Qatar Airways announces Los Angeles, Boston and Atlanta, increases JFK. Turkish Airlines plans to resume service to Miami

Against the backdrop of a geopolitical spat between U.S. carriers and the Big Three Gulf Carriers, Etihad, Emirates and Qatar Airways, the allegations against the Middle Eastern carriers of receiving government subsidies have only driven their respective airlines to flex their muscles by adding new routes to the U.S. and unveiling intentions to make improvements to their already vastly superior premium products.

On Monday, Qatar Airways announced that it will be adding service through 2016 to Los Angeles, Boston and Atlanta, three new markets for the OneWorld carrier, as well as adding an additional daily frequency to New York JFK for a total of 14 weekly flights. Qatar has been serving the New York market since 2007 as its inaugural U.S. destination, commencing service from Doha to Newark (via Geneva) in June 2007 before shifting the route to New York JFK in October 2008 (where it began flying nonstop to Doha).

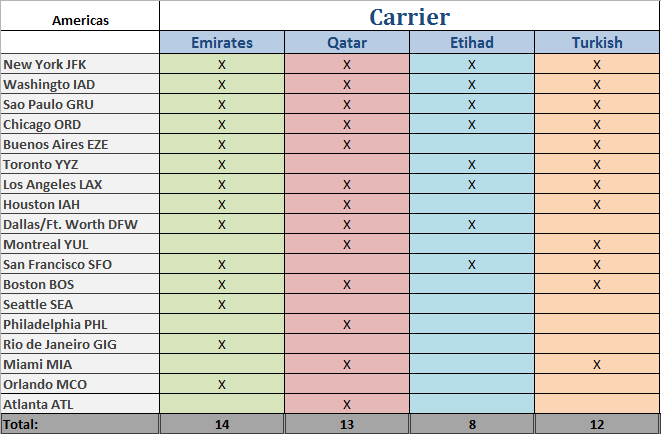

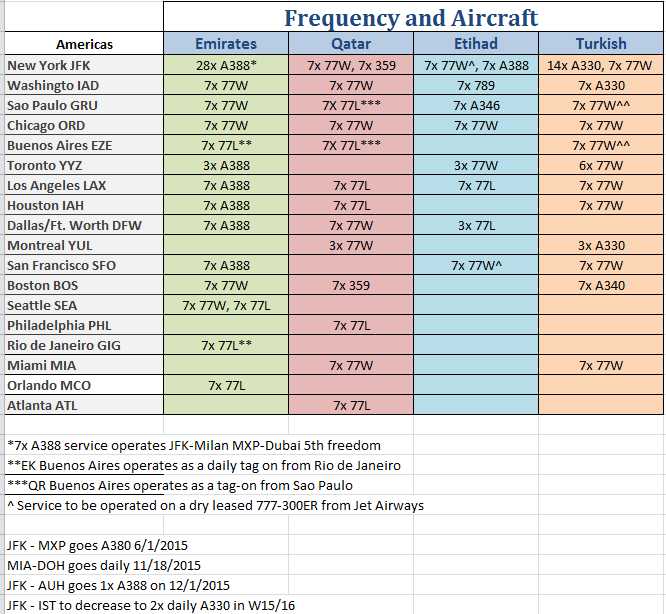

Unlike the other Gulf carriers, Qatar is the only airline that does not serve any of its U.S. markets with more than a single daily frequency. Emirates operates 3 daily A380 services into Kennedy airport from Dubai, with an additional 777-300 (soon to be up-gauged to an A380) which operates via Milan. Etihad serves New York JFK with two daily 777-300ERs, one of which is operated using a dry-lease aircraft from its equity partner Jet Airways. Turkish Airlines, which is generally bundled into the analyses of Middle Eastern carriers in terms of using a highly similar network model over its Istanbul hub, operates 3 daily flights into JFK utilizing a mix of Airbus A330s and 777-300ERs.

Emirates has recenly unveiled plans to boost frequencies to Boston and Seattle by adding an extra daily flight to each market. However, Qatar will be operating its newest aircraft type, the Airbus A350 XWB, on its inaugural route to Boston as well as on its second daily New York JFK frequency.

Related post: Emirates adds second daily Seattle flight: is there an ulterior motive?

Turkish will resume its services to Miami in October 2015 utilizing a 777-300ER on a daily basis.

