I don’t believe in app-o-ramas. And I believe there’s a growing contingent of readers who agree with me.

One of the more popular and revisited posts from the Devil’s Advocate archive is titled “App-O-Ramas Are Your Father’s Oldsmobile.” In that post I argued that app-o-ramas are a relic of the past when credit reporting agency computers weren’t as fast and integrated with banks as they are today. Now, in most cases I think you’re better off waiting for higher quality offers and picking them off individually as they come down the pike.

However, some folks still prefer the app-o-rama, and on occasion there may be decent reasons to do one. Maybe you’re planning to apply for a mortgage in a year or two and know you’ll need to pause your credit card applications for a while, so you want to go out with a bang. Or perhaps there’s a moment in time (such as the one we had recently) where there are several excellent bonus signup offers worth taking advantage of all at once.

OK, fine. But is there a better way to do your app-o-rama?

I think there is. Because if we no longer have the benefit of slow computers, we can still take advantage of another quirk in the system, one that’s been discussed but not completely strategized for.

I’m talking about combined credit inquiries. And the key to maximizing your app-o-rama is knowing exactly how they work and when they happen.

What exactly are combined credit inquiries?

In many (though not all) instances, when you apply for two credit cards from the same bank on the same day, the two separate inquiries will eventually be combined into one inquiry on your credit report.

As we all know, minimizing credit inquiries is a major part of the churning game, so if we can get two credit cards from just one inquiry, that’s an enormous advantage and cause for celebration.

But hang on! Before we get super excited, let’s stop for a moment and offer some important caveats…

1) Combining inquiries does not work at every bank. Some banks are easier to combine than others.

2) Sometimes you can combine personal and business cards and get one pull, but sometimes you can’t.

3) Even when you follow the rules precisely, sometimes combining inquiries simply doesn’t work. It’s a YMMV situation, though I would say if you follow previous data points, it’s usually successful. But it’s never 100% guaranteed.

So how do we determine which banks will combine credit pulls and under what circumstances? Well, for the answer to this question, we can go to our good friends Will and Chuck over at Doctor of Credit, whose post on combining credit inquiries is the most comprehensive resource I know on the subject and should be required reading when it comes to app-o-ramas.

Now, once you’ve reviewed the Doctor of Credit data on combined inquiries, there’s still one more important point to keep in mind…

Credit inquiries do not combine instantly.

There’s a bit of confusion about what actually happens when inquiries combine, so let’s clear things up. It’s not usually the banks that combine credit inquiries, but rather the credit reporting agencies themselves. Many CRA computers appear programmed to assume that two or more inquiries on the same day from the same lender are a mistake, or simply a duplicate of the same inquiry. Therefore, the repeated ones are deleted (or “combined”), leaving just one inquiry on your credit report.

However, the most important aspect of this to note is that it does not usually happen immediately.

Rather, it sometimes takes between 12-48 hours for the CRA computer to delete the extra inquiries, which means during that time, your credit report may very well list the multiple inquiries. So even though those extra inquiries will eventually drop off, they’re still visible to any additional lenders that pull your credit report in the meantime.

Can you see where I’m going with this? If we do a traditional app-o-rama where we apply for all our cards on the same day, and we include multiple cards from the same bank in the hopes of combining inquiries, we’re actually reducing our chances at approvals because the extra inquiries might not have combined yet when we do our other applications.

So how can we maximize our app-o-rama?

One option is to leave our “second” applications at banks for which we hope to combine inquiries until the end of our app-o-rama day, thereby avoiding the temporary multiple inquiries from appearing on our other applications. But the problem with doing it that way is that by the time you get to the second and/or third applications, you’ve already loaded up extra inquiries from the rest of your applications at other banks.

The better choice, in my opinion, is to spread your app-o-rama out over the course of a week instead of doing it all in the usual single day. Since we already know our inquiries at other banks are reported almost instantly on our credit reports (more on that in a moment), there’s no credit inquiry advantage to doing all the apps in one day. But by waiting a day or two between each app, we allow enough time for the multiple inquiries at each individual bank to combine, thereby allowing the next lender to see fewer inquiries when they pull our report.

Let’s demonstrate this via a real-life example – the app-o-rama I did just a few weeks ago using this advanced style. To show how it works in real time, I temporarily signed up for credit monitoring services at all three of the credit bureaus. That’s not necessary to execute this method, but I wanted to be able to see the inquiries happening in real time.

