A while ago, FrequentMiler detailed how those enrolled in Chase Private Client can get a 65,000-point bonus on the Chase Sapphire Preferred. This is a fantastic bonus in and of itself, since the public offer is “only” 55,000 points (still a great offer).

However, what makes this Private Client 65,000-point offer spectacular is that this offer is immune from the infamous Chase “5/24 rule.” Recently, Chase has denied applications for many of their credit cards if applicants had opened 5+ credit cards (with any bank) in the past 24 months.

I’ve been fielding a lot of questions recently from friends and colleagues who are opening up their 1st or 2nd credit cards and are keen on travel rewards. The 5/24 rule means that I often tell them to apply for Chase cards early on.

I last held a Chase Sapphire Preferred in 2013 after a 2-year stint with the card, so it’s been a while since I’ve applied for it. I’ve always hoped to get the card again – even though it has lost benefits like the 7% annual dividend, it has gained things like Primary Car Rental coverage. Plus, who doesn’t love another Chase bonus if you could get one?

However, I also have more than 5 new accounts in the past 24 months. If a great offer comes around, I try to take advantage of it, and so I don’t foresee opening fewer than 5 new personal accounts over a 2-year period anytime soon.

Joining the Chase Private Client family

I’ve heard of the Chase Private Client program, but never thought much of it. I’m currently in a graduate program and won’t be making any big bucks from my career for quite a while (in fact, I’m paying quite the big bucks to possibly make some big bucks one day, but that’s another story). While Frequent Miler’s post doesn’t provide any concrete requirements for joining the program, I’ve seen elsewhere that Chase will talk to you if you have $250,000 in various accounts with them. I’m not quite there yet ….

Recently, my mom asked me to help her with an award ticket, and I gladly obliged. I needed to transfer a few thousand points from Ultimate Rewards for her ticket, so I called her on the phone to ask for her Chase account information to make the transfer from her Ink Plus. When I got in, I noticed that her homepage looked a bit different from mine, especially up top:

I immediately recalled Frequent Miler’s post about Private Client and started grilling my poor mother about it:

me: “Mom, you have Chase Private Client?”

mom: “What? Did you book the ticket? Can I hang up now?” (At least make some small chit-chat with me, mom, like I do with the AAdvantage agents when they’re having trouble finding Etihad space).

me: “No, wait, mom, you have Chase Private Client? How?”

mom: “Oh that. Yeah, I’ve been with [her banker] for a long time now, before that branch was even Chase. I got my loan for the business from him. You know, he got married last month!” (I then listened to her for what felt like an eternity about her banker getting married as if that’s supposed to be a clue for me).

me: “Okay … but how?”

mom: “He just signed me up for this one day and said they’d waive some of the fees for things on my account. You know they gave us a free safe deposit box, and Wells Fargo wants to charge me $50 a year, can you believe that?” (I don’t know anyone outside my mother who still uses safety deposit boxes).

me: “Um … can you ask him if you can apply for a Sapphire Preferred card? There’s supposed to be a good bonus for Private Clients and you can get almost enough for a one-way business class ticket to India from it.”

mom: “Yeah, he’s been bugging me about it for the past few months, but you told me not to get it because you said it was a waste. But he said it was a good card and I remember you made me apply for it a while back.” (4 years ago, according to my credit card spreadsheet. And I thought it was a waste because everyone in my family has applied for more than 5 cards in the past 24 months).

me: “Okay, mom, from now on, you can start listening to your banker instead of your son. Go get that bonus, it’s the best I’ve seen on the card in a very long time.”

