American Express currently offers four different versions of their fan-favorite Platinum Card. They all come with the standard $695 annual fee and all have the same great benefits such as Global Entry, Uber, Saks, entertainment, Equinox and airline incidentals credits; hotel elite status; and complimentary access to the American Express Global Lounge Collection. And if you have one of the specialty cards from Charles Schwab or Morgan Stanely, you can enjoy additional perks that are uniquely special to their partnership with American Express. Today, I am going to talk about the American Express Platinum Card exclusively for Morgan Stanley and show you how to get one for free every year. But be warned; it’s a little time-consuming and you’re gonna have to jump through some hoops…

First, let’s talk about the three most popular American Express Platinum Cards (Vanilla, Charles Schwab and Morgan Stanley) and see how they stack up against each other. Note: American Express does have a partnership with Goldman Sachs but I won’t be discussing that card as it’s invite-only.

American Express Platinum Card

The normal American Express Platinum Card, or as people call it, the “Vanilla” American Express Platinum Card, is your standard Platinum Card.

- Annual fee of $695, not waived the first year

- Currently has a 100,000 Membership Rewards (MR) points signup bonus after $6,000 spend in six months

- 5 x points on flights booked directly with airlines or through American Express Travel

- 5 x points on prepaid hotels booked through American Express Travel

- 1 x point on everything else

- Hilton Honors and Marriott Bonvoy Gold status

- $200 airline incidentals credit

- $200 Uber credit

- $100 Saks Fifth Avenue credit

- $240 digital entertainment credit (effective 7/1/21)

- $300 Equinox credit (effective 7/1/21)

- $200 Hotel credit when booking a prepaid Fine Hotels and Resorts or Hotel Collection stay through American Express Travel (effective 7/1/21)

- $179 CLEAR credit (effective 7/1/21)

- Global Lounge Collection access including Centurion Lounges, Delta SkyClubs, and Priority Pass Lounges, etc.

- Cell phone protection up to $800 when you pay your monthly cell phone bill with your American Express Platinum Card

- And more

The one benefit of this card is that it’s the only one that regularly offers increased signup bonuses. It’s not uncommon to find signup bonuses ranging from 60,000 to 100,000 + MR points after eligible spend.

Charles Schwab American Express Platinum Card

The Charles Schwab American Express Platinum Card is only available to Schwab clients with eligible accounts such as a Schwab One or a general brokerage account.

- Annual fee of $695, not waived the first year

- Currently has a 100,000 Membership Rewards (MR) points signup bonus after $6,000 spend in six months

- 5 x points on flights booked directly with airlines or through American Express Travel

- 5 x points on prepaid hotels booked through American Express Travel

- 1 x point on everything else

- Hilton Honors and Marriott Bonvoy Gold status

- $200 airline incidentals credit

- $200 Uber credit

- $100 Saks Fifth Avenue credit

- $240 digital entertainment credit (effective 7/1/21)

- $300 Equinox credit (effective 7/1/21)

- $200 Hotel credit when booking a prepaid Fine Hotels and Resorts or Hotel Collection stay through American Express Travel (effective 7/1/21)

- $179 CLEAR credit (effective 7/1/21)

- Global Lounge Collection access including Centurion Lounges, Delta SkyClubs, and Priority Pass Lounges, etc.

- Cell phone protection up to $800 when you pay your monthly cell phone bill with your American Express Platinum Card

- And more

Exclusive to this card, you can receive a $100 statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 or receive a $200 statement credit if your holdings are equal to or greater than $1,000,000. Additionally, you can transfer your MR points to your eligible Schwab account at a value of 1.25 cents per point, which is not a bad deal. For example, you can transfer 60,000 MR points to get $750 deposited into your Charles Schwab brokerage account. Effective 9/1/21, the transfer rate will be reduced to 1.1 cents per point.