Qatar Airways seeks to outmaneuver Emirates and Etihad in New York and Boston

The second daily New York flight will be operated on Qatar Airways’ new Airbus A350-900XWB, which will allow the carrier to compete against Emirates and Etihad on the same route. Etihad will soon be replacing one of its daily New York services with an Airbus A380 on December 1, 2015 which will feature its newest Premium class product, The Residence, as well as its First class “Apartment” suites.

Meanwhile, Emirates announced on Monday that it intends to overhaul its first class cabins on the Airbus A380, followed by the 777, with “railway style” suites designed to provide more privacy for its on-board guests. Though few details and specifications have been divulged, the carrier alluded to the fact that the price points for its new first class product would remain “commercially viable” and at the same tiers as it offers today, although presumably this is a back-handed comment aimed at Etihad’s elaborate A380 product.

Meanwhile, for Qatar, this naturally creates a business need to offer a competing product on its New York routes to stay abreast with its primary competitors. Currently, its daily 777-300ER flight arrives mid-afternoon in New York followed by a late evening return departure to Doha. The additional daily service, scheduled to commence on March 1, 2016, will arrive early morning in New York with a faster turnaround departure to Doha mid-morning.

QR703 DOH0130 – 0825JFK 359 D (NEW)

QR701 DOH0815 – 1515JFK 77W D

QR704 JFK1025 – 0600+1DOH 359 D (NEW)

QR702 JFK2200 – 1735+1DOH 77W D

Boston has experienced a massive growth in foreign carrier competition since 2012, with the additions of Japan Airlines, Hainan, Turkish, Emirates, Copa, Cathay Pacific, El Al, AeroMexico and now Qatar. Although Qatar will be going against two daily flights on Emirates, it will be leveraging its newest premium product on the Airbus A350 in an effort to lure customers on its Boston route. While Emirates will be adding its second daily Boston services on October 1, Qatar will launch its inaugural flight to Boston on March 16, 2016.

QR743 DOH0820 – 1430BOS 359 D

QR744 BOS2255 – 1810+1DOH 359 D

Qatar’s Boston schedule is virtually identical to Emirates’ evening flight to Boston from Dubai. As is per usual for US flights to and from the Middle East, the route is scheduled to time ideally with connections to South and Southeast Asia from Doha Hamad International airport. In addition, Qatar is likely to codeshare with JetBlue Airways out of Boston, as it alread does on its existing routes to New York JFK and Washington Dulles, by placing its code on JetBlue-operated flights from BOS to various cities in the Northeast.

Los Angeles joins elite list of receiving service from all of the “Big Three” while Atlanta finally receives ME3 attention

LAX will join New York, Washington, D.C., Chicago and Dallas/Ft. Worth on the elite list of airports that sees service from Etihad, Emirates and Qatar Airways when the latter commences daily nonstop service to LA on January 1, 2016. LAX is a OneWorld hub for American Airlines, and the final “cornerstone” hub for the world’s largest carrier service from Qatar Airways, which already serves New York JFK, Chicago O’Hare, Miami and Dallas/Ft. Worth, as well as Philadelphia, a former US Airways hub.

QR739 DOH0745 – 1310LAX 77L D

QR740 LAX1510 – 1810+1DOH 77L D

At LAX, OneWorld is the dominant alliance across systemwide capacity with 23.7% marketshare for the week of May 4, 2015, according to CAPA data, followed next by Star Alliance closely at 23.3% and then SkyTeam at 21.1%. However, when measured strictly by international seat capacity, OneWorld is actually the smallest operator with 20.9% weekly seat capacity, outpaced by Star at 33.5% and SkyTeam at 24.6%. Qatar’s addition to LAX will help boost OneWorld international ASM presence, joining fellow alliance members Cathay Pacific, Qantas, Japan Airlines, airberlin, LAN, Iberia and British Airways.

Atlanta will finally receive service from a Middle Eastern carrier with Qatar launching nonstop service to Doha, although start dates and times have not been announced (presumably a daily service on a 777, effective July 2016, has been rumored).

Foreign carrier competition at Atlanta Hartsfield-Jackson airport is less fragmented relative to other mega US gateways, with its predominant hub carrier, Delta Air Lines, controlling 82.5% of the overall market share based on seats, and 85.2% of the market share based on frequencies.

