Alaska and Korean Air seek to expand marketing agreement, firing salvo on Delta

The plot continues to thicken in the hotly-contested Seattle market with the latest development being a joint filing by Alaska Airlines, Horizon and Korean Air to the US Department of Transportation for a broad “blanket codeshare” authority on each others’ services. Both AS and KE have had a codeshare in place since 2008, with 25 city-pairs authorized to carry each others’ codes. The request is designed to extend the marketing agreement to include all domestic US points, and beyond US-points in any open skies market.

If approved, this move is intended to send a cold shock to Delta Air Lines, who has plans to more than double its weekly seating capacity to Seattle by mid-summer, with even further growth in the pipeline slated for late 2014. Even more broadly speaking, the codeshare would help bolster feed and revenue on Korean Air’s transpacific services to key west coast markets, including Vancouver, Seattle, San Francisco, Los Angeles and Las Vegas.

This would come as a direct affront to Delta as it gears up to launch two transpacific routes from Seattle this summer to Hong Kong and Seoul. Seattle will eventually be the second-largest transpacific gateway market to Asia for a US carrier, behind United at San Francisco.

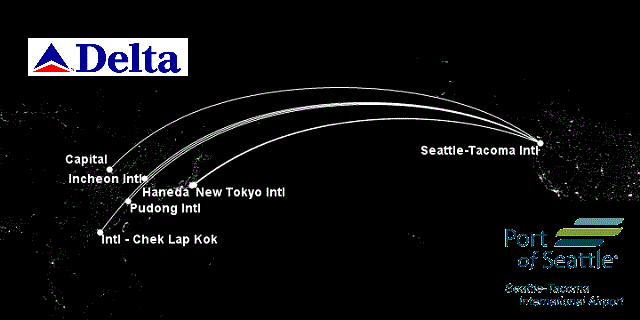

Delta transpacific network from Seattle, effective fall 2014

Today, both carriers filed their intended initial expanded codeshare markets to cover the following routes:

From Seattle to

- Anchorage, Fairbanks, Juneau, Los Angeles, Las Vegas, San Francisco, Dallas/Ft. Worth, Denver, San Diego, San Jose, Austin, Sacramento, Ketchikan, Honolulu, Phoenix, Boston, Oakland, Salt Lake City, Newark, Minneapolis, Washington Reagan, Orange County (operated by Alaska)

- Portland, Spokane, Boise, Eugene, Kalispell, Pasco, Missoula, Yakima, Medford, Redmond, Reno, Billings, Pullman, Bozeman, Helena, Vancouver, Calgary, Edmonton, Victoria, Kelowna (operated by Horizon)

From Portland to

- Las Vegas, Los Angeles, San Francisco (on Alaska)

- Los Angeles, San Francisco, Vancouver (on Horizon)

From Los Angeles to

- Anchorage, Washington Reagan, Vancouver, Guadalajara, Mazatlan, San Jose, Puerto Vallarta, Salt Lake City (all Alaska)

From Honolulu to

- Anchorage, San Diego, San Jose, Oakland, Portland

From San Francisco to

- Palm Springs, Salt Lake City

Foundations are shifting at Seattle with major capacity infusion ahead led by Delta

On a weekly seats basis, CAPA data currently shows that Alaska maintains 55.4% of the overall marketshare at SEA offering 387,293 seats for the week of February 17, 2014, while Delta stands at 11.6% at 80,844 seats.

By mid-summer, however, the numbers will change considerably. For the week of July 22, 2014, Delta’s marketshare will grow 5.7 percentage points to 17.3% with 166,109 weekly seats, nearly double the current level it offers today. In contrast, Alaska’s market share will drop by 8.4 percentage points to 47% total with 451,403 weekly seats, even though the number of actual seats offered on a weekly basis will grow between now and then.

