Note: I designed this as a “Devil’s Advocate” type of post. Therefore, I mostly (intentionally) ignore the opposing argument. Please consider that before throwing rotten tomatoes at me for bad-mouthing the most awesome card on the planet.

Pretty much everywhere I turn, I see bloggers singing the praises of the American Express Platinum card. One of the first “premium” travel rewards cards, Amex has built a loyal following over the years. In fact, my brother recently picked up the card himself. He’s a Jeopardy! champ and all, so surely the card really is great. Yet this is one credit card I just can’t get excited about. In fact, it might rate as the most overrated of the premium rewards credit cards.

The Premium Rewards Credit Card Space

The Amex Platinum competes in the premium rewards space with two other primary competitors. These are the Chase Sapphire Reserve and the Citi Prestige. (You could include others, but for simplicity’s sake, I will refer only to these two in this post.) For an annual fee of $450 ($550 for the Amex), the cards provide the following similar benefits:

- Earnings in a convertible points currency

- An annual travel credit

- Global Entry/TSA Precheck credit (usually once every 5 years)

- Airport lounge access

- Concierge service, including access to preferred reservations for restaurants and entertainment

- Travel insurance and/or purchase protection

- Special hotel discount/perk programs

So why do I consider the Plat overrated compared to its competitors? Allow me to count the ways…

A Gimmicky Travel Credit

The Plat offers an annual $200 credit, similar to those offered by Citi ($250) and Chase ($300). So why do I consider it vastly inferior? Because Amex offers only an “airline fee credit”, which covers only incidental fees. I know, I know. Just buy gift cards in small increments. Rohan even has a special how-to on the subject. There’s one problem, though – doing so technically violates the card’s T&Cs:

Airline tickets, upgrades, mileage points purchases, mileage points transfer fees, gift cards, duty free purchases, and award tickets are not deemed to be incidental fees.

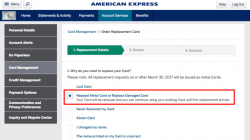

Historically, Amex has chosen to look the other way, and does reimburse gift cards as long as you don’t buy all $200 at once. Still, I don’t like playing games to take advantage of a perk. Plus, from my days in Corporate America, “loophole abuse” was usually the first crackdown when costs needed cutting. Do you really want to chance it the next time Amex fails to meet its earnings guidance?

Beyond that, I dislike Amex’s credit because you have to pre-select one airline, and can only change once per year. This is significantly more restrictive than its competitors. Citi allows you to use the credit against any airline charge, for example. I used it one year to buy cheap tickets on Airberlin, Czech Airlines, and Air France. Chase makes it even easier, by allowing the credit against ANY travel expense. No can do with the Amex.

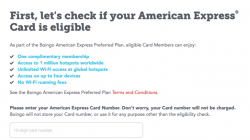

An Even More Gimmicky Uber Credit

Amex tried to justify its fee hike to $550 by introducing a $200 Uber credit. A $200 credit for a $100 fee increase sounds too good to be true, right? That’s because for the average cardholder, I’d venture that it is. Amex splits the credit by month – $15 from January through November, then $35 in December. If you use Uber regularly, then I concede you probably receive full value from the credit. On the other hand, I might use Uber for personal use once every few months. (I don’t count business trips; my employer foots the bill so the credit is meaningless.) Worse, where I do find Uber especially helpful – out of the country – the credit is completely useless. That’s because Amex restricts the credit to Uber rides in the US.

In short, I have a hard time believing the average card user can use even half the value of the credits. Hardly a justification for jacking up the annual fee, in my opinion. For the occasional user, you’re far better off using the Sapphire Reserve and applying the general travel credit.

Mediocre Points Earning on Everyday Spend

If you rack up large bills on airfare, then the Plat might make sense. 5x points on airfare adds up quickly, after all. But for everything else? It’s pretty lame. Both Chase and Citi offer some bonus categories. While Chase offers 3x points on travel and dining, Citi offers 3x points on airfare and hotels, and 2x points on dining. The Plat, though? It offers bonus categories, but pretty lame ones. You can earn 5x points on hotels, but only prepaid bookings made through Amex Travel. (These prepaid bookings usually don’t qualify for hotel points accrual or elite benefits.) On everything else, just a single Membership Rewards point.

Heck, by downgrading to Amex’s own Gold card, you earn 2x points on groceries, gas, and dining. And still earn a respectable 3x on airfare. Suppose you spend $2,000 on airfare, $5,000 on groceries, $1,000 on gas, and $2,500 on eating out. The Gold earns 23,000 points; the Plat, only 18,500. And you’ll pay only a $175 annual fee vs $550. The Plat just doesn’t seem very compelling for everyday use.

No Travel Insurance

To me, this is where the Plat really falls flat. Both Chase and Citi offer very good travel delay and cancellation protection baked into the card. The Prestige, for example, offers up to $500 for trip delays (IRROPS) over 3 hours, or up to $5,000 for cancellations/interruptions for medical reasons. Thankfully, I’ve never had to use the coverage, but it’s nice to know it’s there.

The Plat, though? Bupkis. I’m not keen on plunking down big bucks on cruise fare or premium cabin airfare without some kind of a backstop in case things go wrong. On my last cruise, for example, a delay/interruption package would have run $150-200. My Prestige covered it; the Plat would have left me out of pocket. That adds up if you buy several big ticket items each year. That’s not even counting the costs of IRROPS, where the Plat’s lack of delay benefits leaves you SOL.

Serially Overcrowded Centurion Lounges

Perhaps the most lauded Platinum perk by frequent flyers is Centurion Lounge access. The lounges are a unique perk; no other card issuer offers access to exclusive, proprietary lounges like Amex. From what I gather, they also offer a far superior food & beverage selection compared to other domestic lounges. Amol, Rocky, and Scott have reviewed the lounges, and I admit they do look good.

The problem is, quality attracts a crowd, and Centurion Lounges have a reputation for serial overcrowding. There’s a 59-page long Flyertalk thread dedicated to the subject. And of course, the lounge at DFW Airport usually ranks as the worst offender. I’ve visited my share of overcrowded lounges over the years, like the Admirals Club in Paris.

For me, an overcrowded lounge is almost as bad as not having one. I enjoy lounges as a space to relax, and too much noise and crowding makes that impossible. Until Amex figures out a permanent solution, it seems cardholders aren’t getting their money’s worth.

Final Thoughts

Much as when I blasted hotel breakfast as an overrated benefit, I’m sure many of you will point out the holes in my logic. But I just don’t see how the Amex Plat deserves the hype it gets in the blogosphere. Gimmicky benefits you have to play games to use, poor earnings for everyday spend, no travel insurance, overcrowded lounges – it hardly seems worth the $550 annual fee. At least under this one-sided devil’s advocate analysis.