Atlanta-based carrier can keep Seattle – Tokyo Haneda flights, but with conditions

Delta Air Lines has been granted yet another reprieve by the US Department of Transportation to retain access to operate a flight from its Seattle/Tacoma hub to Tokyo Haneda airport, but with a firm caveat: to maintain daily, year-round services between the two cities; otherwise, they will surrender the rights to American Airlines.

The “shape-up, or ship out” command essentially means that whether or not Delta earns or burns money on the route, it has to be operated, no questions asked. Delta had been under scrutiny ever since it pared down the availability of its Seattle to Tokyo Haneda flight between October 2014 and April 2015, roughly 15 months after its inaugural launch in June 2013, due to poor load factors during the slow winter season.

Related: US carriers spar over Tokyo Haneda airport rights – are they worth the fight?

The DOT’s ruling, disclosed last Friday, represents another chapter in the nearly 5-year saga with four U.S. carriers clamoring over one another for rights to four landing slots at Haneda airport. The government-owned Tokyo airport had previously been closed to long-haul flights to Europe and North America due to congestion, but the completion of a fourth runway project altered the landscape in 2011 when foreign carriers could bid for a select number of nighttime landing slots to service Haneda airport.

Although many global carriers have served the privately-owned Tokyo Narita airport for decades, Haneda is located much closer to Tokyo’s central business district and is the “preferred” airport for non-transit passengers given its proximity to the city. Intially, when the US DOT awarded the slots to the various bids, American and Hawaiian each received one right to operate one nonstop route apiece, and Delta received two rights.

Haneda airport: Hype or Hysteria?

Despite the fanfare and bloated expectations of receiving coveted access to Haneda, the airport has been a frustrating and costly run for US airlines. Haneda’s convenient location was marketed to be boon to high-value business travelers to fly in and fly out of Tokyo with shorter commutes to the city. Unfortunately, foreign carriers are awarded few daytime arrival and departure runway slots at Haneda, and are therefore relegated to late evening arrivals and early morning departures. Not only does this limit connecting opportunities, but also inhibits ground transportation to and from the airport during off-peak hours. Furthermore, requiring an expensive widebody aircraft and crew to RON (Remain OverNight) drives utilization costs up and productivity down.

All of these components reduced the appeal factor of flying to Haneda, and occurred independenty of unforseen events such as the ill-timed March 2011 Tsunami, and following this, the depreciation of the yen and softening Japanese economy. Right after startup in early 2011, both American and Delta temporarily suspended service on the new Haneda routes for several months as the market took time to recover. Upon resumption, both carriers significantly down-gauged capacity from their gateway hubs in the U.S. Delta even was successful in lobbying the DOT to gain permission to move one of its two Haneda rights from Detroit to Seattle in hopes to improve performance, and American surrendered its Haneda rights (which it operated from New York JFK) to United in 2014.

The only surviving US carrier to have reported a healthy track record of performance at Haneda has been Hawaiian airlines, which operates a daily service to its Honolulu hub. Hawaiian is aided by a massive origin-and-destination volume of passengers between the Islands and Japan, as well as advantageous scheduling given its geographic location in relation to Japan and corresponding time zone differences, in contrast to US carriers on the mainland.

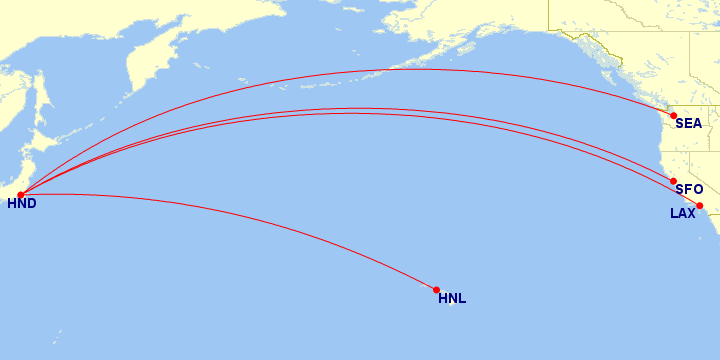

At present, in addition to Hawaiian, Tokyo Haneda is served by Delta to Los Angeles and Seattle, and United to San Francisco. Hawaiian has sustained the strongest load factors on a year-round basis in the 90% range, and Delta’s flight to Los Angeles tends to perform decently well during the summer and winter months (90%) but dip during the shoulder season (March – May and October – December). Delta’s Seattle route, which was moved from Detroit in June 2013, performed very poorly during the fall months last year, achieving an average of 34% load factors in November and October 2013, and maintained an average of 58% between December 2013 and June 2014.

