immense value in investing in the United Airlines Club Card. This card essentially grants you access to all systemwide United Clubs, along with a few participating Star Alliance Clubs. There are approximately 31 airports that offer one or more United Clubs, and they can be really handy in a pinch for several reasons:

- You can relax in peace and quiet (although sometimes tougher during delays or rush hour periods) with complimentary beverages (alcoholic and non-alcoholic) and snacks

- You can bring up to two adults as guests

- You can access it even if you’re not flying United, as long as you have a boarding pass to show for a same-day flight.

- Some have additional amenities like conference rooms and showers (this is particularly useful after a long international flight or work day)

- You can access partner airline lounges in foreign cities. Some examples include:

- Air Canada Maple Leaf Lounges

- Lufthansa Business Lounges

- Singapore Airlines SilverKris Lounges

- All Nippon Airways Lounges

- Austrian Airlines Business Lounges

- Air India Lounges

- Air New Zealand Lounges

- Thai Airways Lounges

- Turkish Airlines Lounge

Furthermore, the club card is offering a sign-up bonus of 50,000 miles after $3,000 in expenditures within the first 90 days. This is valued at approximately $750, and I personally believe United offers the best award space of all frequent flier programs on partner carriers. Finally, the Membership also comes with Hertz Gold Plus Rewards with a 25% bonus on Gold Plus Rewards.

In my opinion, this card has incredible value for frequent fliers, next to the AMEX Platinum card and Chase Sapphire Reserve.

Earn Delta SkyMiles as an Airbnb Host or Guest

Through February 28, 2018, you can earn up to 5x SkyMiles for every $1 spent on an Airbnb booking, plus a $25 coupon, if this is your first time using Airbnb. If you’ve already used Airbnb before, then you can get 2x SkyMiles for every $1 spent. This is valid for stays through February 28, 2019. You can also earn up to 25,000 bonus miles for being a host with Airbnb once you reach $2,500 in host earnings, through November 30, 2018.

3X JetBlue TrueBlue Points via Amazon Expenditures

This is a perk that everyone should be participating in, even if you don’t live in a large JetBlue station or even a market where JetBlue flies at all. It doesn’t require a JetBlue credit card, and all you have to do is link your Amazon account with a True Blue miles account to start earning 3 True Blue points for every dollar spent on Amazon.

2x JetBlue TrueBlue Points for Food, Gas, and Utility Purchases

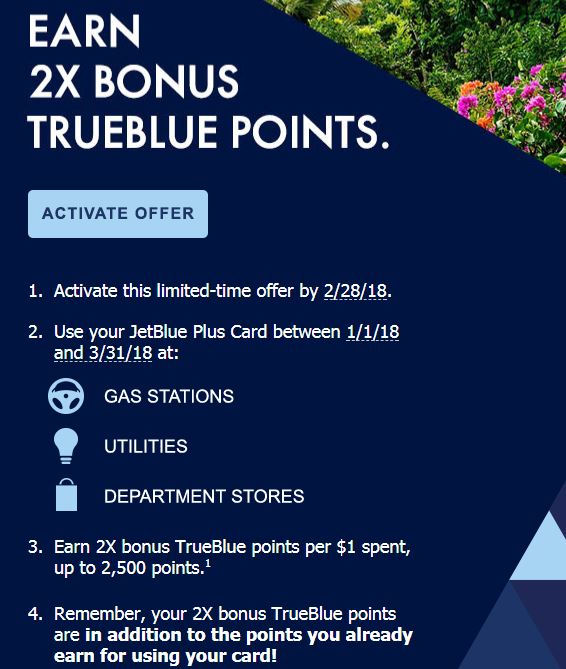

For those who do possess the JetBlue Plus Card, there is current offer to earn double points at gas stations, on utilities, and at department stores between 1/1/18 and 3/31/18 (activate offer by 2/28) and they’ll be posted 6-8 weeks after the promotion ends.

Dining Rewards

This is a fantastic way to double-dip on rewards, without penalty! Literally, every airline offers a dining program that you can use to earn miles and points for eating out. Here are the ways in which you can register with each airline:

The great thing about this perk is that often times, there are hidden bonuses like earning 5x miles per dollar spent. I personally credit all of mine to Spirit Airlines, since these miles are the most liquid (3 months without any Free Spirit activity automatically wipes your mileage balance). If you have multiple credit cards, this is also an excellent way to earn miles, like registering a corporate credit card with one loyalty program and the Chase Sapphire Reserve with the other, or you can consolidate them.

