The Avianca LifeMiles loyalty program recently announced a sale on Star Alliance partner redemptions. Some of the prices provide excellent value, especially for Business Class tickets to and from Asia. But given Avianca’s currently financial difficulties, some may wonder: should you take advantage?

LifeMiles Star Alliance Award Sale – The Basics

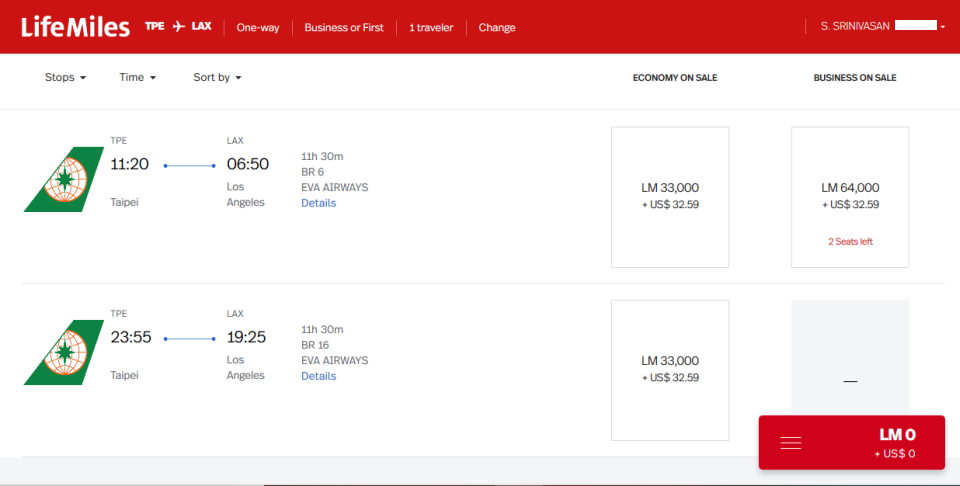

The sale permits LifeMiles redemptions on select partner routes to Asia for up to a 31% discount each way. The headline number, though, is a bit misleading. While yes, there is one route offering the 31% discount, most discounts range from 13-15% in Business. So, still a good deal, but don’t expect 50k redemptions to Asia. You can see a full list of eligible routes and prices here. The general theme, though, is that routes that normally run 75,000 LifeMiles in Business Class cost 64,000 instead with the promotion. Some sample routings include:

- Chicago to Taipei

- Houston to Taipei

- Los Angeles to Hong Kong, Seoul, Shanghai, and Taipei

- San Francisco to Hong Kong

- Seattle to Taipei

I consider 64,000 miles for Business Class a very good value on these routes. For example, American charges 70,000 on most of these routes. United, meanwhile, charges 70,000-75,000 miles on its own metal, or 80,000-90,000 on partners. Delta no longer publishes award charts for SkyShinplasters, but partner awards usually price out at 85,000. Thus, this sale provides significant discounts over competitors. Avianca’s Star Alliance partners to Asia include excellent products on ANA, Asiana, and EVA Air. That, to me, provides even more value at this price point.

In addition, LifeMiles currently has a purchased miles promotion, with a 2-for-the-price-of-1 sale. Also, sites including OMAAT offer an additional 15-40% bonus. If you want just enough for a one-way Business Class award, you can buy 30,000 miles for $990, which nets 64,500 redeemable miles. That works out to 1.53 cents per miles; I regard that as basically a wash compared to the value of miles transferred in from credit card programs.

The award sale runs through June 19th, while the sale on purchased mile ends June 5th.

What’s Available

Sales, of course, only provide value if you can actually find seats to redeem for. I didn’t extensively research availability, but did find fair availability from Asia to the US from March, 2020 through end of schedule. On the other hand, availability from the US to Asia looked pretty slim. (Oddly, it looks like there’s consistently one seat every Friday next spring from LA to Taipei.) So, the ideal use looks like a one-way return from Asia combined with either a cheap westbound coach/premium economy fare, or a premium cabin award from another program. Importantly, LifeMiles allows bookings up to 360 days in advance; that gives you an additional 25-30 days of availability compared to domestic programs. So, if you’re advance planning a trip to Asia late next spring, LifeMiles provides you a leg up.

