Last week I suggested that airline elite status may not be justified for some people any longer as programs have changed their rules and their award charts in the past year or two. I promised to follow up with a quick evaluation of the current programs and where they still offer some value to their customers. I am going to try to keep a positive spin on this even though I’m planning to leave United Airlines next year. And since I lined up a lot of criticisms last week, today I’ll give them priority.

I was willing to give United my business for three years as a Premier 1K because of three main benefits. First, United served the cities I visited. I could reach friends and family in places like Amarillo, San Francisco, and Orange County without too many inconvenient detours. Second, United has a large presence in both Asia and Europe — two continents that have been recent interests of mine. And, third, I have appreciated the complimentary upgrades for companions even though the policy is no longer quite as beneficial in practice as it was under the old United, pre-merger.

Such value kept me with United even with some customer service issues. MileagePlus use to be considered one of the more valuable loyalty programs (and may still be). They had a valuable award chart and partnered with many excellent international partners. The MileagePlus Select credit card I signed up for several years ago was actually quite good, offering the chance to earn triple miles plus a few elite qualifying miles when I bought United tickets.

As someone who does a lot of domestic travel, I appreciated the complimentary domestic upgrades more than any international upgrade certificates, regardless of their restrictions. And as someone who does a lot of travel with a companion, I appreciated that her upgrades were complimentary, too.

The problem is that in the past year United has made several changes to reduce the value of its loyalty program for some people. The introduction of Premier Qualfiying Dollars effectively places a value on every customer, no matter how many miles they fly. What matters is how many dollars they spend, instead. Credit cards like my trusty MP Select have been replaced with others like the MileagePlus Explorer that share the benefits of Silver and Gold status with anyone willing to pay an annual fee. And elite mileage-earning bonuses have been reduced, meaning even Premier Gold status is no longer worth much if you only get a 50% bonus.

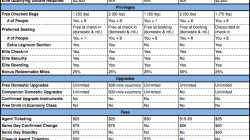

These days, the new sweet spot for United is no longer Premier 1K (for the upgrades) or Premier Gold (for bonus miles and international lounge access) but rather Premier Platinum. With a co-branded United credit card, customers can still bypass the PQD requirement by spending $25,000 per year on their credit card or changing their address to one outside the U.S. All that’s left is to fly 75,000 miles in a year.

And for that, you continue to get access to some complimentary upgrades, though I doubt they will clear very often with so many Premier 1Ks about. The 75% mileage earning bonus is not awful, though still not as good as the 100% offered by United’s competitors. And you’ll still receive two regional upgrades each year. The real value is that Platinum members still receive free same-day changes to revenue fares and free changes and cancellations on award tickets. This means you can continue to freely earn and redeem miles earned through other avenues, such as Ultimate Rewards-affiliated credit and charge cards.

If you do get a United-branded credit card, they’re not too bad. I don’t think they’re really worth it for the benefits if you already have elite status, but they stand out in two ways:

- Primary rental car insurance coverage with both the MileagePlus Club and Explorer cards, meaning Chase steps in before you have to file a claim with your own insurance company.

- A generous 1.5 miles per dollar on all purchases with the MileagePlus Club card, making it ideal for manufactured spend.

I’m not sure that the Club card is actually worth it for a membership to the United Club given that they have downgraded the food and beverage offerings at these airport lounges. But it’s not too difficult to get some extra value out of the bonus miles. If you were a Premier Platinum member, I’d probably recommend this card over the Explorer. Use it for manufactured spend, as I suggested, to get the PQD waiver and 37,500 miles.

And United’s miles are still valuable due to some flexible routing rules. No, not as flexible as they used to be, but pretty darn flexible when compared to Delta, which makes it hard to find any saver award space, or American, which has some limiting stopover rules. It’s just painful if you want to redeem United’s miles for first class on another carrier. As long as you’re still traveling in business (which is perfectly alright in my book) then you will probably be okay under the new award charts.