*Editorial update: An earlier version of this post unintentionally listed a credit lock as the same as a credit freeze. Credit locks and credit freezes are very similar but they do have some minor differences. For a detailed analysis of the differences, you can view this helpful article by Value Penguin.*

Equifax screwed up bad, I mean, really bad. They suffered a huge data breach, lost sensitive data belonging to 145.5 million Americans, and they were slow to react and rectify the situation. First they offered a free credit monitoring service in exchange for you not suing them and then they offered a free credit locking service but only for a limited time. Well, that clearly didn’t cut it so the old CEO is out and the new CEO is in and he’s trying to make things right.

Starting now, Equifax will give everyone, YES, EVERYONE, even if your information was not deemed to be compromised by the Equifax hack, access to 3-Bureau credit monitoring, social security scanning and a ONE MILLION DOLLAR ID theft insurance policy for FREE. Additionally, Equifax will waive the fees to lock and unlock your Equifax credit report (I’ll explain more about this in a bit) for one year. And starting sometime before January 31, 2018, Equifax will give all of us the ability to lock and unlock our Equifax credit report for free, as many times as we want, FOR LIFE! That’s pretty impressive and the best part, Equifax removed that offensive language from their T&Cs preventing us from suing them. So win win.

But what exactly does this mean and how does it affect you?

Let me explain. Between May 13, 2017 and July 30, 2017, (possible state sponsored) hackers hacked Equifax’s systems and stole personal identifying information including names, dates of birth, social security numbers, driver’s license info, etc. for 145.5 million people. That’s about one out of three Americans and guess what, you were most likely one of them. Because of the severity (but really because of the public relations nightmare), Equifax set up a webpage to identify and assist possible victims of the data breach.

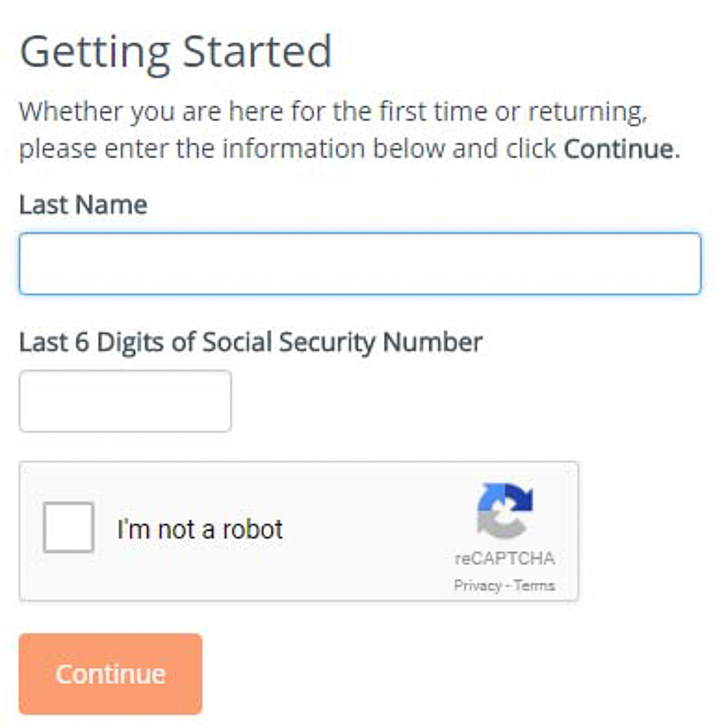

To find out if you were a victim of this massive Equifax data breach, follow this link to the Equifax’s security breach information page. Here, you can learn more about the breach, see what you can do about it or just enter your information to see if you were were a victim. It’s a very simple process and all you need to enter is your last name and the last six digits of your social security number to get started.