Alaska Airlines and Delta Air Lines weekly capacity metrics at Seattle Tacoma Int’l, February 2014 vs. July 2014:

| Alaska | Delta | |||||

| February ’14 | July ’14 | % change | February ’14 | July ’14 | % change | |

| Seats | 397,293 | 451,403 | 13.62% | 80,844 | 166,109 | 105.5% |

| ASMs | 371,159,334 | 427,412,318 | 15.16% | 186,529,900 | 369,351,510 | 98.0% |

| Frequencies | 3,347 | 3,904 | 16.64% | 481 | 1,093 | 127.2% |

Rocky has published several excellent posts pertaining to Delta’s growth in Seattle, outlining the detailed changes ahead:

See related

Delta Names Seattle a “Hub” & Adds even more flights! (published February 10, 2014)

Delta adds 2 more routes from Seattle & Dedicates a B737 to Seattle (published December 6, 2013)

Delta Expands even FURTHER in Seattle, Alaska Watch out! (published November 5, 2013)

Delta Continues Seattle Expansion; Could Sour Relationship With Alaska Airlines (published October 1, 2013)

Delta continues to omit Korean Air when discussing focal shift in Asia strategy

Last week, the Wall Street Journal conducted an interview with Delta President Ed Bastian from the Singapore Air Show, discussing the evolving dynamics across Delta’s transpacific network. In sync with similar movements executed by United Airlines, Delta has been de-emphazing its reliance on its Tokyo Narita hub, interited from its merger with Northwest Airlines in 2008, and for the first time in the upcoming summer, Japan will represent under 50% of Delta’s capacity across the Pacific.

Bastian attributed much of this shift in focus to the “growing middle class demand” in the region, noting China in particular, seeking “more direct nonstop links,” to the US, combined with Delta’s ability to build out of Seattle as a US gateway. He also mentioned a desire to formulate deeper partnerships with mainland Chinese SkyTeam carriers such as China Eastern and China Southern to build upon this growth.

Consistent with similar behavior in the past, Delta explicitly did not mention anything about its formidable North Asian SkyTeam partner, Korean Air, in any of the transpacific discussions. The exclusion is noteworthy considering that Korean Air is the third largest player between the U.S. and North Asia, after United (#1) and Delta (#2), carrying roughly 10% of nonstop traffic between the two regions. This figure is pretty substantial given that there are 18 U.S. and Asian carriers vying for this traffic on a weekly basis.

Moreover, Korean Air serves the largest number of U.S. markets of any foreign flag carrier from the Asia-Pacific region, a feat that it has seemingly managed on its own without seeking major support from its SkyTeam partners. Earlier this month, Korean unveiled plans to launch service to Houston in Spring 2014, initially on a less-than-daily basis, but has since opted to increase services to a daily, indicating that forward-out bookings have exceeded expectations.

Delta will compete with Korean Air on the Seattle to Seoul route, with all signs indicating thus far that neither carrier intends to proceed ahead with a formal codeshare agreement nor partnership in a joint services fashion. Again, this is interesting given that both carriers will be competing against a third carrier on the route, Star Alliance-affiliated Asiana, yet neither carriers seem interested in capitalizing on an opportunity to combine forces against a mutual foe.

An enemy of an enemy is a friend of mine

The primary driver behind this gradual un-raveling and re-alignment of airline partnerships and agreements is Delta’s Asian network strategy, in which it no longer sees value in Tokyo, and to a lesser extent, Korean Air.

Put simply, Delta’s hey-days of doing everything by the Northwest book, aka centralizing the network around Japan, are in the past. Without a local Japanese partner, which is an advantage both American and United have with JAL and ANA, respectively, Delta hasn’t expressed a pressing desire to look elsewhere in North Asia for stronger partnerships. Again, it’s a major mystery as to why South Korea isn’t high on Delta’s preferred partner list given that its geographic location between North America and the rest of Asia is pretty similar to that of Japan’s, and that Seoul Incheon airport serves as a very efficient transit point between traffic flows. Moreover, the U.S. and South Korea enjoy Open Skies agreements, which eliminates a crucial regulatory burden often uncommon in Asian countries.

