Aer Lingus will operate 12 transatlantic routes in Summer 2016, with ten routes from its Dublin base to Boston, Hartford, New York, Newark, Washington, Orlando, Toronto, Chicago, San Francisco and Los Angeles, and from Shannon to Boston and New York. New routes to Los Angeles, Newark and Hartford will begin next May.

Irish flag carrier Aer Lingus will add three additional North American markets in 2016 with new services to Hartford, CT and Newark, as well as the resumption of Los Angeles. All three routes will emanate from its Dublin hub, and will represent the second surge in transatlantic capacity that Aer Lingus has adopted in 3 years.

Related post: Aer Lingus re-commits to North America and long-haul strategy

Matthew has provided an excellent synopsis on the cabin configuration on the new routes, as well as links to the product offering and redemption opportunities as they come online.

Aer Lingus continues to utilize A330s as it awaits A350 deliveries in 2018

Aer Lingus will continue to deploy its widebody Airbus A330 aircraft on its new transatlantic routes, although it expects to receive its first Airbus A350-800 XWB in 2018. Currently, Aer Lingus deploys its A330s on transatlantic routes to San Francisco, Chicago, New York JFK, Orlando and Boston, while also operating 757s to Toronto, Washington Dulles and between its Western Ireland gateway at Shannon airport to both New York JFK and Boston. Its transatlantic 757 operations are wet-leased from ASL Aviation Group’s Irish airline Air Contractors and based out of Dublin to operate medium-range “thin” routes to the U.S. and Canada.

Aer Lingus currently has 8 Airbus A330s in its fleet, according to CAPA Fleet database, comprised of 4 -200 series and 4 -300 series. The -300 series are deployed on high-density routes, such as Dublin to Boston, Chicago and New York, which are cities with significant Irish diasporas. Aer Lingus also operates its A330-300s to Malaga, Spain during the peak summer season as it is a popular tourist destination. Its high-density -300 series Airbus frames feature 24-30 flat bed seats in Business Class and 287-298 in Economy, depending on the precise configuration.

Aer Lingus sends its -200 series to San Francisco, Orlando and Washington Dulles (although the latter will transition to a 757 during the Northern Winter season). Aer Lingus also sends its -200 configured planes to Boston, Chicago and New York JFK periodically when adding frequencies during peak seasons. Its -200 series are configure with 23 Business Class seats and 243-248 Economy seats, depending on configuration. Newark and Los Angeles will be served on -200 frames, and Hartford will be served on a 757.

Aer Lingus has been on a tough road, but has pounced back

Los Angeles last saw service from Aer Lingus in 2008, which was dropped amid a massive series of reductions in Aer Lingus’ long-haul network, which saw services axed from Dublin to San Francisco, Los Angeles, Washington, D.C. and Dubai, as well as niche routes such as Chicago to Shannon. Back then, Aer Lingus was in a troubled state as it struggled to navigate its future through the dark, having recently exited the OneWorld alliance in 2007 and deciding to forge its own conversion from a full-service to a hybrid carrier. The subsequent tolls incurred by rising oil prices in 2008, the global financial grisis, a souring Irish economy and a business model saddled with high-cost operations across its airport and labor forces ultimately create a massive restructuring and cost-cutting initiative in the late 2000’s.

Then-CEO Christoph Mueller helped the carrier achieve a massive turn-around in the early 2010s with a slimmed-down cost structure and a re-vamped short haul network to optimize connections between North America and the British Isles/Continental Europe as well as intra-European operations. The carrier has worn several hats after interfacing externally with Etihad, Virgin Atlantic, Delta, JetBlue and United, and all the meanwhile, grounding itself against under-valued takeover bids from IAG and Ryanair.

Though some projects have come and gone (for instance, the 2009 – 2012 Joint Venture with United to fly between Madrid and Washington) and others have been short-lived (such as the Little Red experiment with Virgin Atlantic, which is now defunct), one can say that this is not “your grandmother’s Aer Lingus.” Mr. Mueller helped revamp the carriers’ organizational, operational and network structure to help keep costs in order and optimize revenue opportunities. From a network perspective, Aer Lingus has returned to markets such as San Francisco, Toronto and Washington with a much more manageable approach to capitalize on growing business and ethnic ties between distinct North American regions and Ireland.