Monitor Valuation Changes

Each month, The Points Guy does a monthly publication of airline valuations, which I find extremely useful in terms of keeping tabs on the monetary value of points and miles. Furthermore, be on the lookout for special promotions on mileage transfers, such as American Express Membership Rewards transferring points to British Airways and Iberia AVIOS program at a 1 : 1.5 rate rather that 1:1 (just as an example).

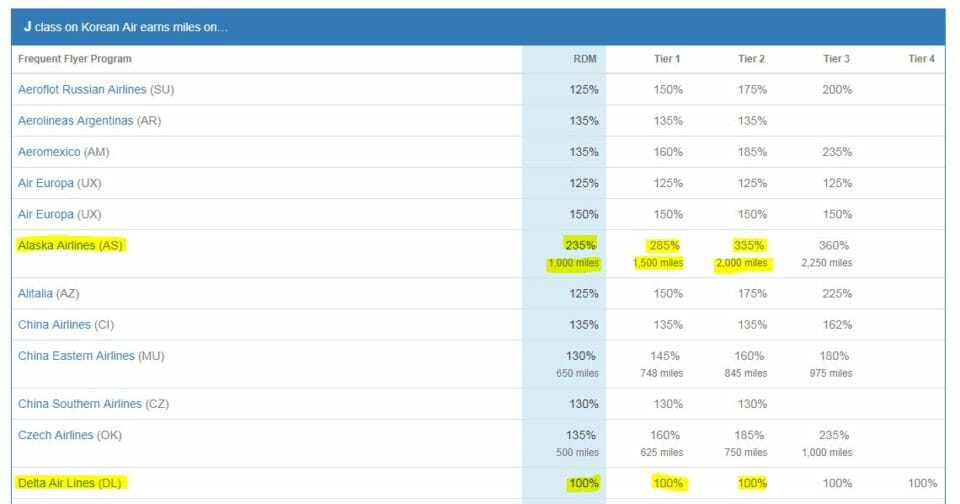

Use WhereToCredit.Com

This is one of the best tools out there to help figure out where to credit flights on certain airlines. It can spell a huge difference in terms of earning value. For example, last year, I flew Prestige Class on Korean Air (business) from Taipei to San Francisco, with a stopover in Seoul. The Taipei to Seoul leg was a codeshare flight operated by China Airlines, whereas the Seoul – San Francisco leg was on Korean Air metal. Both China Airlines and Korean Air are SkyTeam members, and the intuition would be to credit both flights to Delta SkyMiles (since I don’t have loyalty programs with either China Airlines or Korean, nor have much use for them, although I’m toying with the idea of becoming more cozy with Korean Air SkyPass miles…stay tuned).

Anyways, neither here nor there. The point was if I credited the miles to Delta, I would receive only 100% of the elite qualifying miles and redeemable miles (5,659) whereas if I credited to Alaska, I would earn more than three times that amount or 18,392 miles. That is valued at approximately $349.35 in Alaska Airlines Miles as an MVP Gold, compared to just $67.91 in Delta SkyMiles.

Want to know what’s even more absurd? These earning rates would be the same in ANY Korean Air business class fare bucket (J, C, D, I, R, Z) on Delta and Alaska, and even if I were a Delta Diamond, the earning rate would be the same as for a SkyMiles member.

For the China Airlines Taipei – Incheon leg, since China Airlines is not a partner of Alaska, I simply saved my boarding pass, ticket number, and PNR information and filled out a missing mileage request form on Delta.com. Even though I was in business class on China Airlines, Delta only credited me with 901 miles for that leg, which is literally worth $10.81.

Use Scott’s Award Maximizer Tool and Flight Connections.Com

Both of these are extremely valuable resources to help with optimizing the costs involved in an award booking between different cities, as well as helping to determine routing possibilities between different markets, with up to 2-stops on a single leg.

Remember, miles and points knowledge isn’t acquired in a day. It takes years of engagement, practice, planning, and learning to become more familiarized with the possibilities that are out there. But, the ROI is incredible once you become well-versed in the subject, and can allow travel to become much more of a reality than a possibility.