Southwest Airlines is going shopping. The airline is expected to soon announce a large purchase of new aircraft for the low-cost carrier.

The Need For New Aircraft

Southwest is looking to order a specific type of aircraft, a replacement for the 476 Boeing 737-700 aircraft in their fleet. Since the beginning of Southwest, it has been an all 737 airline and the 737-700 is the smallest variant in their fleet. The 737-700 fleet has an average age of 16 1/2 years while the oldest has seen twenty birthdays during their tenure with Southwest.

Costs are the driving force behind the upcoming purchase of about 300 aircraft:

- Functional obsolescence – This is when the design and mechanics are too old to be viable,

- Economic obsolescence – This is when older models become too costly to fly and

- Maintenance costs – This is the cost of extensive service checks along with the aircraft’s out-of-service time.

Although the 737-700 aircraft are still viable and reliable to fly, the costs associated with operating costs and maintenance say it’s time for those aircraft to go.

The A,B,C,D’s Of Aircraft Maintenance

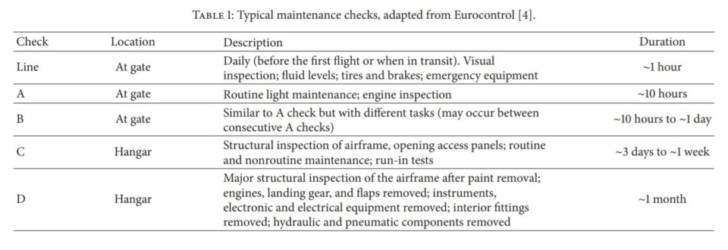

Aircraft are required to undergo various maintenance operations depending on the hours of operation and time in service since the last maintenance check. The table below shows the progression of maintenance checks that are required:

A Boeing 737-700 requires these maintenance checks to occur:

- A checks every 275 flight hours,

- B checks every 825 flight hours,

- C checks every 18 months and

- D checks every 48 months.

At the age of the Southwest 737-700 fleet, it is likely that these aircraft are due for “D” checks. These heavy maintenance operations can take over one month to complete because the airplane is taken apart down to the frame, inspected, repaired and put back together. A “D” check can easily cost more than $1.5 million to over $2 million depending on how many repairs are needed. Since these heavy maintenance checks can take over a month, these aircraft will be out of service for the duration and other aircraft will have to be rotated in.

The Contender: Boeing 737MAX 7

Boeing’s entry in the competition is the 737MAX 7. This would be a logical choice since Southwest in an all Boeing 737 operator. The reasons for choosing the economics of the MAX are:

- Pilot training would be minimal since the MAX only required pilot orientation and not training,

- Cabin crew training would also be minimal,

- Airframe and Powerplant (A&P) mechanics would need minimal training as well and

- Parts commonality with previous generations of 737 models would reduce maintenance costs.

Fleet commonality is the best way to reduce operating costs and has been the Southwest model since the beginning of the airline.

If Southwest selects the 737MAX 7 as the replacement aircraft, they would most likely reduce the passenger capacity to no more than 149 passengers. At a capacity of 150 passengers, the airline would be required to add another flight attendant.

The MAX 7 would also win the race on flying range of 3,850 miles versus 3,350 miles for the A220-300.

A downside to ordering the MAX 7 is customer willingness to fly it. The 737MAX has been cleared to return to the skies but there may be customers that are leary to get on board that aircraft.

The Challenger: Airbus A220-300

Airbus is challenging with the new Airbus A220-300. Selecting the A220-300 would negate the common fleet model and add to operating costs. However, the A220-300 weighs 500 pounds less than the 737-700 and 23,000 pounds less than the MAX7. What Southwest would lose in fleet commonality they could gain back in fuel savings. Early calculations shows that the fuel cost per seat would be 7% less than the MAX 7 and 15% less than the current 737-700 fleet. Southwest indicates that it could save about $270,000a per day in fuel costs due to the lower weight of the A220-300.

The A220-300 has a lower flying range by 500 miles than the MAX 7. This shouldn’t be a deal-breaker for Southwest since the 737-700 fly shorter routes.

Early results show a high level of passenger acceptance and satisfaction with the Airbus A220.

Southwest Is In The Driver’s (Pilot’s) Seat

Be it the 737MAX 7 or the A220-300, the big winner will be Southwest. Both aircraft manufacturers have seen their order books drop due to the pandemic. Boeing also suffered cancellations of hundreds of 737MAX orders due to the grounding of the MAX series. Both manufacturers are hungry for new orders.

Airlines typically receive discounts from the list (catalog) price of aircraft. Southwest is in the unique position to play Boeing against Airbus for deeply discounted prices to secure the order. The purchase is looking like 130 firm order aircraft with options for an additional 170 aircraft. You can bet that both Boeing and Airbus are going to sharpen their pencils to win this major order.

Final Thoughts

Southwest is smart to say goodbye to these older aircraft now instead of paying for expensive “C” and “D” checks. You spend a couple of million dollars on a twenty-year-old aircraft and it’s still a twenty-year-old aircraft.

Both manufacturers will probably include a favorable exit strategy for the existing 737-700’s that will be replaced. The used aircraft market is flooded and the successful bidder might win on taking the existing aircraft in trade.

I’m guessing that Southwest is playing Boeing against Airbus to get a rock-bottom deal on the MAX 7 replacement aircraft.

I think that Southwest will make a decision soon. Who do you think is going to walk away with this major order – Boeing or Airbus?