I’m a big fan of the Alaska Airlines Visa Signature card, and it’s not just because I like to fly with Alaska Airlines. In fact, it’s not even because the card offers particularly generous rewards. While you can earn 3 miles per dollar on purchases from Alaska Airlines and Virgin America, it gets just 1 mile per dollar everywhere else. You might be better off using a different card for everyday spending — a fact that frustrates me all the time.

But you should still get the card. There’s simply too much value NOT to have it in your wallet even if you never fly on Alaska Airlines.

Start off with the 30,000 bonus miles from the current sign-up offer after you spend $1,000. I value Alaska miles at about 2 cents each, so even though you’re getting fewer miles than some other airline cards, the miles are worth more. Compare the cost of some award tickets that you can book with Alaska miles or miles from other airline programs, like American AAdvantage. Cathay Pacific is a partner of both carriers, yet you can fly first class on Cathay Pacific using just 70,000 Alaska miles each way — about the same price as a business class award using American miles.

Next, the annual discounted companion fare. This is, admittedly, only valuable if you fly on Alaska Airlines, but it is much more flexible than most companion fares. You can use it for any economy class flight operated by Alaska or Virgin, and it will still earn miles, be eligible for upgrades, etc. Normally it costs $99 to redeem the companion fare, making it worthwhile for any flight that costs over ~$200 (you also have to pay the card’s annual fee). But a limited time promotion has been repeatedly extended, removing the $99 fee from the first year’s companion fare when you apply for a new card.

Want more miles and companion fares? You can apply for more than one card. This is tricky, and I strongly recommend waiting a healthy period between applications. A history of repeat applications might weigh down your eligibility for a high credit line and stick you with a less impressive card with fewer benefits. Some people repeatedly apply for and close their cards to earn miles; I keep mine open so that I can get multiple companion fares.

Finally, the discounts! Bank of America doesn’t have a high profile for its travel rewards cards, but it does offer some additional perks not unlike American Express.

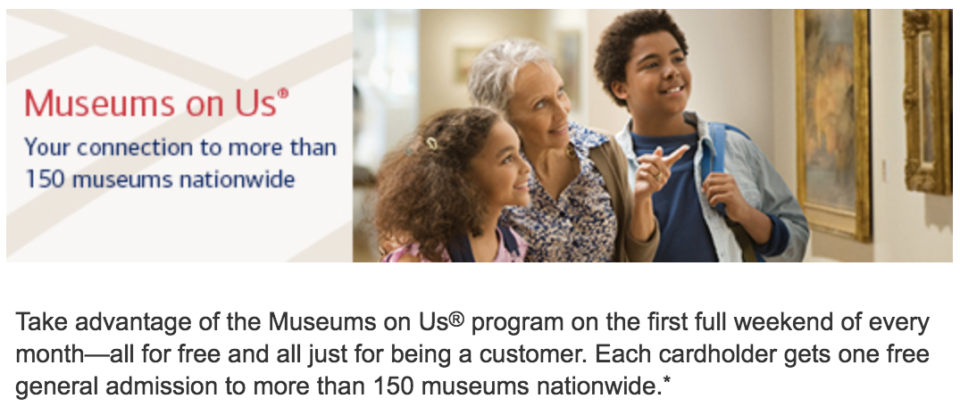

First, you can take advantage of monthly free admission to many top museums. Just show your card and a photo ID on the first full weekend of each month. (If you have multiple people, they will each need their own card or pay the regular rate.) I have used mine at the Seattle Art Museum; you could also visit leading institutions like the Art Institute of Chicago or the Museum of Fine Arts in Houston.

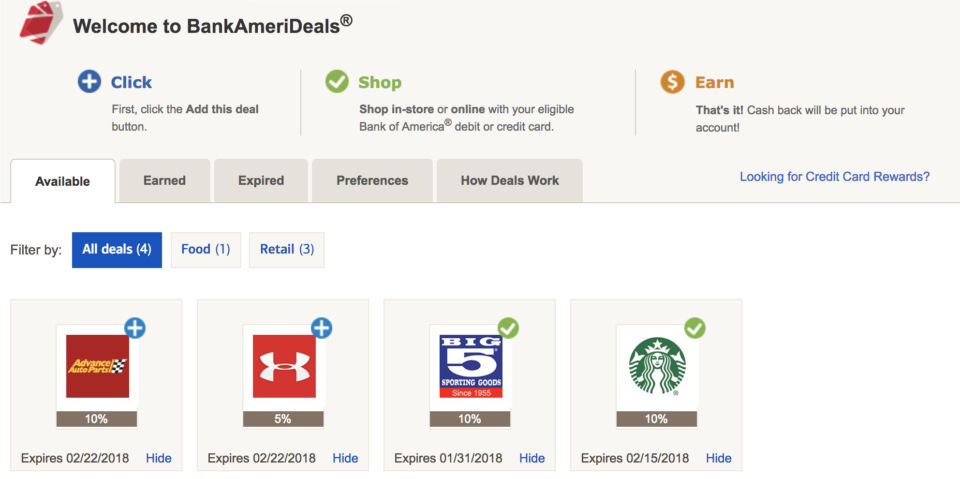

Second, there are a few discount offers — look for BankAmeriDeals on your account dashboard — when you use your card to pay at select merchants. A recent check identified only four, and three of those I don’t shop at. But 10% off at Starbucks sounds pretty good to me. That’s worth using my Alaska Airlines Visa Signature even if I’ll only earn 1 mile per dollar, since the double or triple points I’d earn for dining if I used some other card don’t come close to 10% in value.

While it’s true that the card isn’t going to be top-of-wallet for many active travel hackers, it shouldn’t be ignored either. There are a number of reasons to apply for one or more cards, especially if you live on the West Coast. Adding all these perks together, I’ve easily saved hundreds of dollars per year with my Alaska Airlines Visa Signature, and the annual fee is still surprisingly low at $75.