However, if you have flexible plans and don’t mind some tedious trial and error, you can find seats westbound. For example, I snagged one Business Class seat from Houston to Taipei next May. I have no idea what to do for the return, though. I might do a crazy round-the-world routing. Maybe a cheap coach or premium economy fare. Or just a “standard” award booking like JAL Business Class. If anyone has ideas/suggestions, I’m all ears.

So Should You Take Advantage of the LifeMiles Star Alliance Award Sale?

I’ve noticed several comments suggesting caution in taking advantage of this sale. The common theme: the risk of an Avianca bankruptcy, given its financial troubles. And I’ll be the first to admit, I have no idea what happens if that happens. That presents a situation where the ticketing carrier goes belly-up, but the operating carrier still flies. So what happens to your codeshare ticket in that case? I doubt this is a similar case to a travel agency declaring bankruptcy. In that case, issues tickets sometimes end up canceled due to failure of the agency to pay. However, in the case of a frequent flyer redemption, my understanding is that the airlines settle “payment” fairly quickly. I see no signs right now that Avianca might disappear in the coming days or weeks. Therefore, I see the risk of cancellation for non-payment as remote.

However, there is another potential issue – what happens if you need to later change or cancel your ticket? If Avianca stops operating, there’s now nobody to handle a change or cancellation request. And for that matter, how does a refund work, since the ticketing program no longer exists? The operating carrier probably honors your ticket, but you might be SOL on changes or refunds.

Now, with that out of the way, I personally see the risk of an actual liquidation as low. Keep in mind, the entity facing financial problems is Avianca’s parent, BRW Aviation, and not Avianca itself. BRW recently defaulted on a loan owed to United Airlines, primarily due to problems with Avianca Brasil. And that’s why I regard the risk as low. Avianca Holdings basically broken even in 2018, and reported an eye-popping $69.7 million loss for Q1 2019. However, it also reported positive operating income of $18.5 million, slightly adding to its cash position in the quarter with about $291 million on hand. Certainly, the Q1 numbers aren’t good, especially in view of deteriorating operating results like revenue per seat mile. But these aren’t dire numbers either; certainly nothing to suggest an imminent collapse.

Now, BRW’s default on its United debt does present an interesting side issue. BRW pledged its shares in Avianca as collateral for the loan. United could force BRW to tender those shares, which effectively means a United takeover of Avianca. (In fact, it seems United’s already angling in this direction, even if it doesn’t actually take the shares.) If that happens, I can see United forcing “enhancements” on Avianca, including a LifeMiles devaluation. But I hardly think United might shut down Avianca; the flying side of the business seems reasonably healthy, as the airline filled 82.1% of its seats last quarter. It’s also a dominant player throughout Central and Northern South America.

So, all that said, I don’t suggest speculatively buying a bunch of LifeMiles, as a devaluation certainly seems possible. (Though I generally think buying miles without an immediate use isn’t a good idea anyway.) But the possibility of Avianca going out of business anytime soon? I just don’t see it, and wouldn’t worry about it too much.

