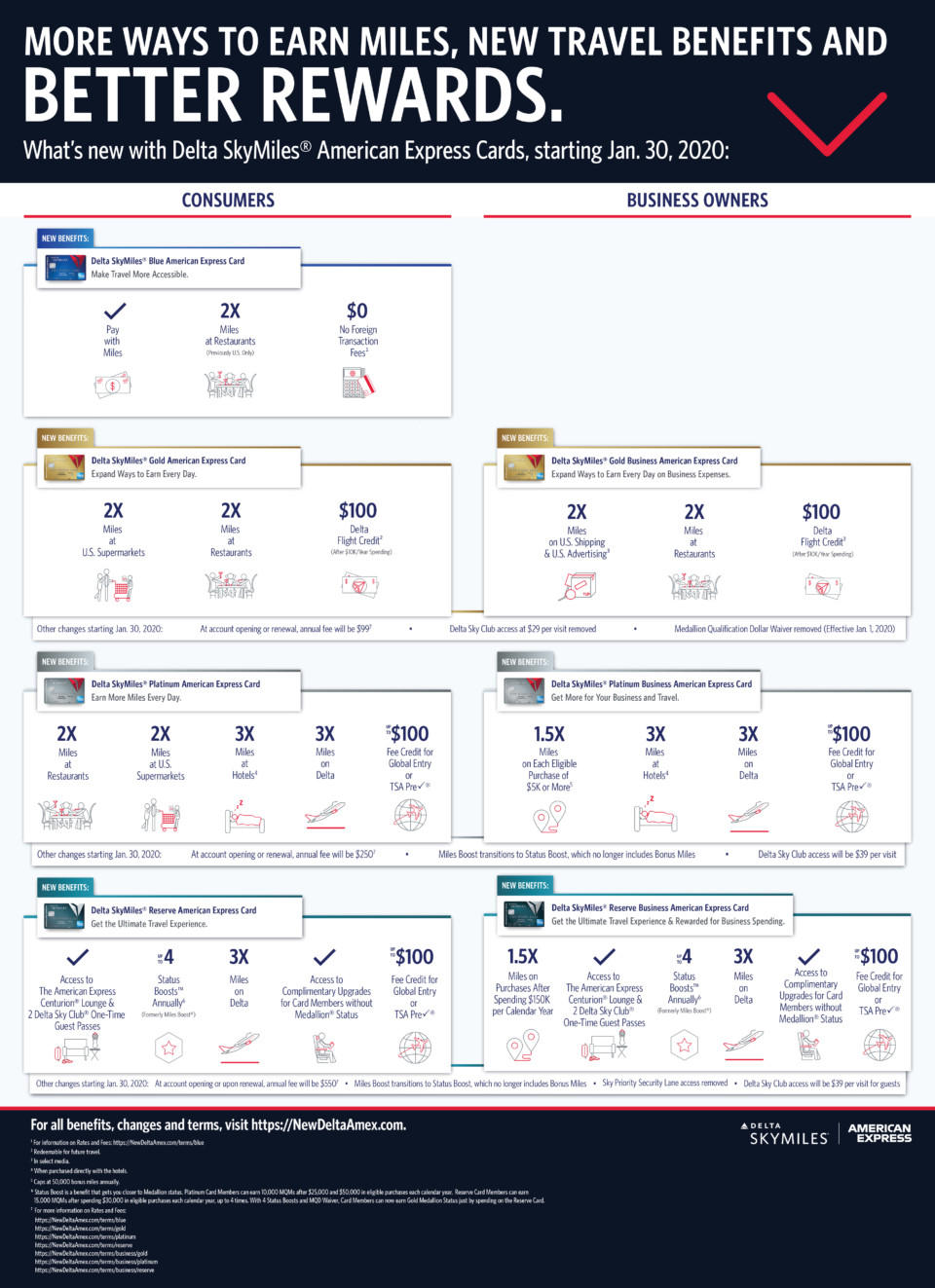

American Express and Delta have announced new perks for their co-branded credit cards. As the only airline with a co-branded card issued by Amex, it shouldn’t be a surprise that they’re eager to keep Delta and Delta’s customers happy. But what’s more curious is that Amex is blurring the lines between Delta’s cards and its own products that earn Membership Rewards points. Case in point: Starting next year, some lucky Delta Amex credit cardholders will be able to access the exclusive American Express Centurion Lounges.