——

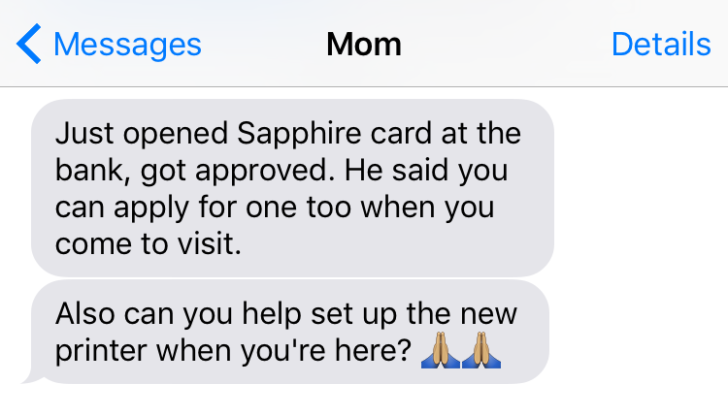

A few days later, I got the following message(s) from my mom:

WAIT, WHAT? I could apply for a Sapphire Preferred as well? Surely, there must be some mix-up here. I had to get to the bottom of this, so I put on my thinking cap (and Googled it):

Joining your family’s Chase Private Client family

Not only do Chase Private Client benefits extend to your spouse, but they also extend to any adult members of your immediate family (as long as they are over age 18). Immediate family clearly means spouse and children, though I wonder if it includes parents of the account owner or even siblings (unfortunately, I have no way of testing this. If this post inspires anyone to try, please let us know).

Does this mean that if you have an immediate family member with Chase Private Client, you can get in on the 65,000-point non-churner-phobic Sapphire Preferred offer? Or, if you have Chase Private Client, can you multiply your Ultimate Rewards windfall by getting as many immediate family members in on the action?

But wait … the terms clearly say “Service benefits extend to adult members of your immediate family when you are joint owners on Chase Private Client deposit accounts.” I’ve never jointly opened up a Chase account with either of my parents before, so how could I do this?

On my next trip home, I made plans to go with my mother to see her Chase banker. I was helping my dad book a United award for himself and logged into his Chase account where I saw the Private Client banner as well. The thing is, he does most of his banking at another bank, where he has had a long business relationship as well. I asked him how he had that designation, whether he was a co-signer on any account my mother had … turns out, he had signed on as a co-signer on, of all things, my mom’s safety deposit box. Bingo.

Later that week, I tagged along with my mother when she went to the bank, where she added me as a co-signer to the same account. I was still wary if this would work, so I didn’t apply for the credit card then, and waited to see if my account would update to show Private Client. It took several weeks, but one day, my Chase online account looked a bit different … with the Private Client banner quite notable.

The application

A couple weeks ago, I was home again for the long weekend, and decided to go to the Chase branch and apply for the card. I’ve had at least 7 new personal credit card accounts in the past 24 months, so I knew I wouldn’t be eligible through the public link. I applied through the banker and didn’t get an instant approval – I somewhat expected this, as my income has gone down since going back to school. He made a call to the reconsideration line for me and explained the application to the person on the phone.

I did have to answer some questions to the reconsideration line, particularly why I had opened so many accounts in the past 2 years. I remarked that I went back to school around 24 months ago and that my new area doesn’t have a Chase branch, so I made new relationships with other banks while keeping my Chase accounts open for the future. That’s actually most of the reason – there’s legitimately no Chase branch in my current state, but I might not be staying here very long so I didn’t want to close things like my checking account just yet. I was told a decision would come in the next week … I didn’t keep my hopes up.

However, a week later, a new account showed up in my Chase online management, and a few days after that, a Sapphire Preferred card came in the mail! I called to activate and confirmed the $4,000 spending in 3 months for 60,000 points offer, as well as 5,000 points for adding an authorized user!

So, there you have it – my mother’s fascination with a free safe deposit box just made me 65,000+ Ultimate Rewards points richer. More importantly, it showed that family members of Chase Private Clients can get in on the benefits.

In any case, it’s clear that all this happened because of my mother’s banking relationship with Chase, as she didn’t have to tick off a set of boxes to join Private Client, rather she just had a good working relationship with her banker. It’s kind of a good lesson, in that as much as we love to take advantage of banks, having a good relationship with a bank can get you far as well. After all, there’s only so many banks to take advantage of.