The Chase Sapphire preferred card is a great card form both pros and beginners. If you’re just starting learning how to travel hack and fly for free or have been doing it for years, this card is for everyone. The Chase Sapphire preferred has a low introductory fee, plus good bonus point opportunity to maximize returns. And right now, you can earn a ton of bonus points for signing up for this card.

Chase Sapphire Overview

For those of you who are not familiar with the Chase Sapphire brand, it is one of Chase’s best travel cards. They have both the preferred and the reserve. The Reserve is more expensive and has more travel benefits. The Preferred, my focus for today has a lower annual fee and is for more casual travelers. With an annual fee of $95 it is more attainable. In addition, the Sapphire has a number of transfer partners allowing credit card points to go further.

Points can be transferred to a number of travel partners. Instead of redeeming each point for just a penny via their ultimate rewards portal, you can transfer points to a partner. 80,000 points is worth $800. Or like I said, transfer them. Currently, there are 13 transfer partners where points transfer at a 1:1 ratio. These include 10 airlines: Aer Lingus, British Airways, Emirates, Air France, KLM, Iberia, JetBlue, Singapore Airlines, Southwest, United and Virgin Atlantic. Or transfer 3 hotel chains. Hotel partners include: Hyatt, IHG and Marriott.

Chase Points Earning Review

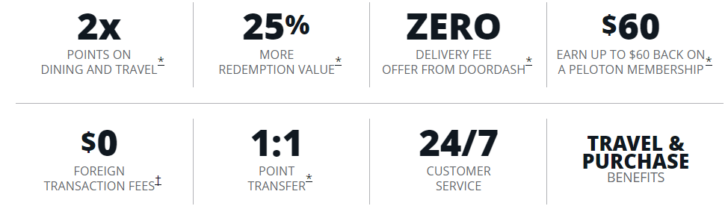

The Chase Sapphire earns two points per dollar on everything travel. This includes parking, uber, tolls, hotels, flights, etc. The only thing “travel” that doesn’t earn bonus points is gas. It also earns two points per dollar on all restaurants and bars. Takeout services such as doordash, ubereats, etc also earn two points per dollar. All other purchases earn 1 point per dollar.

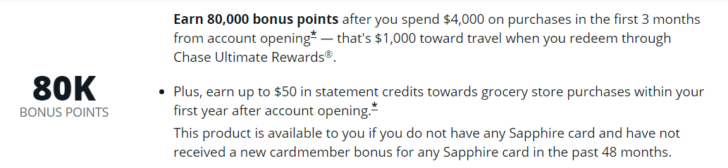

Chase Sapphire Limited Time offer

New card holders can apply now and earn 80,000 bonus points after spending $4000 in the first three months of membership. This bonus to anyone who does not current have a Chase Sapphire Preferred or Reserve card. In addition, you cannot have received a bonus in the previous 48 months for either card. I recently closed my Reserved card at the start of the pandemic to save over $550 in annual fees. Then recently, I signed up for the Chase Sapphire Preferred and earned the 80,000 bonus points.

In addition to earning 80,000 points, new card holders will earn a one time $50 bonus after spending $50 or more at grocery stores. This essential reduces the annual fee to $45 for the first year. There are other benefits on this card which can make it a money maker for many. These include up to $60 back on Peloton memberships and $0 delivery free with Doordash. All included when you apply for the card today.

80,000 Points – So What?

80,000 points is worth at minimum $800 in travel credits. You can use the points to book via Ultimate rewards. Or you can make your points go further by transferring them to one of the 13 travel partners. 80,000 points is enough points to fly to several destinations in the world. You could book a one-way business class ticket to Asia or Europe, or fly round trip in economy on several airlines.

If traveling isn’t on your bucket list this year, don’t worry. As long as your card is open, your points do not expire. And if you’re not looking to travel, instead pay yourself back. Through September 2021 you can use points to pay down your credit card bill. Chase’s Pay Yourself Back tool increases the value of Ultimate Rewards points by 25%. That means up to $1000 of spend can be paid via points in select categories. If you go this route, you’re essentially saving money by opening this card.

The Chase Sapphire 80,000 points is the highest we’ve ever seen. Pair this card with your Chase Freedom Unlimited and transfer points between the cards to maximize your earning. This will allow you to earn even more points across multiple categories and then transfer these points to travel partners.

What are you waiting for, this deal will not last.