The Delta “squat” in Seattle

Per the conditions set by the U.S. DOT, a slot pair authorized to an airline at Haneda becomes dormant if more than a 90-day period passes without the carrier operating a flight. Given the dismal performance of its Seattle – Haneda flight last fall, Delta opted to draw down capacity to stem the bleeding, but discovered a loophole in the DOT restrictions that would allow the carrier to reduce operations to Haneda while also holding onto its access rights by merely offering the flight at irregular periods during the slow months.

In other words, Delta essentially suspended service between Seattle and Tokyo Haneda airport between the months of October 2014 and April 2015, but would operate a certain number of flights during off-period weeks to satisfy the minimum requirements set by the DOT. Over a grand total of 182 possible calendar days, Delta flew approximately 17 total roundtrips between the two cities, effectively squandering scarce resources that could have been fully utilized by other carriers.

American, along with Hawaiian Airlines, had petitioned the DOT to review and reconsider Delta’s rights to a single landing slot at the coveted Haneda airport. American, emerging from Chapter 11 bankruptcy as a leaner and larger competitor post consolidation with US Airways, was ready to re-engage in the battle for Haneda access, especially as its largest foe, United Airlines, had entered the fray in its place, putting American at a competitive disadvantage. Hawaiian, with the longest surviving success story of serving Haneda, renewed an application to fly between Kona and Tokyo, one of the largest underserved markets from the U.S. to Tokyo, which has been denied several rounds in the past.

On Friday, the DOT ruled in favor of Delta, permitting the carrier to maintain authority to operate flights from its Seattle hub to Tokyo Haneda airport, but with an unwavering requirement to provide, year-round flights each way between the two cities unless granted permission by the DOT. Any failure, without a Department-granted waiver, to operate the route will result in a violation of the route authority and forfeiture of the rights to American Airlines to receive Delta’s landing rights at Haneda airport.

After all that, Delta can face one of two choices: pull the Haneda route altogether and surrender its rights to another airline that may succeed or fail, or operate the route and be “squatless” in Seattle.

The US DOT should have considered past mistakes and secondarily awarded the slot to Hawaiian, not American

In all fairness, Delta was not technically violating any agreements by dramatically reducing inventory to Haneda. The carrier was still abiding by the legal requirements set by the DOT,. Still, on the other side of the token, American and Hawaiian were justified in their right to have the DOT investigate matters further and tighten the minimal requirements to insure a level playing field.

However, the part that does not make sense is the secondary alternative to grant the route authority to American over Hawaiian should Delta fail to adhere to standards and subsequently forfeit the slot. Although it is unpredictable whether or not it will come to that, the DOT once again has bent towards the concept of what theoretically “could” provide the maximal benefits for all US consumers without realizing that their logic is ambiguous and has failed multiple times in the past.

In other words, even though Hawaiian’s proposed Kona – Tokyo Haneda route does not provide maximal benefits for the vast majority of US travelers to Japan, it is still a route that creates additional supply for a highly underserved market between the two countries. In addition, Hawaiian has a track record of success at Haneda airport, whereas its competitors do not. American has been transparent about its proposed Los Angeles – Haneda route in that it will effectively replace its existing Los Angeles – Tokyo Narita route. United pulled a similar stunt by re-deploying 1 of its 2 daily San Francisco – Tokyo Narita flights to Haneda. European and even Japanese carriers have even taken this route (no pun intended) with Japan – Europe flights. Put simply, these carriers are not creating additional capacity to Tokyo, but rather are re-shuffling the deck.