Other changes include the ability to earn more Medallion Qualifying Miles even as others lose the ability to earn an annual waiver for Medallion Qualifying Dollars. Annual fees are increasing pretty much everywhere, some more than most, but you might earn more miles.

Here are some of the key changes taking place, effective January 30, 2019, although American Express is providing special promotional offers if you apply for a card now during the month of October. I won’t cover the most basic Delta Blue Amex or the business cards, which you can read more about in the press release. (Click the link on the graphic above for more detail.)

Delta SkyMiles Gold American Express Card

The entry-level Delta Gold card from American Express has a $99 annual fee like most other airline credit cards and offers 2X miles per dollar on dining and grocery purchases. You’ll also get a $100 credit on a Delta flight after you spend $10,000 each year. That fee is only a slight $4 increase over the current $95.

It’s a good everyday option if you want to earn airline miles and get a free checked bag, but frankly I think you’ll find better value with more flexible rewards offered by the American Express Gold Card or the Chase Sapphire Preferred Card. Locking yourself into an airline credit card means you can only earn and redeem miles with that airline loyalty program, which isn’t a great position to be in if the airline increases its award costs.

Delta is also removing the ability to use this card for discounted one-time lounge passes or to earn an annual waiver on earning Medallion Qualifying Dollars for elite status. These were both pretty good perks, so I think it’s a negative change overall.

The current sign-up offer available through October 30, 2019, includes 60,000 bonus miles after spending $2,000 in the first 3 months, plus a $50 Delta statement credit in the first 3 months.

Delta SkyMiles Platinum American Express Card

Similar to the Delta Gold Amex, this card earns 3X points on Delta and includes a $100 credit for Global Entry or TSA PreCheck. (Always pick Global Entry. The application process may take longer, but it includes PreCheck and many other benefits.)

On the downside, the annual fee is increasing from $195 to $250. I’m not sure this is worthwhile considering Global Entry and PreCheck memberships are each valid for five years, so it’s not like you’re getting $100 in added value each year. Plus there are so many cards that offer this perk. I have at least half a dozen and am frustrated that none of my family will let me sponsor their application. They like to wait in line, I guess.

The current sign-up offer available through October 30, 2019, includes 75,000 bonus miles and 5,000 Medallion Qualifying Miles after spending $3,000 in the first 3 months, plus a $100 Delta statement credit in the first 3 months.

Delta SkyMiles Reserve American Express Card

Finally, we learn more about lounge access. Like the Delta Platinum Amex, the Delta Reserve Amex earns 3X miles per dollar on Delta and comes with complimentary Global Entry. It also includes two one-time guest passes to the Delta Sky Club, which is one reason the card has a whopping $550 annual fee (increasing from $450). That’s comparable to the $550 charged for the American Express Platinum Card.

The fee is high in part because the card comes with a membership to the Delta Sky Club, but it’s for the individual only and doesn’t include guests. That’s why the guest passes are being added.

Another interesting change is that Delta Reserve Amex cardholders get complimentary admission to Amex’s own Centurion Lounge network, previously exclusive to the Amex Platinum Card. (Amex has even been kicking out its own Amex Gold Cardholders, and placing new restrictions on Platinum Cardholders.) You can only get access to the Centurion Lounge when flying on Delta, but that makes sense because another perk of the Amex Platinum Card is that Delta passengers can use the Sky Club.

Other perks of the Delta Reserve Amex include complimentary upgrades without SkyMiles Medallion status (you’re still at the back of the queue) and the ability to earn 15,000 Medallion Qualifying Miles up to four times each year, each time after spending $30,000. That’s potentially a total of 60,000 MQMs, but Amex is removing the ability to also earn bonus award miles.

I don’t recommend that you sign up for this card unless you really need those MQMs (enough to earn SkyMiles Gold status without even flying). As I pointed out, it has the same annual fee as the American Express Platinum Card, which also includes Centurion Lounge access and also gets you access to the Delta Sky Club every time you fly Delta. You can also earn 5X Membership Rewards points when you use you Platinum Card to pay for your ticket (on Delta and all other airlines). And those points, as I said, are more flexible and can be transferred to over a dozen airline loyalty programs, including SkyMiles if you choose. There are a host of other Amex Platinum Card benefits like a $200 airline credit that do more to offset the annual fee.

But if you disagree with me, you can sign up for the Delta Reserve Amex through October 30, 2019, and get 75,000 bonus miles plus 10,000 Medallion Qualifying Miles after spending $5,000 in the first 3 months.