Last week an article appeared on the front page of Yahoo! Finance that detailed the Chase 5/24 rule we’ve all come to know and loathe. The article was notable for being roughly 70% correct (yes, I keep the bar rather low when it comes to mainstream publications trying to cover the frequent flyer community) and even included a link to a recent post written by yours truly analyzing the differences between the Chase 5/24 and Amex once-per-lifetime rules.

While I appreciate the extra traffic from Yahoo! and all, what I want to focus on today are the reader comments that appear at the bottom of that article.

(By the way, does Yahoo! really still use that exclamation point on their name? Because every time I type it that way my autocorrect thinks I’m starting a new sentence and I have to go back and fix the capitalization. So I hereby decree that for the rest of this post, Yahoo=Yahoo! Thanks for your understanding.)

Now, whenever someone tries to convince me that human beings are, deep down, good at heart, I invite them to peruse the unmoderated reader comments section of any article posted on nearly any highly-trafficked website. After you’ve read the vile, hateful, racist, homophobic, and just downright awful things people write when they know they’re safely anonymous and untrackable, if you still want to come back and tell me with a straight face that people are, deep down, good at heart, we can probably have a worthwhile debate about it.

To that end, I think most Travel Codex readers are smart enough to know that one should generally ignore the collection of misinformation that appears in the reader comments section of any mainstream publication trying to cover complex subjects such as churning and manufactured spend.

But as the Devil’s Advocate, it’s my job to take the opposing view of any argument. So if the Conventional Wisdom is that reader comments on Yahoo are inane and abhorrent, then isn’t it up to me to argue that they’re actually thoughtfully delightful?

So, here we go… my attempt to defend the “best” comments from the Yahoo 5/24 post. Buckle your seat belts, folks. I’m betting there’s some turbulence ahead.

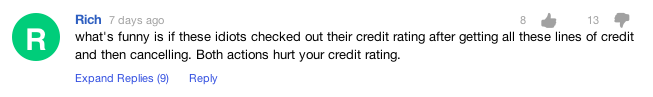

Damaging your credit score.

This first one sums up a lot of Yahoo comments that were made about credit scores and churning in general…

While Rich may be lashing out a bit, he is in fact correct that opening a line of credit temporarily lowers your credit score, albeit by only a few points per credit inquiry and only for about 3 months. He is also right that cancelling an account will generally lower your score, not because of any change in the age of accounts (the standard FICO model includes accounts for 10 years beyond their closing date) but because you are eliminating open credit lines while maintaining the same amount of debt, which worsens your debt-to-credit ratio.

What Rich doesn’t seem to realize is that practically every member of the points and miles community knows exactly how credit scores work and likely has a much better handle on their current score than Rich does. If you’re a churner, you always know your score – it’s part of the game.

Also, most of us are not “idiots,” though I can’t personally vouch for everyone. That guy who’s always boasting on Business Insider and Mashable about his “free” $60,000 Emirates trips obviously isn’t terribly bright.

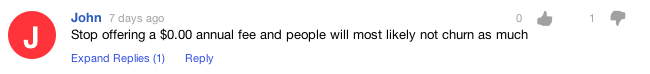

Churning because of an annual fee.

OK, while John obviously doesn’t quite get the whole concept of “signup bonuses,” most churners do in fact have a few “keepers” in their credit card collection and those keepers are the ones with the best ongoing benefits.

A longtime favorite keeper with churners has been the Chase Freedom card (and now the Chase Freedom Unlimited) because it has no annual fee and offers competitive travel rewards. Discover cards are popular for the same reason, and everyone could use a basic no fee Amex Everyday card to keep their Membership Rewards points intact while churning the higher end charge cards.

So maybe John has a point on the annual fee thing. Actually, now that I re-read John’s comment, he appears to have things backwards – he thinks giving cards a higher annual fee will discourage churning. I’m honestly not quite sure what his logic is there, but I wish John the best of luck hanging onto as many high annual fee cards as he can get his hands on. Moving on…

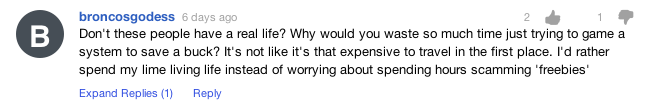

Get a life!

