It’s been more than three months since Love was finally set free after 40 years of Wright Amendment restrictions, and I thought now would be a good time to check in with the various players at the airport to see how successful their efforts at expanding service have been so far. To quickly review, four airlines currently fly out of Dallas Love Field: Delta, Southwest, United, and Virgin America.

In the run-up to the Wright repeal, Southwest, with 16 of the airport’s 20 gates at its disposal, announced an aggressive ramp-up from 118 to 153 flights a day, a number that was finally achieved with the beginning of flights to San Francisco and Oakland on January 6th. Virgin America, with two gates, announced plans to discontinue flights at DFW and launch 13 flights a day out of DAL, eventually rising to 18 per day by late April, 2015. Delta tried and failed to obtain the gates that were ultimately awarded to Virgin America, initially proposing 18 flights a day to five destinations, but eventually settling on 5 flights a day to Atlanta via a sublease agreement with United. For its part, United initially planned to increase service to Houston’s Bush Intercontinental to 12 flights a day, but eventually scaled that back to 7 per day.

United never seriously planned to do very much at DAL, and not surprisingly, Delta hasn’t gained much traction with only a handful of flights, so the focus of this post will be on Southwest and Virgin America. The story is one of opposite results, one airline that appears to have exceeded expectations, and the other, not so much, at least not yet.

Virgin America Struggles Out of the Gate

VX pushed hard to obtain its two gates at DAL, the same gates that the feds required AA to divest as a condition of its merger with US Airways. On October 13th, the day the Wright Amendment was officially toast, VX packed up and moved the 18 miles down State Highways 114 and 183 and Mockingbird Lane from DFW Airport to Love Field, to much fanfare, of course. But has the airline lived up to the hype? Product-wise, VX delivers an excellent experience, as my flight in Main Cabin Select back in November confirmed. In terms of operating statistics, though, the numbers don’t look great so far. As the chart below shows, overall load factors from October 13th through December have been poor, averaging just 65.4% over the period through 79,086 enplanements. Note on methodology: I calculated load factor by taking total VX enplanements as reported by DAL over total seat capacity on operated flights during the period, as determined by schedule and aircraft type data listed in FlightStats. This could be slightly off from actual numbers after accounting for connecting traffic, but as this is likely minimal, this should be pretty close.

What is somewhat interesting is the sharp drop-off in load factors noted from the last few months of service at DFW:

The numbers jump around quite a bit, from 66.7% in September to 83.2% in July. I didn’t do a detailed analysis farther back than June, but some quick number crunching showed poor results in January and February, at 63.3% and 56.6%, respectively, before running pretty consistently between 74 and 79 percent from March through June. Clearly, there does seem to be a downward trend, though it is somewhat difficult to draw conclusions from the DFW data due to the limited number of flights (just 3 each per weekday to LAX and SFO).

It’s one thing for load factors to lag a bit, especially in the first few months after the launch of several new routes, but what concerns me a little more than that is the seemingly constant discounting going on. Nearly every week, my Inbox is graced with yet another Virgin America fare sale like this:

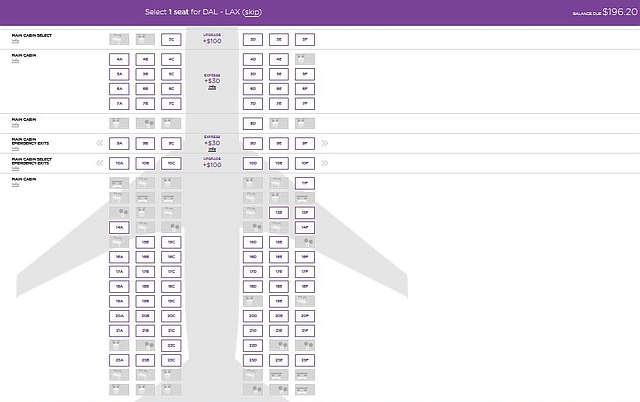

And when I say cheap, I’m not kidding; fares from DAL to DCA, for instance, have been available for as little as $59 each way, and I have booked flights to both SFO and LAX later this month for less than $275 all-in. Plus, we recently heard Rocky’s news that VX will price match any nonstop flight that competes against Southwest. Just for kicks, I pulled up a search for a February 28th departure/March 1st return to Los Angeles. The results? An insane $196.20 round-trip fare, and an almost completely empty seat map.

Lots and lots of empty seats in coach, even at $196 each

Yes, seat maps aren’t perfect indicators of the number of tickets actually sold, but still, this doesn’t look good.

