I ended last year with 49,976 Elite/Medallion Qualification Miles (MQMs) on Delta. With any other airline, that would send frequent flyers into a tizzy, since I was only 24 miles off the 50,000 MQM tier and will drop to Silver Medallion on March 1. However, with Delta’s Rollover program, I begin this year with 24,976 MQMs, which is practically another year of Silver status. I’m thinking of going for Platinum Medallion status, given at 75,000 MQMs. That means I would only need 50,024 MQMs to get Platinum.

Elite status isn’t for everyone, but I think I benefit from it. While I don’t have business travel, I’ve always lived in a coastal state and traveled far for relatively cheap. I’d rather pay $350 for a roundtrip (that earns 5,000 or more miles) than pay 25,000 miles and be subject to availability. I fly at minimum 40,000 miles domestically each year, so I think doing a push for mid-tier Gold status is great. On Delta, I move from 25% mileage bonus to 100% bonus; get free Same-Day Confirmed (to switch to earlier or later flights); and get to skip a lot of lines. To me, it’s a small incremental amount of work needed to enjoy major benefits.

I really want to get Platinum Medallion for two reasons — one is free award changes, which would save me $150 each time I need to amend an award. If I made 3 award changes as Platinum, that’s $450 I would save. This would really make my miles more flexible.

The second reason is that Platinum Medallion would allow me to challenge for United Premier Platinum later this year, which has the same benefit of free award changes. I have lots of United miles and Chase Ultimate Rewards points, and I really foresee booking a lot of trips for myself and family with those. I would most likely need to fly 25,000 miles on United metal within 90 days once I do that challenge. With 50K MQMs on Delta and 25K flown miles on United, I could essentially get twice the Platinum status for 2014!

The Plan

My plan is to obtain 50,024 MQMs by this summer to hit Delta Platinum, then fly 25,000 miles on United in 90 days to hit United Platinum. Of the 45,000 miles I predict I’ll have to fly this year, I’ll need to save 25,000 of those miles for the United challenge, so will only have about 20,000 MQMs on Delta from the trips I was already going to make. Thus, I’ll need an extra 30,000 MQMs on Delta to hit Platinum.

The problem is, I’m not a big fan of mileage runs. I don’t mind mileage “jogs” (where I go to a new destination and check it out for a day or two) and don’t mind “playing around” with fares/routing to get an extra connection and 10-20% more miles on trips I am already making. And yes, I will volunteer my seat for a bump and a $300 voucher. But is mileage running for these miles really the best way to go about it? The idea of MRs seems to be entrenched in a group who could get away with 2-3 cents-per-mile routings in the “old days,” when fares were low and routing rules were lax. Head over to the FlyerTalk mileage runs forum nowadays and you’ll see that runs that are under 4 cents per mile are harder to come by.

At the same time, spending has become much easier, with Vanilla Reloads, Bluebird, prepaid cards, shopping portals, and other “tactics” frequent spenders tend to use. Even after we bemoaned losing Office Depot as a seller of Vanilla Reloads, other stores like Walgreens and CVS have picked up the slack.

Luckily for me, Delta flyers can get MQMs via spend on two cards – the Platinum Delta American Express and the Delta Reserve American Express (each of which has a personal and business version).

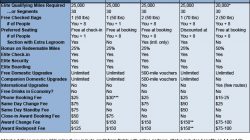

The Platinum Delta American Express card (not an affiliate link) gives 10,000 MQMs after $25,000 spend in a calendar year, and another 10,000 MQMs after $50,000 spend. The current signup bonus is 30,000 miles for opening a card, in addition to 5,000 MQMs, though the $150 annual fee isn’t waived (there have been times during previous years when they offered a better bonus, such as 40,000 redeemable miles and 15,000 MQMs with a $100 statement credit).

Cost Analysis

One of the arguments that mileage runners have for mileage running is that you accumulate redeemable miles at a high rate with 100% bonuses, thus earning a rebate that makes your cost for an EQM low.

So let’s then look at how much an EQM costs through spending vs. mileage runs. For reference, I’m going to value an RDM at a low value of 1¢ each (which is the bare minimum value a Skymile has if you have a co-branded credit card). I’m going to value the opportunity cost of $1 spent on a credit as 2¢, using the benchmark of a 2% cash-back card. Yes, clearing spending bonuses gives better return, but I’m clearing bonuses in record time nowadays thanks to reloads, so I still use 2¢ as a benchmark for everyday purchases.