Broncosgodess doesn’t seem to understand how a “hobby” works (“why would you waste so much time just trying to knit a scarf when you could buy one at the 99 Cents store?!”) but she has a valid point about losing track of the purpose of churning for travel. How you travel is just part of the equation – what really matters is what you discover about other people and yourself when you get to your destination.

Yes, it’s a lot of fun to sit in premium classes and be treated well, but being able to discover new people and new places is what having a “real life” is truly about.

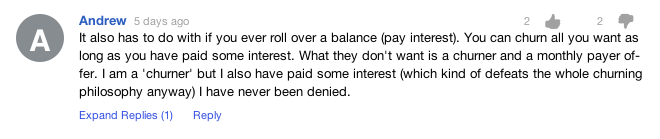

Pay interest and you’ll never be denied?

Ummmmmm, I don’t think it works that way, Andrew. I mean, yes, the banks do like it when you pay interest because it effectively negates the value of all those rewards they gave you. But if you’re paying any interest at all, you’re doing it wrong and should not be “churning” in the first place.

Also, I highly doubt Chase has written into their approval algorithm the idea that “hey, this guy paid a little interest, so let’s forget that whole 5/24 thing with him. He’s good people!”

I make a million dollars!

Really, David? Your annual income is over a million dollars and you’re taking time to leave complaints about Chase credit cards on a Yahoo article? That seems kinda unlikely. But hey, people can’t lie on the internet, right? So I’m sorry that you got snagged, David, but it does show exactly how Chase might be cutting off their nose to spite their face with the 5/24 rule.

(Also, I rather enjoyed this response to David from another Yahoo commenter…)

Stealing candy from a baby.

It feels like we might be going off the rails a bit on these comments. Let’s try another one and see if we can get back on track…

Yeah, okay, I got nothing. A “classless” activity? I’m not even sure exactly how that adjective would apply to churning. I guess perhaps if I bought a dinnerware set with my Citibank ThankYou Prestige card but neglected to include a set of salad forks, then yes, that would be totally classless and a terrible example to set for other churners.

Also, if one Monday morning during the regularly scheduled 8:30am meeting Jamie Dimon was informed by his actuaries that churning Chase credit cards was like “stealing candy from a baby” I’m pretty sure we’d find a new 1/600 rule implemented by the end of the day.

OK, we’re running out of steam here, but I think maybe we can find a good one to finish up with…

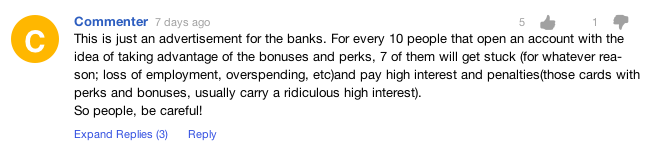

It’s a trap!

This actually might be the most intelligent comment of all. The credit card churning game requires a massive amount of organization and discipline, and there are plenty of people who do not have those traits. For every person who can successfully work the system, there are plenty of others who will get caught and find themselves with ultra-high interest and unmanageable debt.

Banks offer big signup bonuses for a reason – they make gobs of money on credit cards. Literally billions and billions of dollars every year. Chase was not losing money on credit cards before the 5/24 rule went into effect. They’re just implementing it to make even more money by cutting off the folks who are responsible enough to successfully game the system.

See, that wasn’t so bad now, was it?

OK, I admit I avoided reposting any comments that were truly rude or inappropriate. But while this was just a sampling of the over 160 comments left by Yahoo readers on that post, it’s representative of what a lot of people think they know about credit cards. And as most churners realize, it’s generally wrong.

While I’ve tried to put these comments in the best possible light, the reason people know so little about credit cards and credit card rewards is because it’s to the banks’ advantage for people to be confused, so they’re not particularly interested in trying to fix things.

It’s a waste of time trying to explain the facts to someone online who is absolutely certain of their misinformation, but you can help the cause by being patient with your friends and family when they ask about your hobby. Make sure the people you care about understand how credit cards really work and how you can use them to your advantage.

And make sure they get Chase cards with their first 5 applications, because after that… well, I’ll let the Yahoo readers explain it to you.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Now No One Likes Daily Getaways… So I Love Them!

- Why The Chase 5-24 Rule Is Worse Than Amex’s Once Per Lifetime

- Did Following My Own Advice Save My Serve From Armageddon Part Deux?

Find the entire collection of Devil’s Advocate posts here.