Still, foreign carrier competition at Atlanta has been increasing, although much of it is SkyTeam-oriented. Delta JV partner Virgin Atlantic commenced service to Atlanta in October 2014 by replacing one of Delta’s 3 daily London Heathrow flights, as well as assumed Delta’s daily Atlanta – Manchester U.K. service on March 30, 2015. Virgin Atlantic also commenced a second daily summer-seasonal service between Atlanta and Heathrow at the end of March.

Virgin Atlantic revamps network, focuses on transatlantic and Delta JV

These additions have allowed Virgin to become the #3 foreign carrier at Atlanta, behind Air Canada, followed next by Southwest, Air France, Lufthansa, Korean Air, British Airways and KLM. Once Qatar will launch service to Atlanta, its presence will likely remain abreast with British Airways on a capacity basis, but it will allow OneWorld to overtake Star Alliance at Atlanta.

Turkish Airlines to return to Miami for the first time since 2001

Turkish Airlines will return to Miami in October 2015 after a fourteen year absence. Turkish flew to Miami between 1999 and 2001, cancelling service after the September 11, 2001 terrorist attacks. Turkish previously operated its twice weekly Miami flights on an Airbus A340-300 and had a codeshare agreement with American Airlines.

In the wake of its withdrawal from Miami, Turkish has focused on expanding its route profile across other geographies in the Americas region, adding Washington, Toronto, Sao Paulo, Buenos Aires, Houston, Boston, Montreal and San Francisco before returning its attention on Miami. It is estimated that approximately 20,000 people of Turkish descent reside in the Miami-Dade county area, and Miami also has a Turkish consulate.

Turkish will not be able to rely on any onward feed from Miami as it is a predominantly OneWorld hub and its only US codeshare partner, United, has a weak presence at Miami airport. The carrier will rely more heavily on O&D traffic between Miami and Turkey as well as beyond traffic to North Africa and the fertile crescent region of Asia (Iraq, Kuwait, Syria, Lebanon, Jordan, Israel, Palestine, Cyprus and Egypt) as well as parts of Eastern Europe and the Mediterranean, where Turkish has a strong presence. Israel, in particular, will be a strong selling point for Turkish out of Miami given that it is home to a large Israeli diaspora and Istanbul offers up to six daily roundtrip flights to Tel Aviv.

TK077 IST1330 – 1930MIA 77W D

TK078 MIA2130 – 1630+1IST 77W D

At Istanbul Ataturk international airport, an afternoon arrival permits connections from Miami to Kigali, Addis Ababa, Tehran, Thessaloniki, Dhaka, Ankara, Izmir, Tel Aviv, Mumbai, Dubai, Dar Es Salaam, Delhi, Baku, Antalya, Biskek, Abu Dhabi, Bahrain, Ashgabat, Almaty, Khartoum, Shiraz and Baku. An afternoon return flight to Miami similarly permits connections from these markets to South Florida. The late evening arrival and return from Miami is therefore not designed to promote connections from the Miami end due to lack of alliance connections.

Have US carriers kicked the hornet’s nest?

The likely scenario is that the ME3 + Turkish have been planning these routes for some time now, long before the spat began earlier this spring over alleged subsidies and outcry against unfair competition. Moreover, the Gulf carriers not only expand in seeing lucrative opportunities in the U.S., but also as a means of competing against one another. The success of Qatar in Miami has lured Turkish before Emirates or Etihad grab a slice of the pie. Additionally, the utilization of Airbus A380s on Etihad’s New York JFK flight, as well as additional 777-300ER, has prompted Qatar to add a second daily frequency to New York as well as deploy its newest aircraft on the route.

The U.S. carriers can only complain to an extent given how their balance sheets are abounding in wake of Q1 results from the 2015 FY, and with new aircraft on the way and falling oil prices, new routes have been announced and new planes are being swapped out on legacy routes like Chicago – Tokyo (where American will send its 787) or Houston – Sao Paulo (where United will send its 787).

The movement towards Atlanta and Orlando represents an initial step in targeting a second tier of U.S. markets with largely untapped potential for expansion given the volume of O&D to those airports and investment of domestic airlines into those hubs. Airports with similar characteristics, which do not see service presently on any of the Gulf carriers (nor Turkish) include Las Vegas, Denver, Charlotte, Detroit and Minneapolis/St. Paul. All of these airports punch above their weight class in terms of growth and size, and its possible to conclude that these may be among the neo “wave” of airports to sport the tails of a Middle Eastern carrier. 2015, and beyond, will no doubt have more news headed this way.