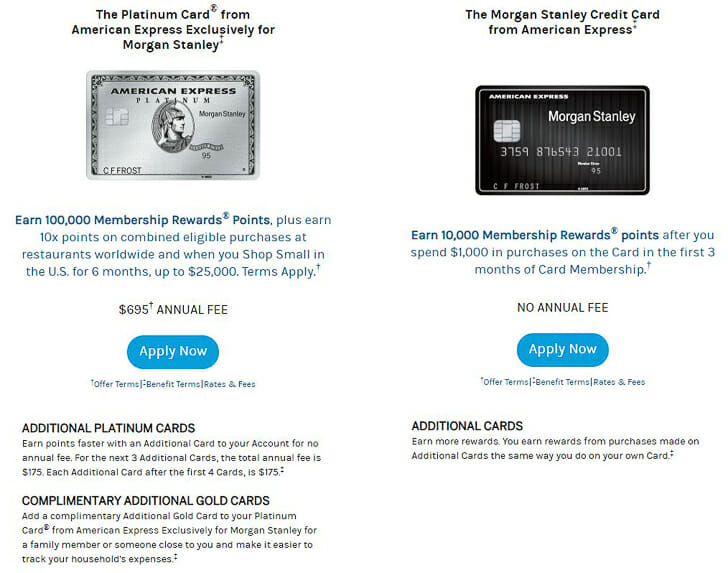

Morgan Stanley American Express Platinum Card

The Morgan Stanley American Express Platinum Card is only available to eligible Morgan Stanley clients. Not a Morgan Stanly client? Don’t worry. I’ll explain how you can be one below.

- Annual fee of $695, not waived the first year

- Currently has a 100,000 Membership Rewards (MR) points signup bonus after $6,000 spend in six months

- 5 x points on flights booked directly with airlines or through American Express Travel

- 5 x points on prepaid hotels booked through American Express Travel

- 1 x point on everything else

- Hilton Honors and Marriott Bonvoy Gold status

- $200 airline incidentals credit

- $200 Uber credit

- $100 Saks Fifth Avenue credit

- $240 digital entertainment credit (effective 7/1/21)

- $300 Equinox credit (effective 7/1/21)

- $200 Hotel credit when booking a prepaid Fine Hotels and Resorts or Hotel Collection stay through American Express Travel (effective 7/1/21)

- $179 CLEAR credit (effective 7/1/21)

- Global Lounge Collection access including Centurion Lounges, Delta SkyClubs, and Priority Pass Lounges, etc.

- Cell phone protection up to $800 when you pay your monthly cell phone bill with your American Express Platinum Card

- And more

In my opinion, this is the best version of the Platinum Card for two reasons. First, you can receive a $695 bonus, which covers the entire cost of the annual fee, every year if you meet certain Morgan Stanley requirements (I’ll explain more in detail below). Secondly, this is the only version of the American Express Platinum Card where you can add an authorized user for FREE. All the other versions charge $175 to add an authorized user.

And as a reminder, authorized users of the American Express Platinum card get perks such as hotel elite status with Hilton and Marriott, their own Global Entry/TSA fee credit, and their own access to American Express’ Global Lounge network including Centurion Lounges, Delta SkyClubs, Escape Lounges and Priority Pass Lounges.

This is great if you and your partner are frequent Delta flyers as the Platinum Card only allows complimentary access to Delta SkyClubs for the individual cardholder. Each guest will cost you $29 per visit. But if your partner is an authorized user with his/her own Platinum Card, you can both get in for free. This is also great for families as the Priority Pass Select membership only allows the cardholder plus two guests in for free. If your partner is an authorized user with his/her own Priority Pass Select membership, he/she can get complimentary lounge access for him/herself plus two additional guests. This is very beneficial for families (or traveling parties) of four or more.

And lastly, you can transfer your MR points to your Morgan Stanley account at a value of 1 cent per point. This isn’t the best deal and I don’t recommend it as I think MR points are worth more than 1 cent but if you really want to, you can.

