JetBlue Airways announced yesterday that it is expanding its “MINT” product from two to nine domestic routes, as well as six Caribbean routes, starting this fall. Several of these were previously announced (such as Boston to San Francisco and Boston to Los Angeles, as well as Boston – Aruba and New York JFK – St. Lucia and St. Maartin). However, the carrier will now introduce MINT on select transcontinental routes, including Seattle to New York JFK and Boston, Fort Lauderdale to San Francisco and Los Angeles, San Diego to Boston and New York JFK, and Las Vegas to New York JFK. MINT will also be expanded to New York – Aruba and Barbados to Boston and New York.

What is significant about these routes, particularly the domestic ones, is that they are all served by Alaska and/or Virgin America. After JetBlue lost the bid for Virgin America to Alaska, the New York-based carrier said it would be making a “big announcement” sometime this week. It launched its highly successful “MINT” product in 2014 on A321-operated flights from New York JFK to San Francisco and Los Angeles, featuring 16 first-class seats. Twelve of the MINT seats are in a traditional two-by-two layout, while the other four feature sliding privacy doors.

On-board, MINT customers receive free WI-FI, entertainment and multi-course meals. They also receive Birchbox grooming and travel products as an amenity kit. Fares start at $599 one-way, but generally are much more expensive given the high demand for the product.

Traditionally, JetBlue starts selling its MINT product on a varied schedule basis, beginning with placing its MINT aircraft on 1-2 of its multiple daily routes between a market such as Boston to SFO, for instance. The carrier then generally phases in additional flights as more MINT A321s are received (there are 13 currently in the fleet with several more on order) before converting the entire schedule to all-MINT, based on forecasted demand.

The Caribbean routes feature a slightly varied scheduling model as they tend to run as Saturday-only, except during high season before Christmas and after New Years, and on a seasonal basis. This is a very smart scheduling metric given that routes such as New York and Boston to Aruba, Barbados, St. Maarten and St. Lucia are high-yielding routes with significant premium demand, and with long-enough stage lengths to justify the expenditure for an upgraded cabin product.

Who will now compete with MINT?

As it exists today, MINT competes against American Airlines, Delta Air Lines and Virgin America between New York JFK and Los Angeles as well as between New York JFK and San Francisco. Inclusive of Newark, United and Virgin America each fly nonstop from Newark to both San Francisco and Los Angeles.

| Mar-17 | |||||||

| Airlines | Orig | Dest | Miles | Ops/Week | Seats | Seat Share | Frequency Share |

| American | JFK | LAX | 2,475 | 86 | 8,772 | 9.67% | 14.26% |

| American | JFK | SFO | 2,586 | 46 | 4,692 | 5.17% | 7.63% |

| JetBlue | JFK | LAX | 2,475 | 44 | 6,996 | 7.71% | 7.30% |

| JetBlue | JFK | SFO | 2,586 | 26 | 4,134 | 4.56% | 4.31% |

| Delta | JFK | LAX | 2,475 | 68 | 13,164 | 14.51% | 11.28% |

| Delta | JFK | SFO | 2,586 | 54 | 10,290 | 11.34% | 8.96% |

| United | EWR | LAX | 2,454 | 87 | 13,758 | 15.16% | 14.43% |

| United | EWR | SFO | 2,565 | 102 | 15,618 | 17.21% | 16.92% |

| Virgin | EWR | LAX | 2,454 | 14 | 2,062 | 2.27% | 2.32% |

| Virgin | EWR | SFO | 2,565 | 13 | 1,931 | 2.13% | 2.16% |

| Virgin | JFK | LAX | 2,475 | 35 | 5,188 | 5.72% | 5.80% |

| Virgin | JFK | SFO | 2,586 | 28 | 4,127 | 4.55% | 4.64% |

| TOTAL | 603 | 90,732 |

From Boston to the West Coast, MINT will compete against Alaska and Delta to Seattle, against Virgin and United to San Francisco, against American, Delta, United and Virgin to Los Angeles, and against Alaska to San Diego.

| Mar-17 | |||||||

| Airline | Orig | Dest | Miles | Ops/Week | Seats | Seat Share | Frequency Share |

| American | BOS | LAX | 2,611 | 28 | 4,480 | 13.27% | 13.40% |

| Alaska | BOS | SAN | 2,588 | 7 | 1,141 | 3.38% | 3.35% |

| Alaska | BOS | SEA | 2,496 | 13 | 2,119 | 6.27% | 6.22% |

| JetBlue | BOS | LAX | 2,611 | 20 | 3,180 | 9.42% | 9.57% |

| JetBlue | BOS | SAN | 2,588 | 13 | 1,950 | 5.77% | 6.22% |

| JetBlue | BOS | SEA | 2,496 | 13 | 1,950 | 5.77% | 6.22% |

| JetBlue | BOS | SFO | 2,704 | 13 | 2,067 | 6.12% | 6.22% |

| Delta | BOS | LAX | 2,611 | 14 | 2,240 | 6.63% | 6.70% |

| Delta | BOS | SEA | 2,496 | 7 | 1,120 | 3.32% | 3.35% |

| United | BOS | LAX | 2,611 | 7 | 1,134 | 3.36% | 3.35% |

| United | BOS | SFO | 2,704 | 46 | 8,264 | 24.47% | 22.01% |

| Virgin | BOS | LAX | 2,611 | 11 | 1,624 | 4.81% | 5.26% |

| Virgin | BOS | SFO | 2,704 | 17 | 2,500 | 7.40% | 8.13% |

| TOTAL | 209 | 33,769 |

From Fort Lauderdale, MINT will compete against Spirit and Virgin from FLL to LAX, and against Virgin to SFO.