So what’s going on here? Without route-level load data, it’s difficult to pinpoint which routes are and aren’t working, though even VX’s DFW service to LAX and SFO wasn’t exactly spectacularly successful, with load factors generally in the mid-70% range. If I had to speculate, I’d say it’s a combination of two things: lack of frequency to compete with the 800-pound gorilla known as Southwest, and a miscalculation on Virgin’s part of the attractiveness of its product in the local market. Those of you from Texas know that Southwest still has an almost cult-like following in places, and with a ton of convenient one-stops and no plane change options in addition to the nonstops to the markets that Virgin serves, it’s going to be hard to get people to switch. Also, while the hard and soft product is great, the lack of frequencies compared to Southwest (or AA at DFW) makes VX a tough sell for business travelers, who need more than three flights a day to LAX. Not to mention, most area business travelers are pretty well locked in to AA or Southwest, thanks to corporate contracts and/or elite benefits, especially on AA. That leaves VX fighting largely for the leisure traveler, and the young and hip leisure traveler at that. And that’s where I suspect the real problem lies.

As I alluded to in my post earlier this fall commemorating the re-opening of Love Field, while it’s true that the hipster population in Dallas predominantly lives in areas that are more convenient to DAL than DFW, that population just isn’t all that large, with approximately 72,000 residents. That means VX is vying for leisure travelers hailing from the northern and eastern suburbs; those travelers are either still enamored with Southwest, or will just head over to DFW, which is closer, since AA is more or less price-matching anyway – or the truly cost-conscious will just fly Spirit. I think Virgin has more work to do in terms of differentiating its product, and explaining how it thinks it’s better than the competition. Take me for example; when I choose VX over WN or AA, it’s because of the availability of things a true premium economy product and A/C power at my seat, but the benefits of Main Cabin Select aren’t prominently touted in the company’s ads. Just marketing itself as young and hip isn’t really enough, especially since a lot of VX’s potential audience has a shorter drive to DFW than DAL.

Meanwhile, Southwest Exceeds Early Expectations, Further Expands Service

The picture for the big man on campus on Cedar Springs, hometown Southwest Airlines, appears to be quite a bit rosier. Southwest claims that load factors on its expanded service out of DAL exceed 90 percent, a claim that is difficult to verify because of Southwest’s penchant for “no plane change” direct service, which means any given aircraft may already have many passengers on board before taking on additional passengers at DAL. However, my number crunching, based solely on enplanements at DAL, would have yielded load factors of 75.9%, 77.8%, and 83.2% in October, November, and December, respectively, so perhaps 90% isn’t that much of a stretch with through passengers factored in. In any event, Southwest apparently feels like its first round of expansion has been so successful, they decided to sublease two more gates from UA and expand service even further:

Without providing many details, Southwest said that in April it would “offer daily nonstop flights to nine new cities from Dallas, including Memphis, Milwaukee and Seattle.” It didn’t identify the other cities.

It also said it would “increase the number of nonstop flights to recently introduced destinations added” after the end of the Wright amendment.

I can’t say that any of the three cities already identified are unexpected; in fact, there was a fair amount of surprise among the North Texas aviation community that Seattle wasn’t among the cities announced for nonstop service back in the summer. I’m also sure Memphis is tickled pink, as they’ve been desperate to pick up new service of any kind ever since Delta decided to dismantle its old Northwest-era hub. So what could the other six cities be? My best guesses are Boston, Charlotte, Detroit, Minneapolis, Philadelphia, and Salt Lake City, with perhaps Cleveland, Portland, and Raleigh also possibilities. Southwest is already borrowing space at one of United’s gates, so I’m guessing we’re looking at somewhere around 15 additional flights total.

Southwest takes over the two gates on March 16th, at which time United will discontinue service, and therefore operate all service out of DFW. Just a few short months ago, United insisted that it wanted to keep its gates, and ramp up service to IAH to 12 flights a day, so why the sudden turnaround? My guess would be a combination of 1) a substantial sum of cash from Southwest, and 2) gentle nudging from city officials to quit “squatting” on the gates. The more interesting question is, what happens to Delta, after its current gate use agreement ends in July? I doubt Southwest is going to care about the 5 flights a day to ATL, though given their expansion plans, they’re probably not going to want to lease any additional time or space to DL to allow them to expand operations. The question then is whether Delta will be content just operating a shuttle to Atlanta. My rudimentary number crunching shows a very respectable 83.9% load factor in December, so I’m thinking they’ll be content to stick with it.

I also suspect we may be seeing the early signs of chafing against the arbitrary 20-gate cap at DAL. Southwest has been making a lot of noise about needing more gate space over the last couple of months. Picking up UA’s two gates will keep the wolves at bay for a little while, but I have a strong suspicion that Gary Kelly’s crew might start agitating for a lifting of the gate cap before very long. That’s just not going to happen, as the resulting noise from the neighborhood associations surrounding the airport will make any Love Field expansion politically toxic. Could this eventually mean that Love’s big brother will once again try to woo Southwest to the spacious but underutilized DFW Terminal E? Perhaps, though such a split operation would be a nightmare logistically, with connections akin to trying to get from LGA to JFK or something like that (not to mention, the Wright compromise forbids any operator that flew from only one of the airports to begin new service at the other). Then again, if VX can’t get its load factors out of the gutter, perhaps more space will open up at Love after all…