Here’s How to Get Your Morgan Stanley American Express Platinum Card for Free

Like I said earlier, you’re gonna have to jump through some hoops so be prepared. The whole process is long and cumbersome but you only have to do it once and it’s worth it to save $695 ($870 with an authorized user) a year. You need to do things specifically in this order:

- You need to have an investment relationship with Morgan Stanley (see below for more information). If you have one already, great. If you don’t, the easiest way is to open up a Morgan Stanley Access Investing account.

- Morgan Stanley’s Access Investing is their latest foray into Robo-investing.

- The simplest way to describe this type of investing is “set it and forget it.” You just pick how aggressive you want to be or the types of industries you want to invest in and they do the rest for you. You don’t pick any funds or individual stocks.

- It requires a $5000 minimum deposit and comes with a .35% annual fee ($17.50 a year for $5000) but your money is invested and in theory, will return a lot more than .35% a year. As a data point, I opened my account three months ago and I’m currently sitting at a 4.04% return.

- Morgan Stanley’s Access Investing is their latest foray into Robo-investing.

- Sign up for Morgan Stanley Online. This is their online portal that allows you to manage all your Morgan Stanley accounts in one place. If you signed up for the Access Investing account online, you will automatically have a Morgan Stanley Online account created for you.

- Wait a month. This is to allow time for Morgan Stanley to recognize your investment relationship with them, which will then allow you to move onto the next step.

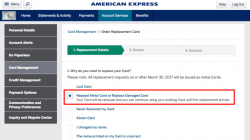

- Open up a Morgan Stanley Platinum CashPlus account and meet their monthly requirements to avoid a monthly fee. Click here for more information and my complete review of the Morgan Stanley Platinum CashPlus account.

- The Morgan Stanley Platinum CashPlus account does come with a $45 monthly fee. Effective 2/1/22, the monthly fee will be raised to $55/month. To avoid this monthly fee, you need to have:

- $5,000 recurring monthly deposit, AND

- $25,000 average daily BDP balance, AND

- Morgan Stanley Online enrollment, AND

- Another qualified non-CashPlus Morgan Stanley account (not including retirement accounts). Your Morgan Stanley Access Investing account will meet this requirement.

- The Morgan Stanley Platinum CashPlus account does come with a $45 monthly fee. Effective 2/1/22, the monthly fee will be raised to $55/month. To avoid this monthly fee, you need to have:

- Make sure both these accounts are grouped together in the same Account Link Group (ALG). This is very important and you need to call them to do this. Make sure they add both accounts to the same ALG, and not just the same household. I hate to say it but Morgan Stanley’s phone advisors aren’t the best. This step literally took me three different phone calls to do.

- Apply for the Morgan Stanley American Express Platinum Card through your CashPlus account. The link can be found on your account home page.

So How Does This Work?

An American Express Platinum Card comes with an annual fee of $695 but the Morgan Stanley Platinum CashPlus account gives you an annual engagement bonus of $695 a year, which covers the cost of the annual fee. If you are able to meet the monthly requirements, you would essentially get an American Express Platinum Card with all of its perks for free every year.

But if you’re not able to meet the monthly requirements each month, then the $45/month fee would kick in. Let’s just assume you weren’t able to meet the monthly requirement at all and paid $45/month for a whole year, you would actually still be paying less for the American Express Platinum Card as $45 x 12 = $540 ($155/year savings). Effective 2/1/22, the monthly fee will be raised to $55/month so if you paid that every month, you would still pay less for a Platinum Card ($660 vs. $695). So if you’re gonna pay for an American Express Platinum Card anyways, why not get it for $155 less a year? Even if you’re only able to meet the requirements a few months out of the year, this significantly reduces your “annual fee” even more. Makes sense?

Important note: You need to spend at least $1000 on your Morgan Stanley American Express Platinum Card each calendar year to keep the $550 engagement bonus tax-free. Otherwise, Morgan Stanley will send you a form 1099 at the end of the year. This is the one unknown at this time. I’m not sure if this rule still applies or if Morgan Stanley will send you a 1099 form now that the bonus has been raised to $695, regardless of how much you spend.