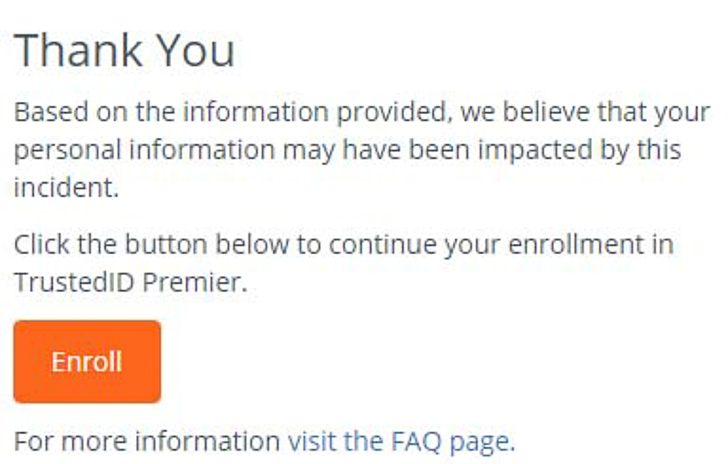

Unfortunately, I was one of those 145.5 million Americans affected. Yeah, me!

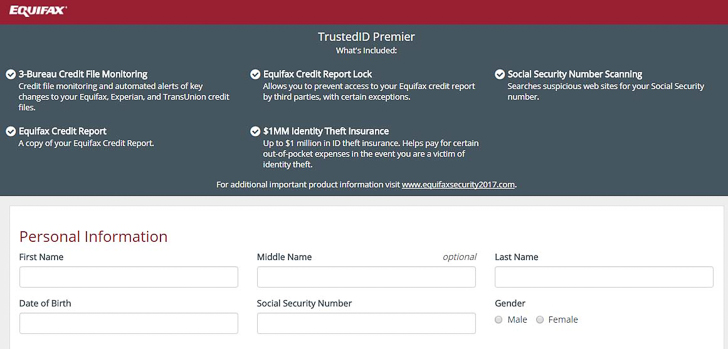

Okay, now that you know your information has been compromised, you should really do something about it. The first thing you should do is sign up for this FREE service by Equifax called TrustedID Premier. It’s Equifax’s way of saying, “We’re sorry and we hope this one year subscription will make you feel better.”

Equifax’s TrustedID Premier will give you:

- An instant Equifax credit report

- 3-bureau (Equifax, Experien, TransUnion) credit file monitoring

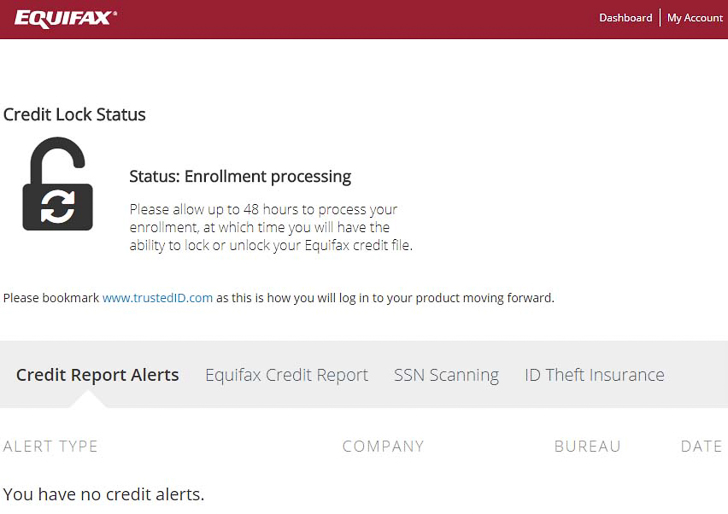

- Equifax credit report lock – allows you to lock/unlock your credit report, preventing unauthorized access to your Equifax credit report

- Social security number monitoring – searches suspicious web sites for your social security number

- 1 million dollar ID theft insurance policy

And did I mention all this was free because Equifax screwed up? Yup. Free. For one whole year (12 months from when you register).