Furthermore, USA – Tokyo is not an underserved market, with plenty of gateway hubs in multiple US cities from coast-to-coast. Kona, on the other hand, has only a single option to connect its population on Hawaii’s Big Island to Tokyo, and that is via Honolulu. Even though Kona is not a primary hub for Hawaiian, and both inbound and outbound traffic would likely hail primarily from Kona, the carrier has codeshare ties with ANA, Air China, China Airlines and Korean Air that would have been leveraged over Haneda had the route come to fruition.

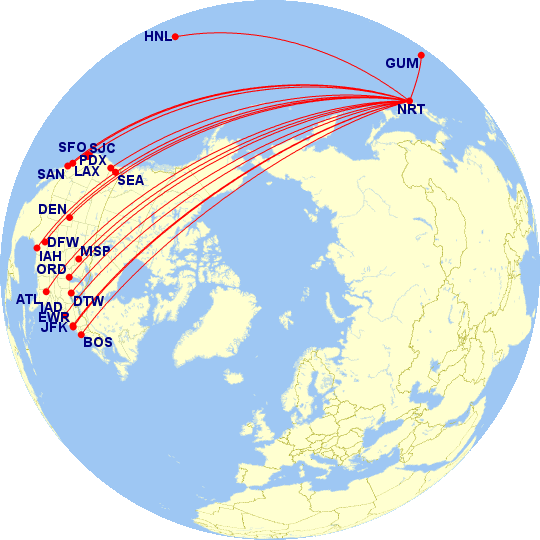

Bottom line: the DOT is providing Delta and American with more ammunition to practice double-standard behavior

Delta CEO Richard Anderson has a history of vocal adrenaline, calling on the Japanese Government in 2013 to seek permission to move its Japanese base from Narita airport to Haneda. From Narita, Delta flies nonstop to Seattle, Portland, Los Angeles, Detroit, Minneapolis/St. Paul, New York JFK, Shanghai, Bangkok, Singapore, Taipei, Manila, Guam, Koror and Saipan. This would have required 25 slots, which would have comprised of larger than 50% of the 42 total available slots that the Japanese Government was willing to allocate to international flights that year.

Of course, this tall order included a tone of “American style Wa” when it came to cultural implications in that Anderson felt that it was a favor the Japanese Government owed to Delta given that its predecessor, Northwest (which merged with Delta in 2008 and Delta had inherited its Tokyo hub) had moved from Haneda to Narita in the 1970’s at the Government’s request, according to CAPA. His statements also reflected a cool attitude towards Japanese favoritism towards its flag carriers, ANA and JAL, by awarding them the vast majority of the prime time slots.

Naturally, such sentiments are generally not vetted carefully before they are openly stated, and for obvious reasons, Delta was denied further access to Haneda. It was a lofty and ambitious goal, but Delta should have concentrated its priorities in markets where it stood to reap larger fortunes: the first being its existing SkyTeam relations with Korean Air in Seoul, which geographically provides the same functions as a Tokyo hub, and secondarily, its build-up in Seattle to create a viable Asian gateway hub. For Delta to complain that it has been a victim in Asia is utter nonsense.

Almost two years later, the data has come in and Delta has been faring poorly on one of its Seattle to Asia routes. There are alternate paths the carrier can take. However, the DOT shouldn’t continue to bail US legacy carriers out with a pail when routes like Seattle to Haneda fail. Delta pulled a sneaky maneuver by dramatically reducing inventory on its Seattle – Haneda route from a daily service to an irregular frequency, on top of already receiving a pardon to move its Detroit flight to Seattle to begin with. United and American have not added more capacity for the market to absorb, and Hawaiian walks away the biggest loser.

Ultimately, the bottom line is that by mandating that Delta adhere to stricter requirements is a step in the right direction for the US DOT. Moving forward, however, the DOT needs to take a much more holistic analysis (beyond the ‘maximal benefits’ theory) and become more tone deaf to the CEOs who scream the loudest and instead tune into the players that need the access the most.