For this app-o-rama, I decided to sign up for 9 cards…

Amex Mercedes Benz Platinum (75K points after $3K spend)

Amex Business Gold (80K points after $8K spend targeted offer)

Barclaycard JetBlue+ (30K points after $1K spend)

Barclaycard Lufthansa Miles & More (50K points after $3K spend)

Bank of America Alaska Airlines (25K+$100 statement credit after $1K spend, now 30K)

Bank of America TravelRewards (20K points after $1K spend)

Capital One Venture (40K points after $3K spend)

Another Capital One Venture (40K points after $3K spend)

Citi Prestige (50K points after $3K spend)

I had recently applied for two Chase cards, so that’s why there are no Chase applications in this app-o-rama. But you might be wondering why I only applied for one Citibank card. The reason is that you cannot get two personal Citibank cards in the same day, and at Citibank in particular, personal and business card inquiries do not combine. This is because they come from two separate divisions of Citibank, so the CRA’s do not see the inquiries as being identical.

(By the way, getting info like this is why it’s critical to bookmark the post from Doctor of Credit with the most recent data points on combining inquiries.)

I started with the JetBlue and Lufthansa cards from Barclaycard, applying for both of them on May 20th. If there is still any dispute about how quickly inquiries appear on your credit report, this data point should put it to rest, because I got an e-mail from Credit Karma within roughly 2 minutes of my applications informing me that an inquiry had been made on my Transunion report.

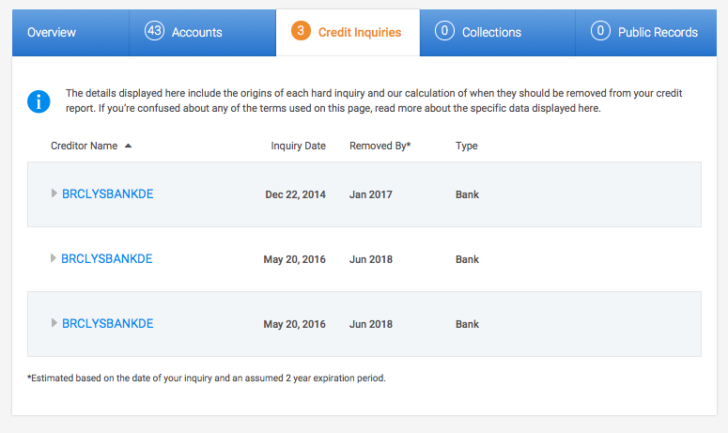

When I signed into my Credit Karma account, I could see both inquiries from my two Barclaycard applications on my report (plus an old one from back in 2014).

Now, depending on where you live, Transunion is primarily used only by Barclaycard and not many other banks for credit cards, so I probably could have safely continued to my next pair of applications. But that’s not an absolute certainty and there was no harm in waiting, so I waited to be sure.

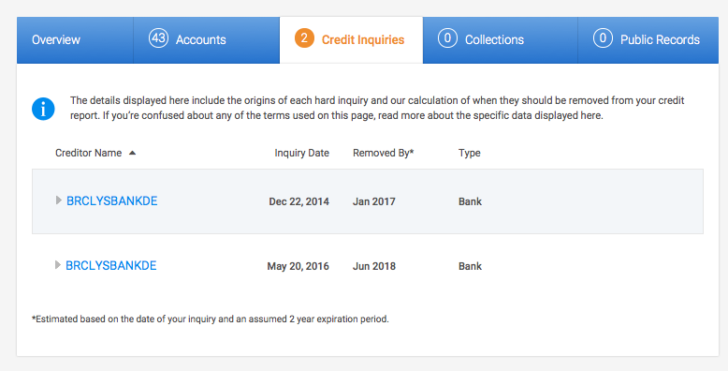

Sure enough, after a few days, I signed back into my Credit Karma account and found the two inquiries combined into just one.

