The air travel news continues to drag on during the pandemic. Airlines are parking the majority or even entire fleets as airline booking continues to fall off a cliff. I recently wrote a two-part post on how and what it takes for airlines to park their aircraft. You can read part 1 here and part 2 here. Airlines are also accelerating the retirement of older aircraft particularly the large, four-engine Boeing 747s and Airbus A-380s and obsolete aircraft like the Boeing 757 and 767.

New Aircraft Orders

There is more doom and gloom on the horizon for new aircraft acquisition. Right now, the last thing the airlines’ needs are more aircraft and additional aircraft payments. Vertical Research Partners analysis shows new aircraft demand could drop by 25%. They base their conclusion on the current drop in airline bookings with projected rebounds of 19% in 2021 and 10% in 2020. Previous new airliner deliveries forecasted at 8,300 could fall in the neighborhood of just 6,300 aircraft.

What happens to existing aircraft orders? Airlines could pay the penalty for order cancellations. They could defer aircraft delivery for a period of time while the business climate returns to some resemblance of normal. I believe that both Airbus and Boeing will work with their airline customers to stretch out deliveries of existing orders. The last thing that Airbus and Boeing need is to alienate their loyal customer base.

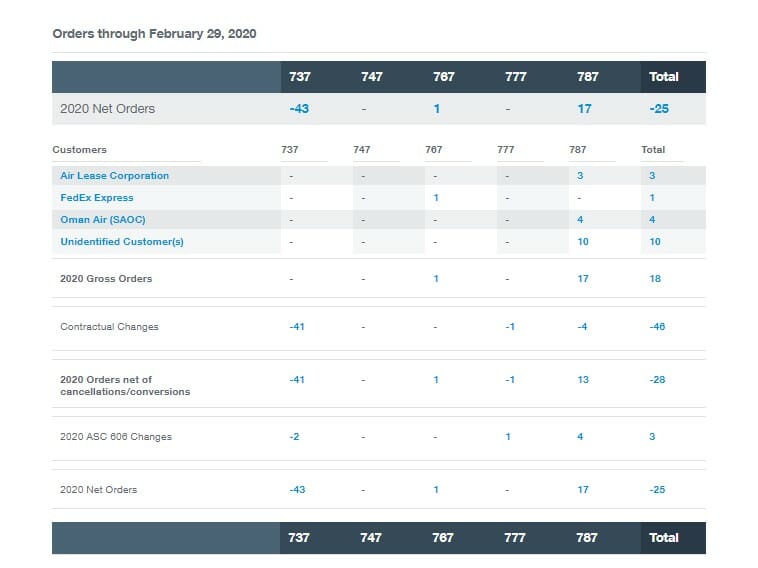

Boeing would be in a worse position than Airbus because of the 737MAX debacle. They have orders of over 4,000 737MAX aircraft plus about an additional 400 completed aircraft that have not been delivered. The order book for Boeing in 2019 was a net -85 aircraft orders. The 2020 year-to-date order book for Boeing is still negative with the 737MAX leading in order cancellations.

The Used Aircraft Market

If an airline needs to acquire some aircraft, the used aircraft market may be the way to go. It is all about supply and demand. If the number of aircraft on the ground exceeds demands, it could be a buyer’s market for snapping up a bargain. With Airline failures on the rise, there could be some fairly new aircraft available for resale. An additional upside to the resale market is immediate delivery versus waiting for years to acquire new aircraft from Boeing and Airbus.

Aircraft Lessors Face Uncertainty

Aircraft leasing companies need to have a perfect crystal ball. They have to forecast years in the future to have timely delivery of the right kind of aircraft that the airlines need. Getting this forecast wrong can put leasing companies in a financial bind. In 2017, Amedeo Aircraft Leasing (formerly Doric) in Ireland gave Airbus an order for 20 A-380 aircraft. They found no airlines willing to lease their A-380s. They thought about keeping the orders and forming their own airline which never materialized. The orders were ultimately canceled.

Aircraft leasing can be good for airlines. It reduces the risk that airlines take when they expand their route structures. They don’t have enormous capital expenditures. When they want to replace leased aircraft, they can just return the aircraft at the end of leasing instead of trying to sell or trade-in existing aircraft.

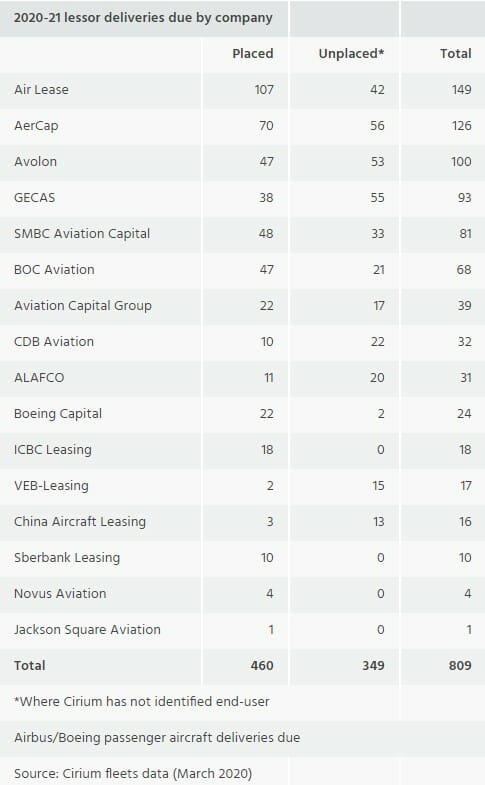

Cirium (FlightGlobal) is reporting that aircraft lessors are facing 800 near-term aircraft deliveries. Their research is showing that airlines are scheduled to take delivery of over 2,700 aircraft by the end of 2021. These acquisitions include direct purchases and new aircraft leases. For leasing companies, having new aircraft deliveries is a good thing if they have these aircraft placed for immediate airline service. Again, the need for new airliners is contracting for the near future. These charts compiled by Cirium are telling:

The “placed” column is the good news at least so far. These aircraft deliveries have a home. The “unplaced” column means there are no pending aircraft customers waiting for the delivery of these aircraft. There may be some lease cancellations as the bottom continues to drop in the air travel market.

Final Thoughts

As I have stated in previous posts, the airline industry is in uncharted territory with no immediate signs of recovery. The major unknowns are how long travel restrictions will remain in force and how long it will take for the flying public to return to the skies. Economic recovery will certainly play a part in creating a demand for air travel. Without demand, there can be no recovery.