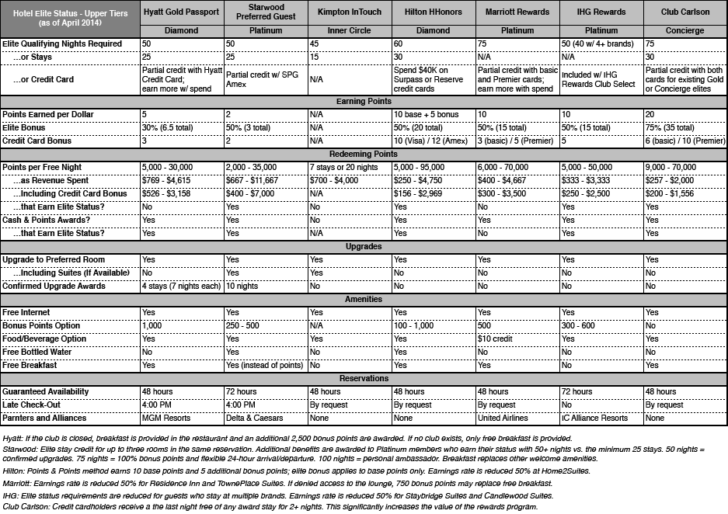

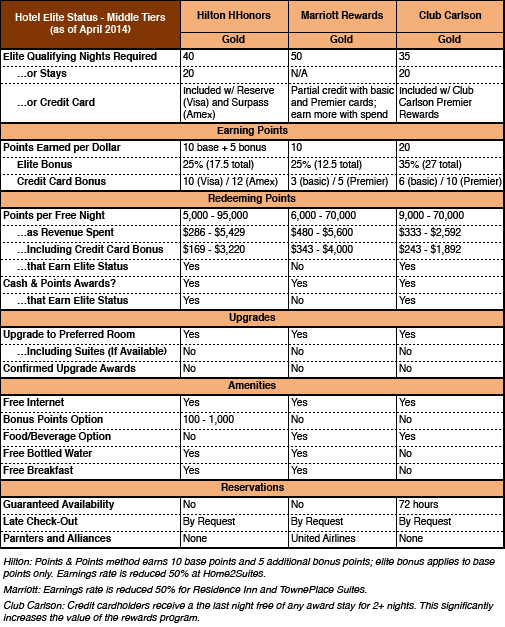

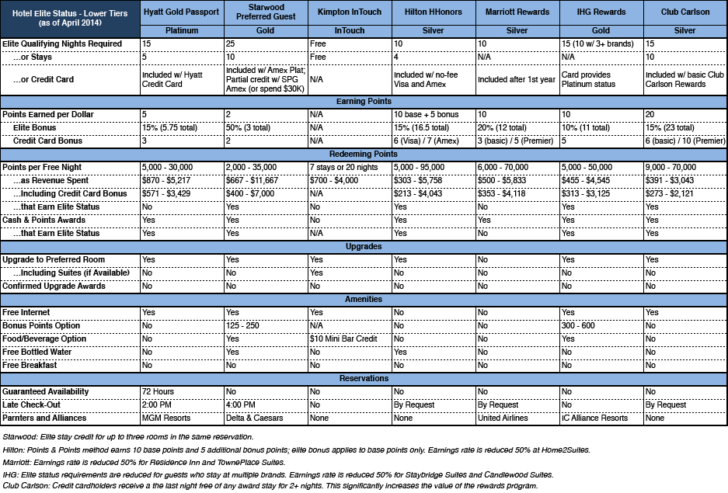

I’ve finally found time to finish creating my comparison tables of hotel elite status in 2014. These things always get ripped to shreds in the first draft, so I won’t do much analysis in this post; I’ll wait until later this week. But do feel free to comment. I will try to get a corrected version uploaded as soon as possible. When I post my analysis, I’ll also include a downloadable PDF.

The purpose of these comparison tables is to show how status differs between and within loyalty programs. Tables are organized primarily to compare between programs with the assumption that the reader will complete a certain number of hotel nights each year and wants to know the most rewarding chain.

However, there are lots of other considerations. By comparing tiers within the same program you might find that, for the benefits you care about, it is acceptable to settle for elite status in the lower or middle elite tier. You might even find that you can obtain this elite status as easily as by applying for a credit card with a $50-100 annual fee. With this knowledge you might decide that your 10, 50, or 100 nights a year are better spent at another chain where you can obtain benefits that aren’t replicable with a credit card. You can then apply for the credit card as a fallback for those times when the second chain is not an option.

It would be smart to provide some explanation of what these tables mean since I don’t always get as much space as I would like. Here are answers to common questions/complaints:

- No, Marriott does not provide guaranteed suite upgrades to its Platinum members. This row in the “Upgrades” section refers to programs that promise a basic suite upgrade if available. Marriott Rewards only promises that its guests will receive an upgrade, which may or may not include a suite.

- No, Marriott does not provide guaranteed late check-out. This row in the “Reservations” section refers to programs that guarantee a specific late check-out time. Marriott Rewards only promises priority consideration.

- I debated whether to consider the value of credit card bonus points when calculated the estimated revenue per award night. There is an opportunity cost from not using some other generic card. However, I suspect that when I do my analysis these numbers could be useful.

- If you have a Club Carlson credit card, I think the math from the last night free is easy enough to do in your head. I’m not going to cut my numbers by 50%. Not everyone breaks up their stays so they can check in and out every 48 hours.

- The added benefits for SPG Platinum members at 75 and 100 nights require exceptional loyalty and are not greatly different from those for 25 stays and 50 nights. For that reason, I’ve resigned them to a footnote.

Any other questions, concerns, or complaints will be appreciated. I know I am not likely to get this right the first time. Be sure to click on the tables for larger versions.