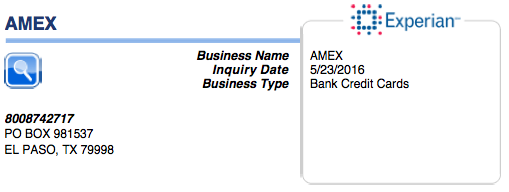

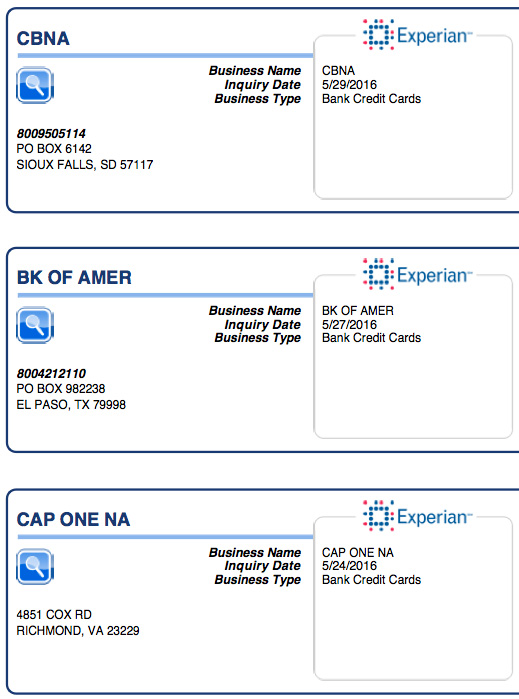

Which meant it was onto the next set of apps at American Express. Again, I made both applications in the same day, then pulled my Experian credit report…

In this case, Amex appeared to only do one pull to cover both cards. As the Doctor of Credit post notes, this does happen sometimes with some issuers, in which case you don’t need to wait for multiple pulls to combine.

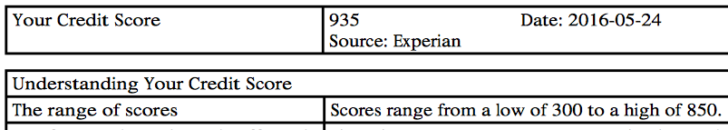

When I made the two Capital One applications, the same thing happened with only one inquiry ever appearing on my reports. But I’m not sure if this is standard procedure with Capital One or if it’s because they figured out I was trying to get the identical card twice in one day. Either way, if you follow me on Twitter, you already know that according to Capital One, I somehow had a credit score of 935 out of 800, which would seem to mean I’m a pretty good credit risk.

And yet they denied me for both cards. Obviously they just don’t like me. Don’t worry, Capital One, the feeling is mutual. The feeling is mutual.

In any case, a few days after that I proceeded to the two Bank of America applications. And finally, once those had combined, I wrapped up with the single Citibank app.

So for a total of 9 applications, I ended up with only 5 total inquiries, and each bank only saw the minimal number of inquiries on my report. In fact, since Barclaycard pulled Transunion and everyone else pulled Experian (except Capital One which annoyingly pulls from all three CRA’s), here’s what each bank actually saw when they pulled my report…

- Barclaycard saw 0 recent inquiries when I applied (both apps approved).

- Amex saw 0 recent inquiries when I applied (both apps approved).

- Capital One only saw 1 recent inquiry (or 2 on my Transunion).

- Bank of America only saw 2 recent inquiries when I applied (both apps approved).

- Citibank saw 3 recent inquiries (app was still approved).

The Devil’s Advocate says use the elongated app-o-rama.

Again, I’m not a fan of the app-o-rama in general, and if I wasn’t testing this method, I probably wouldn’t have applied for 9 cards at once. But if you want or need to do an app-o-rama, I don’t think there’s any downside to this elongated method, and there’s a ton of upside. As you can see, other than the Capital One debacle, I did very well on this round, and while it’s possible I might have still gotten the same result by doing it all in one day, it was a lot more comfortable making reconsideration calls while knowing that the rep wasn’t looking at a credit report with up to 9 possible inquiries.

Also, a word of warning — this is an advanced method and not for beginners. If you’re just getting into the miles and points game, start slow. You don’t need to apply for multiple cards from the same bank in one day, and it’s important to show that you can handle multiple credit accounts without getting yourself into trouble. Just focus on a Chase app or two in the first 6-9 months to be sure you’re under the 5/24 rule, and then once you feel comfortable, you can ramp up from there.

But if you’re at the level where you know you can deal with dozens of credit cards and you’re considering an app-o-rama, give this method a shot and see how you do.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Three Reasons NOT to Privatize the TSA (#garyleffiswrong)

- Is It Time To Dump TSA PreCheck and Get a Clear Membership?

- Skip The Park Hyatt Paris Vendôme and Choose This Hyatt Instead

Find the entire collection of Devil’s Advocate posts here.