I don’t normally blog about my credit card bonuses posting, but a couple things about my experience with the new Citi Executive AAdvantage 100,000-mile bonus Mastercard seemed worth sharing.

First, if you haven’t heard of this card, it’s the best bonus for a single American Airlines credit card I’ve seen (you used to be able to get 2 x 75,000 mile bonuses for 150,000 miles using the now-extinct 2-browser trick). Scott already wrote about it, but the main points are:

- 100,000 American Airlines miles after spending $10,000 in 3 months

- Admirals Clubs/US Airways Clubs access (even when not flying American Airlines)

- No foreign transaction fees

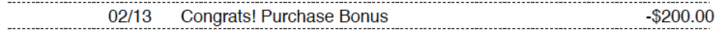

- $450 fee, but a $200 statement credit means it’s a net $250 annual fee.

A couple things I noticed about this card:

Statement credit occurs with any purchase

Although I’ve become a pretty frequent American Airlines flyer, I haven’t made any American Airlines purchases on this card just yet. The only purchases I made were for a large purchase I had saved up for as well as my fee for FTU Seattle and a couple of store charges on a trip to Hawaii (I’m aiming for $40,000 spend to get the 10,000 EQMs).

A few people (including myself) got word from Citi agents that the statement credits were for making American Airlines purchases. But even though I didn’t make a purchase on American Airlines, I still got the $200 credit!

This is good news for people who got the card but don’t have frequent transactions with American Airlines.

Pay down your card before the first statement hits

I received a credit limit just barely enough to meet the spend threshold, so I really wanted to pay it down before my statement hit so it didn’t look like I had used 95+% of my credit limit on my credit report.

Citi has usually been really annoying about paying your bill before the first statement hits. The way to usually get around it is to set up a “push” payment from your bank account, by using your bank’s bill pay function to send a payment to Citi (using your 16-digit card number as the account).

However, Citi recently updated their iOS app, and I was able to make a $1,000 mobile payment before my first statement hit. Once my first $1,000 payment hit, I was able to make a payment on the desktop website for the full balance of the card (a “pull” payment by adding my checking account information to the Citi website and initiating a payment from Citi’s side).

Considering the large spending required for this card, this could be of use to those trying to pay their cards down before the first statement hits.

I received the full 100,000 mile bonus

I had a few people e-mail me and ask if this was a targeted offer, since it asked for an American Airlines’ agent number. I didn’t enter an agent number on my application and still got the full 100,000 miles.

Given that the bonus is 100,000 miles for spending $10,000, and the fee is $250 instead of $450, I really think this is one of the best credit card signups at the moment. While the spend threshold is high, with simple manufactured techniques, you can hit $10,000. While the spend needs to be done in 3 months, if you apply for it now (in the middle of the month), it overlaps with 4 calendar months, so that’s $4,000 on Amazon Payments. Over the course of 12 weeks, you can buy 1 $500 Vanilla Reload per week to meet the other $6,000.

I don’t receive an affiliate commission for this one, but you should really think about applying for the Citi Executive AAdvantage Mastercard. We don’t know when the bonus will end, but Scott thinks it will end in mid-March.