Opening a Platinum Delta SkyMiles card for the bonus would net 30,000 RDMs and 5,000 MQMs for $150. After spending $25,000, you would earn 35,000 RDMs and 10,000 MQMs. Thus, for a cost* of $650 (and a credit inquiry), you would get 65,000 RDMs and 15,000 MQMs. In this case, the value of the RDMs gained equals the “costs” I incurred, so the 15,000 MQM bonus is just gravy. If I could increase the spending to $50,000, I’d essentially get a total of 100,000 RDMs and 25,000 MQMs for a “cost” of $1150, meaning I’d pay $150 for 25,000 MQMs (or $150 for the incremental 10,000 MQMs).

To put that into perspective, a $650 fare at 4cpm (a decent mileage run price) would earn 16,250 MQMs and 32,500 RDMs with 100% elite bonus. While doing a mileage run would give me a few more MQMs, I get half the RDMs. Using the thought process above, this would be like paying $325 for 16,250 MQMs. Not as good of a deal.

There’s also the Delta Reserve American Express (not an affiliate link), which comes with a 10,000 MQM/RDM signup bonus but also a hefty $450 fee. The main reason for the fee is Sky Club access, though I already get that with my (non-Delta) Platinum American Express. You get 15,000 MQMs for spending $30,000 in a calendar year, and another 15,000 MQMs when you hit $60,000. If I did the lower tier, I’d get a total of 55,000 RDMs and 25,000 MQMs for a “cost” of $1050, or about $500 just for the 25,000 MQMs, just slightly cheaper than the mileage run, but much more than the Platinum Delta card. Hitting $60,000 would get me 100,000 RDMs and 40,000 MQMs for a “cost” of $1650, or $650 for 40,000 MQMs. Of course, some may find value in the Reserve’s Sky Club access or ability to be a tiebreak on the upgrade list, but I don’t value those benefits.

*I didn’t consider the costs of Vanilla Reloads because if I bought a Vanilla Reload on a 2% cash-back card, I would still incur the fee for the reload, so the net reward is still the same. If you are iffy about my math, Frequent Miler also discussed cost-benefit of this method.

By getting a Platinum Delta SkyMiles American Express, I could get 15,000 MQMs for the price of a credit inquiry. Spending more to get 25,000 MQMs would incur an opportunity cost of about $150. For the Reserve, the same 25,000 MQMs would be about $500, and 40,000 MQMs would be $650. That same $650 on a 4cpm Mileage Run would garner about 32,500 MQMs. To me, getting a Business Platinum Delta American Express seems like the best idea. I don’t know where the extra 5,000 MQMs will come from, but the credit card is the cheapest way to get me on my way to Platinum.

But is it really worth it?

Now, if you aren’t going to fly a lot, then these tactics of garnering elite status aren’t going to help. In addition, if you only use miles for trips in business and first class, then status doesn’t really matter. I can handle domestic coach and paid fares aren’t too bad for the places I go, so status really plays its magic there. If I get upgraded, so be it, but I’ve never been amazed by domestic first class. My rule is that if I can hit mid-tier or higher with one spending threshold, it’s worth it to spend my way to that tier. I fly at minimum 40,000 domestic miles a year on my own cash, so getting 15,000 more MQMs really makes a huge difference in getting Gold Medallion (I fly more miles internationally but use awards for most of those trips). If you’re only flying 10,000 miles a year on Delta, then even spending the money for 15,000 MQMs to get Silver status doesn’t seem worth it to me. I’m also somewhat entrenched as a Delta flyer, as I recently moved away from Atlanta and still frequently fly there. If I didn’t have my MQM rollover option and plans to challenge for status later in the year, I probably wouldn’t consider this method.

And of course, this is a rather unique option that Delta flyers have. United, American, and US Airways all have some sort of elite mileage earnings from credit cards, but they are nowhere close to how many MQMs American Express doles out on before of Delta.

What do you all think? Should I even bother with Platinum Medallion? If so, am I right to go with the spending method? I know there will be the flyers who are proud about getting all their miles from “Butt In Seat” flying, but hey, if Delta and American Express want to give me the option of getting MQMs through spending, why shouldn’t I consider it? Or, in the words of Ice-T: “Don’t hate the player, hate the game.”