Once you sign up and create an account, Equifax will send you an email to confirm your registration. It might take a couple of days to get the email depending on how busy they are. It took me a little more than 24 hours to get my confirmation email but once I had it, it was a simple process to complete my application. I then had immediate access to my Equifax credit report and any alerts flagged to my credit report.

Luckily for me, I didn’t have any suspicious activity on my credit report but it doesn’t mean I still wasn’t a victim. Same goes for you. It just means the hackers haven’t sold our information or the thieves haven’t used it yet to apply for fraudulent credit cards. Just because it hasn’t happened yet doesn’t mean it won’t happen. You still have to take active steps to protect yourself.

Freezing Your Credit Report

In a nutshell, freezing your credit report means you are restricting access to your credit report. This is important because banks need access to your credit report to determine your credit worthiness. And if they can’t determine your credit worthiness, they won’t extend you a line of credit. In other words, a credit freeze prevents the bad guys from opening up credit card accounts, mortgages, car loans, etc. under your name. No access to your credit report means no new credit accounts. And I know that sounds bad but if it wasn’t you trying to open that account, then who cares? You just prevented a fraudster from going on a shopping spree and you getting stuck with the bill. Credit locks essentially do the same thing as credit freezes. The main difference is credit locks are a service provided by the credit reporting agencies whereas credit freezes are authorized by state laws.

And if you’re worried about credit freezes and credit locks affecting your FICO score, don’t be. Credit report locks and freezes will NOT impact your credit score nor will it prevent you from getting your free annual credit report during a freeze.

There are some exceptions on who can still view your credit report even with a freeze. These exceptions include government agencies, debt collectors and existing creditors but new inquiries will be denied. It’s also important to note that a freeze or lock by one credit reporting agency will not freeze or lock the other two. You need to freeze or lock all three of them because different lenders will use different credit reporting agencies. This TrustedID Premier account will give you the ability to lock and unlock your Equifax credit report only. You still have to lock or freeze the other two.

And lastly, a credit freeze or lock may prevent unauthorized accounts from being opened in your name, but it does nothing to prevent thieves from accessing your current or existing lines of credit. In other words, it is still important for you to monitor your existing accounts for fraudulent activity such as unauthorized charges and other account changes.

To freeze your credit, you need to contact each of the three credit reporting agencies individually. I have added links to each of the respective credit reporting agencies and their phone numbers below.

- Equifax: 1-800-349-9960.

- Experian: 1-888-397-3742

- TransUnion: 1-888-909-8872

Okay, so what about unfreezing? How easy is it?

Unfreezing your credit report is easy. You can unfreeze it for a specific time period, say two weeks, manually until you decide to freeze it again or permanently. When you call to freeze your credit report (or do it online), you will receive a PIN number to unfreeze your credit report. It is very important that you do not lose this PIN number as you will need it to unfreeze your credit report in the future. Credit locks on the other are a little less cumbersome. Instead of a PIN number, you can control locking and unlocking via the credit reporting agency’s website or mobile app with a password.

My personal recommendation is that you keep your credit reports frozen until you need to apply for credit. You can always unfreeze your credits report before applying for that hot new credit card and then re-freeze your credit reports once your credit has been pulled. However, keep in mind that different credit reporting agencies may have different processing times for freezing and unfreezing credit reports so check with them individually. Also, it might not be a bad idea to freeze your child’s credit report either. Your four-year old isn’t applying for any credit cards yet is she?

There is a small fee associated with freezing and unfreezing your credit report, usually between $5 – $10, depending on your state (California is $10). However, as I stated above, Equifax will not charge you to lock or unlock your Equifax credit report for the next 12 months. And soon, they will roll out the ability for you to lock and unlock your Equifax credit report for life, for free.

For me, my plan is to use Equifax’s TrustedID Premier service to lock my Equifax credit report (because it’s free) and I’ll manually freeze the other two. As for you, I would recommend at least signing up for this free service and locking your Equifax credit report. I would rather you have one of your credit reports locked than not have any protections at all.