| Airline | Orig | Dest | Miles | Ops/Week | Seats | Seat Share | Frequency Share |

| JetBlue | FLL | LAX | 2,342 | 14 | 2,100 | 23.00% | 23.33% |

| JetBlue | FLL | SFO | 2,583 | 14 | 2,100 | 23.00% | 23.33% |

| Spirit | FLL | LAX | 2,342 | 7 | 1,246 | 13.65% | 11.67% |

| Virgin | FLL | LAX | 2,342 | 15 | 2,208 | 24.19% | 25.00% |

| Virgin | FLL | SFO | 2,583 | 10 | 1,475 | 16.16% | 16.67% |

| TOTAL | 60 | 9,129 |

From Las Vegas, MINT will compete against American, Delta and Virgin to New York JFK, and against United and Southwest for traffic between Las Vegas and Newark.

| Airline | Orig | Dest | Miles | Ops/Week | Seats | Seat Share | Frequency Share |

| American | JFK | LAS | 2,248 | 14 | 2,240 | 10.61% | 10.61% |

| JetBlue | JFK | LAS | 2,248 | 21 | 3,430 | 16.25% | 15.91% |

| Delta | JFK | LAS | 2,248 | 35 | 5,873 | 27.82% | 26.52% |

| United | EWR | LAS | 2,227 | 49 | 7,693 | 36.44% | 37.12% |

| Virgin | JFK | LAS | 2,248 | 6 | 876 | 4.15% | 4.55% |

| Southwest | EWR | LAS | 2,227 | 7 | 1,001 | 4.74% | 5.30% |

| TOTAL | 132 | 21,113 |

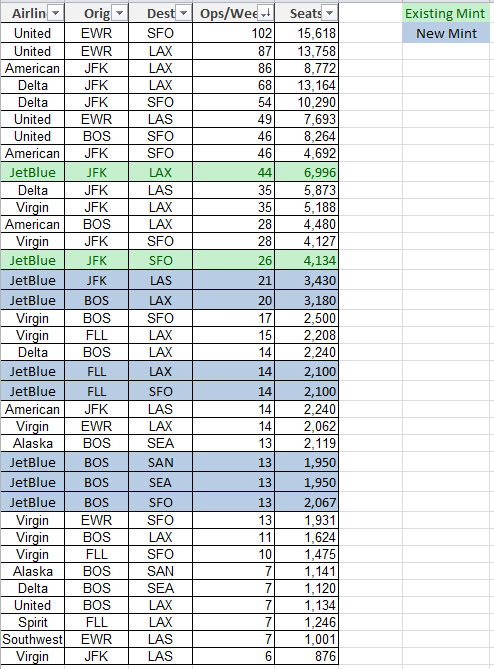

On a combined basis, the combined total will look something like so, based on OPS per week.

Will American, Delta or United begin offering loyalty incentives for pax on the new MINT flights?

My guess is that they will not, because this is a move that is targeting Virgin and Alaska rather than the Big Three. MINT was actually the most recent competitor in the lucrative transcon market (traditionally defined as JFK-LAX and JFK-SFO) to re-vamp its inflight product offering to include lie-flat seats in the premium cabin. Virgin America, by contrast, is the only one that still uses a recliner-style seat, and has maintained the same first generation product since it launched in 2007. Virgin maintains that its Premium cabin product is well-regarded by its customers and hasn’t necessitated any major overhauls, despite what its competitors have done.

Noticeably, Alaska only competes in two of the new MINT markets (BOS-SEA and BOS-SAN) which will be much more interesting to watch given that the pool is smaller between those city pairs. BOS-SAN is a route that American abandoned years ago, while BOS-SEA is offered by Delta. It is also noteworthy that Delta previously had extended its premium transcon product to include Seattle, in addition to LAX and SFO, but this was reversed several years ago. Delta may reconsider, but the original plan was to deploy the transcon product to Seattle in light of the major Asia build-up from 2013. This has cooled somewhat in the intermediary.

This will also be a huge boon for JetBlue customers who earn loyalty points on foreign carriers (such as Emirates, which is a codeshare partner for B6’s True Blue program) who wish to utilize miles to upgrade to nicer seats. This will especially be the case on routes like Boston to San Diego (Emirates flies twice daily into Boston), Seattle to Boston and New York to Las Vegas.

Overall, I think its a great way for JetBlue to step up its game relative to the bigger guys. Moreover, it positions the carrier as a true hybrid airline and differentiates it from Alaska-Virgin and Southwest.