In regards to eligible investment relationships, Morgan Stanley considers eligible investment accounts to be AAA Accounts, Self Directed Brokerage Accounts, Morgan Stanley Access Investing Accounts, or discretionary/nondiscretionary Advisory Accounts or programs through Morgan Stanley’s Advisory Program. Retirement Plan accounts, including IRAs, are currently not eligible. If you have questions about whether a specific account qualifies, please contact Morgan Stanley.

UPDATE: Morgan Stanley recently updated their terms and conditions. For anyone whose investment relationship is solely the Access Investing account, you will not receive the annual engagement for your first year. Your annual engagement bonus will kick in starting your second year.

For more information regarding what qualifies as a monthly recurring deposit, please click here.

Terms for the American Express Platinum Card Engagement Bonus:

- We will only pay an Annual Engagement Bonus to new American Express Platinum cards opened in connection with your Platinum CashPlus Account. You will not receive an Annual Engagement Bonus for an American Express Platinum card not issued in connection with your Platinum CashPlus Account.

- Your Platinum CashPlus Account must be open and your American Express Platinum Card must be opened in connection with your Platinum CashPlus Account and must be open at the time the Engagement Bonus is paid.

- You must be the primary cardholder of American Express Morgan Stanley Platinum (does not apply to any Additional Card Members)

- Your Platinum CashPlus Account must be open and your American Express Platinum Card must be opened in connection with your Platinum CashPlus Account and must be open at the time the Engagement Bonus is paid.

- The Annual Engagement Bonus will be paid in the month following the month you open your American Express Platinum Card (“the Card Anniversary Month”) with the exception of the first year you open your American Express Platinum Card.

- In the first year you open your Platinum CashPlus Account, and apply for the American Express Platinum Card, there may be a three month grace period (“the Grace Period”) before you receive the Annual Engagement Bonus, but only if you do not meet the Fee Avoidance criteria for the Platinum CashPlus Account during the Grace Period. If you meet the Fee Avoidance Criteria prior to the expiration of the Grace Period, you will receive the Annual Engagement Bonus the following month. If you do not meet the Fee Avoidance Criteria during the Grace Period and are charged a monthly fee at the expiration of the Grace Period, you will receive the Annual Engagement Bonus the following month.

- We will only pay an Annual Engagement Bonus to new American Express Platinum cards opened in connection with your Platinum CashPlus Account. You will not receive an Annual Engagement Bonus for an American Express Platinum card not issued in connection with your Platinum CashPlus Account.

- You may be subject to tax and information reporting with respect to any Annual Engagement Bonus.

If you do not meet a minimum spending requirement of $1,000 on your American Express Platinum Card within the calendar year of receiving the $550 Annual Engagement Bonus, then Morgan Stanley may be required to report the $550 Annual Engagement Bonus as taxable income on your Form 1099. You should consult your tax advisor regarding the tax implications of any awards, including the $550 Annual Engagement Bonus, based upon your specific circumstances.

Morgan Stanley Free American Express Platinum Card Bottom Line:

In my opinion, if you’re gonna have an American Express Platinum Card anyways, then the Morgan Stanley version is probably your best bet. Other than the increased signup bonuses, this card offers you all the perks of the normal Platinum Card and it gives you the opportunity to get a free authorized user and the annual fee waived each year. Sure, there are some hoops to jump through but those are all worth it in my opinion. And like I said, even if you can’t meet the monthly minimum requirements each month, you will still save $155/year or $330/year with an authorized user.

What are your guys’ thoughts on the Morgan Stanley American Express Platinum Card? Will you be opening one? If so, please share your thoughts with us in the comments section below. Thanks for reading!

Disclaimer: I’m not a financial advisor and this post is not considered financial advice. You need to figure what works for you or seek advice from a qualified financial planner.