Many frequent travelers apply for credit cards to earn a large block of miles or points as a sign-up bonus. It’s not difficult to meet the minimum spending requirements, and sometimes applying for lots of credit cards can actually improve your score. (Failing to manage credit responsibly is a bigger problem. Don’t apply for a card if you can’t pay it off in full each month.)

Alaska Airlines has one of my favorite cards for two reasons: I think their miles are very valuable, and I can find lots of ways to use the annual $99 companion fare. In fact, it’s an open secret that you can apply for more than one card, accumulating lots of miles and multiple companion fares.

When Alaska Airlines recently increased the sign-up bonus to 30,000 miles from the usual 25,000, I decided it was time to apply again. I have been running out of companion fares and figured the timing was right. I don’t like them all to get deposited or expire at the same time.

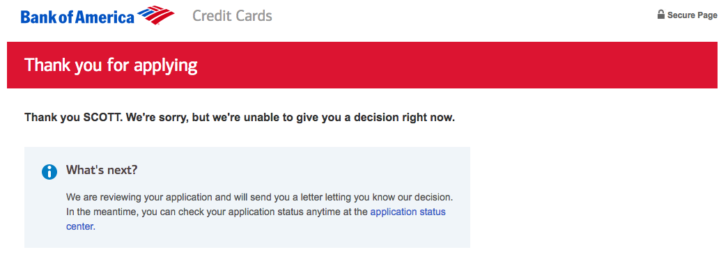

My credit is good, so I wasn’t very concerned about being approved by the issuer, Bank of America, but I did make one fundamental mistake: I failed to call the reconsideration line when I was not instantly approved.

For most banks, instant approvals are not a big issue. If it doesn’t happen, you may get approved a few days later. You may also get rejected, but you can call back after receiving the rejection letter and plead for reconsideration. My requests for reconsideration have almost always been successful. Some people prefer to call for reconsideration right away instead of waiting for the mail. (It makes sense to apply during business hours if you go this route.)

The wait-and-see approach works because you either get approved or you don’t. If you don’t get approved you can call back and get approved later. Bank of America works differently.

I think the only Alaska Airlines credit card worth having is the Visa Signature version. This is the one you see with the big sign-up bonus and the annual companion fare. It requires a $5,000 credit limit. If you can’t get approved for a credit limit that high, you may be approved for the lesser Visa Platinum Plus card automatically. That offers only 2,500 bonus miles and a $50 annual discount.

Frankly, that small bonus is not worth my time, and it’s definitely not worth keeping around if I’m not going to get the companion fare (which I value at over $300). But I was also too lazy to call the reconsideration line when my original application was pending.

I was ultimately approved for the Visa Platinum Plus, and by that time it was too late to do anything about it. When that card arrived in the mail I called the reconsideration line I was told that they could review my credit limit and process an upgrade, but I would not receive the higher bonus. That is only provided “upon approval” — and I had already been approved, even if it was for a different offer.

I chose to cancel the card right then. I didn’t even activate it first. I can’t change the fact that I have a new card application on my credit report, but I can try to limit the damage. I’ll try again in a few months and will be sure to call the reconsideration line immediately if the new Visa Signature card doesn’t get approved instantly.

This detailed thread on FlyerTalk offers more tips for those interested in applying for the Alaska Airlines Visa Signature card and recommends two phone numbers for reconsideration (5 AM to 4 PM Pacific Time, Monday through Friday):

- (800) 354-0401

- (866) 811-4108

Another problem some people have is that they are approved instantly, but it’s for the Visa Platinum Plus card. In that case, submit a second application the same day. It will create a duplicate record in the system without a second pull on your credit report. You may be able to get reconsideration on the second application, moving it up to the Visa Signature level, while simultaneously canceling the first, approved application.

There’s never a guarantee you’ll be approved for any credit card, but reconsideration does help. Sometimes the bank just wonders why you want a second card of the same type (since I already have one Visa Signature). Sometimes the bank is unwilling to extend you more credit, but it is willing to reduce the credit line on one card so that you’ll be eligible for approval on the new application. Once you call in you’ll discover the issue and can offer ways to resolve it.

In the case of the Alaska Airlines Visa Signature card, proactive reconsideration is probably necessary rather than optional. Don’t make the same mistake I did.