Bloomberg reported earlier this week that JetBlue Airways is removing its flights from a dozen, mostly smaller online travel agencies (OTAs). It cites the high fees that the airline pays to issue tickets through these channels, which make it more difficult to be profitable on the least expensive fares.

The issue is similar to coffee shops and other small businesses that refuse to take a credit card for small dollar transactions. Card processing includes a mix of fixed and variable costs (i.e., a flat fee plus a percentage of the total). On smaller purchases, the fixed portion becomes a drag on the net sales revenue.

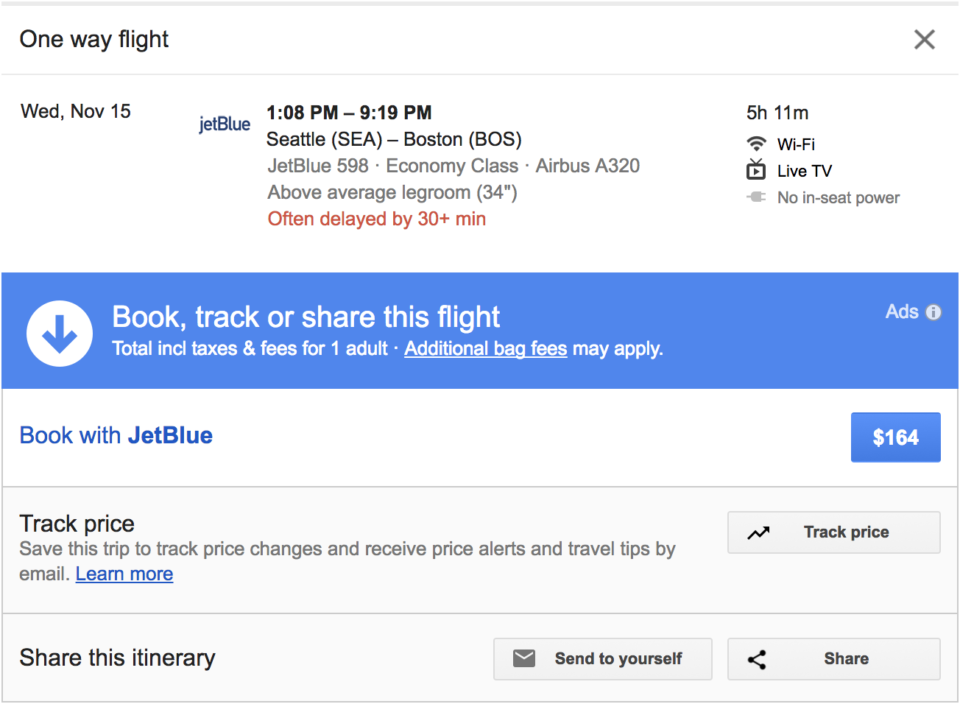

Other airlines have done this before. Southwest Airlines is famous for not listing any of its flights on any search engine, which is why you also won’t find it on some of the services I’ve been talking about this week, including ITA Matrix and ExpertFlyer. These rely on the global distribution system, or GDS. And not all online search tools are bad. Google Flights, for example, refers you to the airline to book — JetBlue’s preference.

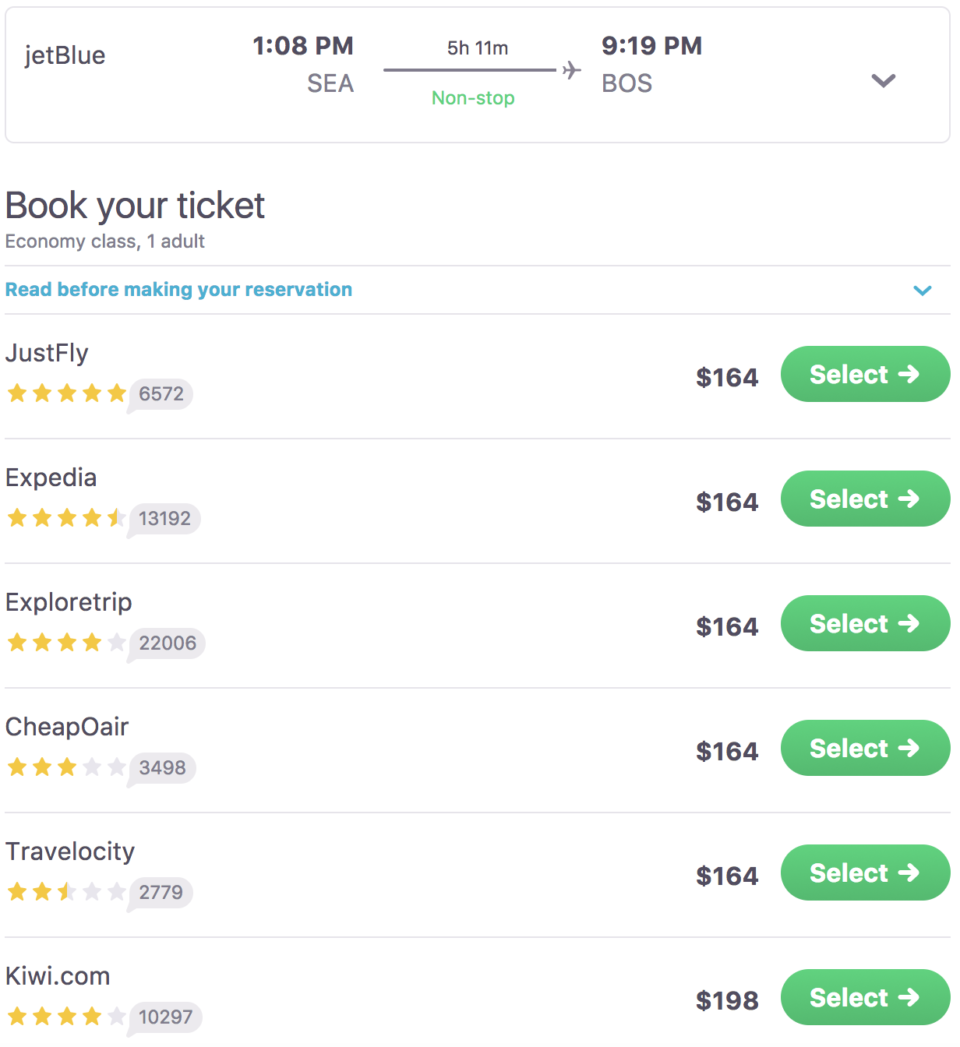

It’s interesting that JetBlue isn’t pulling out entirely. It’s simply not selling tickets through some websites that use the GDS, and in particular it’s keeping its relationship with bigger players like Expedia and Travelocity. This seems more likely to impact people who use a service like SkyScanner, where some of the affected OTAs are among the top results.

The big concern, of course, is that removing these flights will lower not just JetBlue’s costs but also its revenue, as it becomes more difficult for customers to find and book travel on the airline. I’m not a big fan of using online travel agencies. I also know there are some people who don’t book anywhere else, even when they usually fly on the same one or two carriers. (Which makes me wonder: why not go to the airline’s website in the first place if price comparison isn’t that important?)

That’s the power that OTAs have created, establishing themselves in the mind of consumers as the go-to place to book travel. By keeping its relationship with Expedia et al., JetBlue is unlikely to change that attitude. But this could prove a test case for how important these relationships are to the bottom line. If it manages to shift purchases without seeing a large drop in sales, a larger withdrawal is possible in the future.

Featured image credit: JetBlue Airways