“Manufactured spend” is a term that describes spending money without really, well… spending money. At least not as much, since there are often fees attached. All those Vanilla Reloads and prepaid cards you hear some people talk can potentially be part of a strategy for manufactured spend. There are two closely related concepts, so allow me a moment to distinguish between all three:

Manufactured spend: Charging cash-like items to your card so that you can later convert them to cash and pay off your bill. Often used to accumulate miles and points cheaply.

Accelerated spend:Charging cash-like items or gift cards to your card so that you can clear a high spending requirement for a sign-up or other type of bonus. You still use these for normal purchases, but you buy them now (before the deadline) and spend them later.

Category conversion:I’m not sure this is the popular term, but it’s an accurate one. Frequent Miler’s original “One card to rulle them all” is an example. People would use an Ink Bold to buy Vanilla Reloads at an office supply store and earn a 5X category bonus. They could then spend the money at stores where a category bonus wouldn’t normally apply.

Accelerated Spend

I’m not a fan of accelerated spend. I don’t have a lot of free cash lying around, so I can’t really front several months of spending all at once. I usually don’t have such high spend requirements anyway that would require it. One of the few tricks that would work for most people is using Amazon Payments to transfer (and get back) $1,000 just after your next billing period begins. That way you have a free loan for about 6-8 weeks, allowing a month before the billing period is over and a few weeks before the payment is due. It’s safe if you don’t spend the free loan but risky if you do.

Category Conversion

I have mixed feelings on the category conversion. I have enough credit cards that almost all my spending fits one with a very good category bonus. Triple points on airfare and double points on groceries with my American Express Premier Rewards Gold card. Double points plus a 7% annual dividend on all travel and dining with Megan’s Chase Sapphire Preferred card. I don’t normally buy things at drugstores, and the ones in Seattle won’t sell me a Vanilla Reload with a credit card, so I ignore the drugstore bonuses on the Hilton HHonors credit cards.

One thought is I could buy gift cards for select merchants at grocery stores using my Premier Rewards Gold card to get 2X Membership Rewards points or at office supply stores using my Ink Bold to get 5X Ultimate Rewards points. Both are high value programs.

The problem is that I can’t really use them. Seattle has so few stores and restaurants that are part of national chains. The closest Olive Garden is 30 minutes away in Tukwila, and there’s better Italian food within walking distance. If I wanted to rely on prepaid Visa or MasterCards instead, most office supply stores no longer carry denominations higher than $200. But I can still get double points at grocery stores, which go as high as $500.

Manufactured Spend

The only strategy that really works for me is manufactured spend using the American Express Bluebird card for Walmart. You can load this with any debit card and then spend it, cash it out at an ATM, or write checks to your friends, landlord, or credit card issuer (to pay off the debt). Most prepaid cards function as debit cards, so it’s a simple loop:

Credit Card >> Prepaid/Debit Card >> Bluebird >> Cash or Check >> Credit Card

I’m starting out slow, but it’s possible to cycle several thousand dollars a month through this process and pay only a few dollars in fees. The biggest challenge for me is that I don’t earn any category bonuses because I can’t buy Vanilla Reloads and because it’s expensive to buy prepaid Visa and MasterCards, as I explained earlier.

Every time I fund my Bluebird it counts as plain vanilla spending, pun intended. Several banks offer prepaid cards, and while not all allow you to fund them with a credit card, those that do won’t count for any category bonuses. (Read more from Travel Summary about how the fees can add up.)

The only effective way to do this is to fund the Bluebird at a physical Walmart (much smaller transactions are permitted online). And, surprise, the closest one is an hour roundtrip from my apartment. I would never do this without a category bonus, so why bother? Part of it is to accelerate spend. If I can take care of high minimum spend requirements without advancing any cash, then that works well for me.

But the more important reason is to qualify for annual bonuses when I spend a large amount on a card. The Hyatt Visa will give me credit for 2 stays toward elite status if I spend $20,000 in a single year, or a total of 5 stays if I spend $40,000. That is a lot for most people, and if I did spend it all, I would not choose this card just to get some Gold Passport points.

Five stays lets me spend more time working toward SPG Platinum status, without which I might have to pay for $500 in mattress runs. I aslo get 40,000 Gold Passport points, which is almost enough for two nights at any Hyatt. Valued at 1.8 cents each, they’re worth another $720. I can definitely ring up $40,000 in manufactured spend over the course of the year and incur less than $1,220 in fees.

Megan also has her British Airways Visa — $20,000 gets 50,000 bonus Avios points — and both of us have American Express Premier Rewards Gold cards — $30,000 gets 15,000 bonus Membership Rewards points. In the process we’ll earn another 25,000 Avios (1.25 points per dollar) and potentially a lot of Membership Rewards points. I’m vague on the latter number because although there are some bonus categories for groceries, travel, and drugstores, overdoing it can raise suspicions. You do NOT want to be subject to an American Express Financial Review, which is on par with being audited by the IRS.

I’m not suggesting I will go all out on these methods. The Hyatt strategy makes sense for me because I want my Diamond status and the local properties are too expensive for mattress runs. The Avios bonuses make sense because we live in Seattle and can get a lot of value from non-stop awards on Alaska Airlines. We probably won’t use the companion benefit, so Megan won’t shoot for $30,000 on her British Airways card. And you should always be cautious using any of these strategies with American Express, so a plan for my Premier Rewards Gold card may not materialize either.

But my ideas should get the gears turning in your head. Here are a some (not all) of the cards that might make sense for manufactured spending. I tried to limit the list to more reasonable thresholds and more valuable bonuses. Learn more how Amol will be using manufactured spend to earn elite status with Delta this year. Applications for some of the cards below can be found on my list of the Best Travel Credit Cards.

Chase British Airways Visa Signature

- Spend $10,000 in first year >> Get 25,000 bonus points

- Spend $20,000 in first year >> Get 25,000 bonus points

- Spend $30,000 in first year >> Get free companion ticket for paid or award travel (plus taxes/fees)

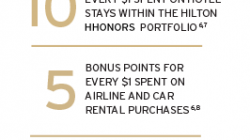

Citi Hilton HHonors Reserve

- Spend $10,000 any year >> Get 1 free weekend night

- Spend $40,000 any year >> Get Diamond elite status

American Express Delta Reserve

- Spend $30,000 any year >> Get 15,000 bonus miles + 15,000 MQMs

- Spend $60,000 any year >> Get 15,000 bonus miles + 15,000 MQMs

American Express Platinum Delta SkyMiles

- Spend $25,000 any year >> Get 10,000 bonus miles + 10,000 MQMs

- Spend $50,000 any year >> Get 10,000 bonus miles + 10,000 MQMs

American Express Premier Rewards Gold

- Spend $20,000 >> Get 15,000 bonus points

Chase MileagePlus Explorer

- Spend $25,000 >> Get 10,000 bonus miles

Barclaycard Arrival World MasterCard

- Actually, there’s no bonus for high spend. But because every point is worth 2.2 cents toward airfare, they are extremely valuable. Earn them cheaply, and I think that’s good enough in itself. 😉