Tips for Booking with LifeMiles

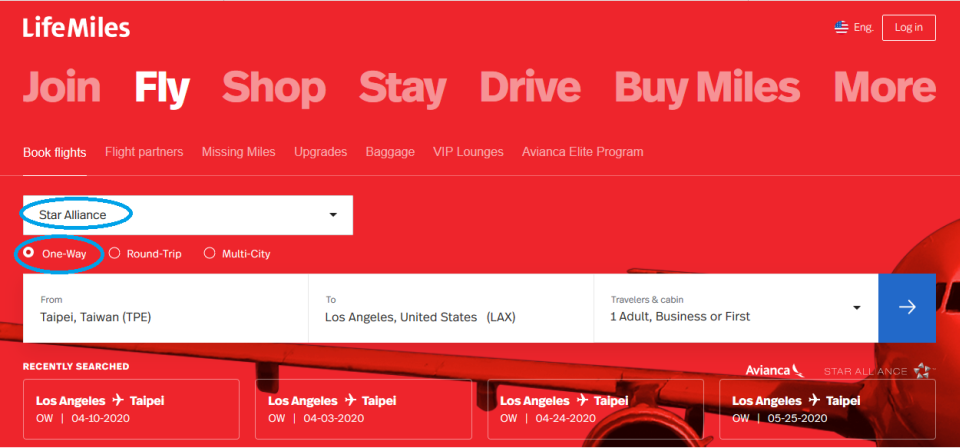

Anyway, here’s a few tips if you decide to take advantage of the LifeMiles Star Alliance award sale. I personally think the hate the LifeMiles site receives is overblown, but it does have some quirks. First, make sure to select “Star Alliance” for your search option. Also, I strongly suggest searching for one-way awards, rather than round-trip.

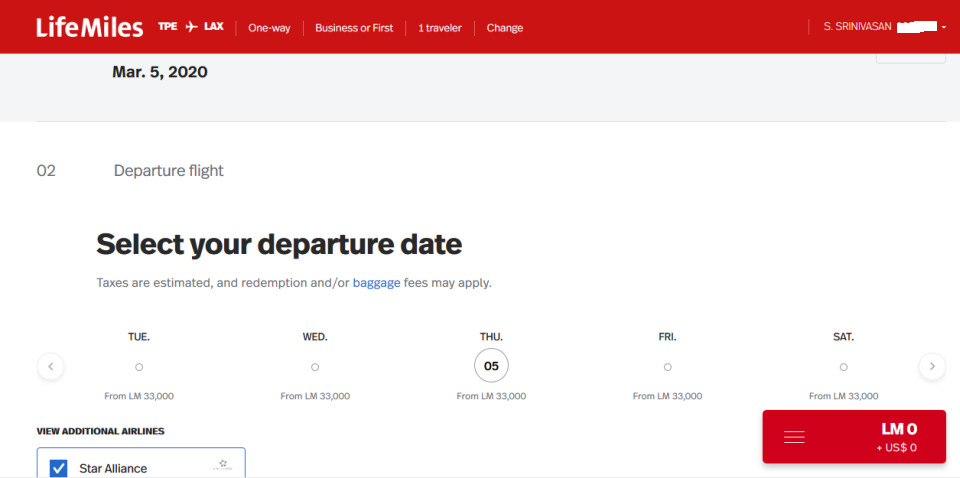

Unfortunately, the LifeMiles site only displays availability one week at a time. Also, even if you search for Business Class, the lowest cost defaults to Economy if seats are available. Even if there is no Business Class availability on that day. Thus, the “trial and error” I mentioned earlier in this post.

Once you find a flight, I suggest verifying availability on another site. ESPECIALLY if you plan to buy or transfer points for the award. LifeMiles has long had issues with phantom availability. If you don’t have Expert Flyer, United’s search engine generally provides accurate information.

After selecting a flight, you can use “LifeMiles + Money” to partially use miles, and purchase up to 60% of the balance at 1.5 cents/mile. If you do this, expect issues completing your transaction online. I had to contact the call center to complete my most recent LifeMiles + Money award. Fortunately, the experience wasn’t the fustercluck I expected.

Anyway, for what it’s worth, my award confirmed instantly online. So don’t believe all the horror stories you hear.

Final Thoughts

If you need tickets to (or especially) from Asia, this sale presents a real opportunity to score Business Class seats on great airlines at a good price. Yes, I’d keep Avianca’s financial pressures in mind, and it would make me wary to speculatively buy miles. But at this point, I wouldn’t worry much if you have a firm use in mind. Just pack a little patience and flexibility to find seats using the search tool.