Stephen wrote in with a question on how best to credit his remaining flights this year AND which credit card he should use for some big upcoming purchases:

I saw another article today from Gary about Agean airlines and “lifetime” star alliance gold. I first heard about it from you earlier this year and each time I see something it makes me stop and think if this works for me. Having said that I wanted to get your opinion on my situation.

I just hit United silver this week and also have the chase united mileage plus card (got a $100 statement credit for the next year so free again). I have a flight from Boston (discount economy) to Norfolk on US Airways and a full Y fare from Norfolk to Naples on United scheduled for the rest of the year. Even if I credited those flights to United I expect to be about 10k eqm short for united gold. I may have other travel for work but I believe that last 10k will be difficult.

I was thinking about crediting those flights to A3 [Aegean] to work towards Star Gold. I would still expect to be 10k short of gold at the end of the year but the status miles do not reset at the end of the calendar year which would give me more time.

I see the biggest benefit to Star Gold as being the lounge access at this point and I do not expect to be able to requalify united silver next year.

I also am looking into the United Club card for the 1.5 miles per dollar spend since I am expecting to make some very large purchases over the next year.

I guess my final point is that it feels like I am duplicating some effort here. So between that and my thoughts on Star Gold what do you think?

Elite status with United or Aegean?

Stephen’s main concern appears to be getting access to the United Club since he’s outlined two approaches to getting there, but he also wants some of the benefits that come with being an elite traveler. His strategy was overlapping significantly in some places. If he applied for the United Club card, he’d be paying $300 ($395 minus a $95 credit) for lounge access. But if he already had Star Gold access from an international partner like Aegean, he wouldn’t need the card and would effectively pay $300 just to get the 50% bonus points on his predicted spend. So first we have to tackle whether he should aim for status with United or Aegean.

There are three factors working against Stephen:

- Premier Silver status with United’s MileagePlus isn’t a great deal to start.

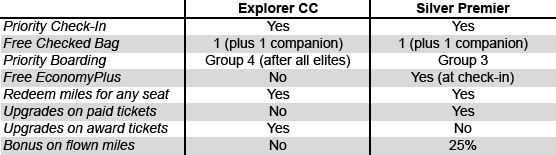

- He already has many of those same benefits as a United Explorer cardholder. (see chart below)

- He doesn’t think he’ll be able to requalify for Premier Silver next year, so it definitely doesn’t sound like aiming for Premier Gold is worthwhile, even if Stephen could make it happen with a mileage run or two.

Here’s a chart showing my evidence for Point 2. As you can see, there isn’t a lot that Premier Silver elites get that Explorer credit card holders do not. The few distinctions, like access to EconomyPlus and upgrades, have been diluted (by limiting access until check-in) or just aren’t huge losses (even Premier 1Ks are having trouble with upgrades on some routes).

Instead, Stephen’s plan to go for Gold status with Aegean is superior, especially given his desire to get lounge access. Aegean allows you to earn Gold status by flying 16,000 miles in any 365-day period after earning Blue status. Blue status requires only 4,000 miles, but this threshold is lowered if you get the 1,000 bonus miles as a new member. That’s 19,000 miles total. And then once you get Gold status, you only need to credit one flight every three years to maintain it.

The biggest risk as Gary pointed out is that Aegean could change the terms at any point so that his status is harder to maintain (that is, they might require him to earn 20K miles every year). The second risk is that he’ll be crediting his flights to Aegean, where he might find them more difficult to redeem for awards. Always check out the earning and award charts for any airline before crediting flights to their program, as you might find big restrictions on redeeming them and also lower earning rates on deep discount fares. All US Airways flights credit at 100-150%, and the full Y fare on United Stephen has planned will credit at 150% (some discount UA fares earn 50%).

The final risk is that he won’t be able to earn Complimentary Premier Upgrades or EconomyPlus seating since these are benefits only for United’s own elites, although access to the elite check-in and things like an extra baggage allowance are still benefits of Star Gold status.

What about elite security lines? I’ve read mixed messages on that. It’s not explicitly stated on United’s site or the Star Alliance site, but I think you might have a good shot. Just flash your Aegean Star Gold card. This is also stated benefit of the United Club card (part of the Priority Access package) but not the United Explorer card.

Given that Stephen expects to be an infrequent traveler, not able to requalify for Silver, the inability to get better seats or upgrades is a non-issue in my opinion. He can always pay extra for the upgrade on important flights. And I expect the elite security lines to be a non-issue or an infrequent one at that.

Choosing a credit card for large purchases

So let’s now address Stephen’s second question. The United Club Visa Signature is a good choice for large purchases that don’t fit any other category AND when you don’t expect to meet certain spending thresholds that earn you bonus points or a companion pass from other cards. If you are already going to have lounge access as an Aegean Gold member, I don’t think it’s worth paying the $300-395 card fee just to get 1.5 points per dollar.

Instead, consider a card like the British Airways Visa Signature You’ll get 1.25 points on all purchases (2.5 points on BA.com) and a single-use companion pass after you spend $30,000 in one calendar year (I admit I don’t know how large these purchases are that Stephen mentions). The companion pass is good for paid and award tickets in any cabin, so the points you earn from the card are stretched twice as far.

Stephen could also just apply for lots of cards and split his purchases across them to meet the various minimum spend requirements. Sometimes the better cards (like AmEx Gold, Sapphire Preferred, or Ink Bold) have very high requirements of $3,000 to $10,000. But this is also a hassle for some people and isn’t feasible if you have only one or two very large purchases.

I later learned Stephen would prefer to keep things simple, and that he already has the SPG AmEx. I like the idea of using the SPG AmEx because I think 1 Starpoint is roughly equal to 1.5 United miles, and they’re especially useful for Cash+Points awards. Hotel awards also tend to have fewer restrictions than flights.

I have several current credit card offers listed on my blog if you check out “Credit Cards” in the top navigation menu. There’s a drop down menu that breaks them out into airlines, hotels, etc. Feel free to look these over and ask me if you think any other cards look like good fits for your spending plans. (Note: Only cards offered by Capital One provide me any referral fees. Everything else is there entirely for your convenience.)