There isn’t a clear-cut explanation to the murky, cordial relationship between Delta and Korean Air. Multiple theories exist, with few proven to be 100% concrete. Some hypothesize that bad blood was created in 2010 when Japan Airlines was restructuring in Chapter 11, and Delta sought aggressively to lure JAL away from OneWorld into SkyTeam, to no avail, which soured relationships with Korean Air. Others point to a first-move attempted by Korean in 2012 to reconcile relations with Delta and expand cooperative service, but discussions between the two airlines stalled and plans eventually fell through. Another plausible explanation could be that Delta sees too many redundancies in Korean Air’s intra-Asia network, as it is heavily exposed to the domestic Japanese market, something Delta doesn’t find of interest due to backtracking.

Delta can also piggy-back off of the brand awareness created by Northwest’s storied presence in Asia as a means of attracting business to travel on its own metal to the U.S., rather than force connections over Japan and South Korea.

Furthermore, Korean Air has a tendency to wander to the beat of its own drum when it comes to airline partnerships and agreements. Perhaps one can look to its own successful track record in expanding in the Americas as an explanation for its limited partnership with Delta: rather than dilute the brand and cross-share revenues, it would rather maintain its independence and formulate tie-ups that make sense for the carrier, rather than the greater good of the local alliance partner. Alaska is not only the largest carrier in the Pacific Northwest, but as a narrowbody-only carrier, competitive threats are low and potential benefits are high from a more integrated agreement.

For Alaska, the risk is similarly minimized given that it can feed Korean’s transpacific operations while also growing its own level of inbound traffic from its West Coast focus cities and hubs also served by Korean. Alaska has put on a brave public face with regards to Delta’s domestic expansion out of Seattle. But arguably, Delta’s buildup out of SEA has been less about attempting to crowd out Alaska, and moreso about needing to feed its new long-haul routes to Asia. Still, such expansions do not come without inciting a pissing match, less it do so at the total expense of the incumbent carrier. As such, it makes total sense for Alaska to not only feed into Delta’s long-haul operations from Seattle, but also Korean’s as well for even more incremental feed and revenue.

There will continue to be losers in this race, and likely from Narita

Delta will continue to trim capacity from Tokyo Narita as it builds up its Seattle transpacific pace. Today, the carrier announced plans to downgauge its services from Tokyo to Hong Kong from a 777 to a 767, overtly stating the need to do so in advance of its impending Seattle to Hong Kong route.

The next likely demolition could hail from the U.S. side of the equation, notably Portland. Delta operates a 767 from PDX to Narita, but by summer 2014, Portland will be the only U.S. mainland destination Delta serves from Tokyo that is not considered a “hub” nor a focus city. It’s likely the weakest performing transpacific route to the mainland, and as the de-emphasis on Narita continues, the flight will need to survive more and more on O&D traffic alone. If Delta adds another transpacific route from Seattle, such as Taiwan, the demise of PDXNRT may be in the cards.

Seattle is like the spoiled child of divorced parents getting presents at Christmas

In the constant evolving world of airline partnerships, also known as airline promiscuity, managing conflict, rather than avoiding it, once again becomes a central theme. In this scenario, Alaska, Delta and Korean are acting in their own interests taking a longer-term view of what’s best for their individual businesses when other partnership wells have either lost strategic value, dried up or run into too many roadblocks.

One victor will emerge entirely from this 3-way love fest, which is Seattle. Travelers will now benefit from an enhanced array of options to expend frequent flier privileges and likely enjoy lower fares created by more competition. Delta is serious about its Asian strategy, Korean is serious about protecting is US markets abroad, and Alaska is serious about its home-town frequent flier base. Neither of the three want to be the first to blink.

Needless to say, the fun has just begun.