Mr. Mueller has subsequently moved on to CEO of Malaysia Airlines, which is undergoing a massive restructuring program, stepping down as of May 2015. IAG, which stands for International Airlines Group and serves as the parent organization for British Airways, Iberia and Vueling, made a 3rd bid for full-ownership of Aer Lingus in January 2015, valued at roughly 1.4B Euros, which fit the conditions of the Irish carrier, as well as EU regulations. IAG acquired Aer Lingus in mid-September 2015.

The increased service to the U.S. not only underscores Aer Lingus’ successful return to growth mode after a dark period in the late 2000s that resulted in the carrier trimming the vast majority of its long-haul network on its path to recovery, but also the strategic place that it will hold in IAG’s network as a reliever hub for slot-constrained London Heathrow airport. The Irish carrier will specialize in transit traffic for U.S. to mainland Europe, the UK and Ireland traffic, as well as compete effectively against the growth of budget carriers, such as Icelandair.

Competition is rife on new U.S. routes, but U.S. – Ireland demand is strong

Aer Lingus will face competition on two of three of its new routes. Ethiopian flies nonstop from Los Angeles to Dublin, which was launched in June 2015 on a 787, flown thrice weekly. Ethiopian purportedly has seen numbers exceed expections during the infancy stages of its Los Angeles route, and as the carrier holds 5th freedom traffic rights between LA and Dublin, the carrier is capable of transporting passengers originating and terminating their journeys in both cities without the need to travel onward to Addis Ababa, its primary hub airport.

Related post: Ethiopian Airlines adds Dublin – Los Angeles, expans 5th freedom routes

EI145 DUB1500 – 1800LAX 330 x24

EI144 LAX1950 – 1400+1DUB 330 x24

From Newark, Aer Lingus will compete against primary hub carrier United, which offers nearly 2,400 weekly seats during peak season to Dublin, alternating between 1 and 3 daily frequencies depending on the time of year. All are operated on United’s internationally-configured 757-200 series aircraft. Aer Lingus will operate Newark on a daily basis year-round.

EI101 DUB1310 – 1540EWR 332 D

EI100 EWR1735 – 0520+1DUB 332 D

Hartford, while not served by any transatlantic carriers, has been pushing to secure a foreign airline since Northwest Airlines pulled its 757 service to Amsterdam in 2009. The formation of the Connecticut Airport Authority in 2012 placed transatlantic service as a high-priority bucket item, and as these developments take time, the wish has been finally fulfilled. Hartford often sees its international traffic bleeding towards New York in the South and Boston to the North, but with a strong population base on the I-90 corridor, with higher-than-average per-capita income, airport officials have always believed there was a strong business case for the route, according to an article in USA Today.

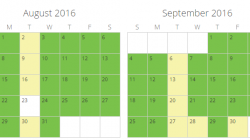

Aer Lingus has not announced schedules for its Hartford flight, which is due to commence on September 28, 2016. It will be predated by the launch of Newark on September 1, 2016 and resumption of LAX on May 4, 2016.

Passenger volumes at Dublin and Shannon airports have grown

Baselined against the growth in the U.S. – Ireland travel market, trends have indicated that the market can support a strong supply of seats on a year-round basis. Data from CAPA OAG schedules show that weekly seat offerings between the U.S. and Ireland has nearly doubled since 2011 during peak season, from approximately 20,000 during Summer 2011 to nearly 40,000 in Summer 2015. Ireland benefits from pre-border customs facilities at Dublin and Shannon to permit seamless travel to the U.S., and with onward connection opportunities.

Additionally, infrastructure developments at Dublin airport have facilitated passenger growth, rising from 18.7 million annual passengers in 2011 to 21.7 million in 2014. Shannon airport, meanwhile, has seen its passenger numbers stabilize after two years of decline. Total emplanements stood at 1.6 million in 2011, before decreasing by 200,000 during the following two years. However, with the capablities enabled by the wet-leased 757s deployed to Boston and New York, Shannon’s volumes rose back to 1.6 million in 2014, which is a positive indication for the airport.

Currently, all three U.S. carriers – American, Delta and United – serve both Dublin and Shannon, as well as Aer Lingus and Ethiopian, rounding to five carriers offering nonstop service. Fifth-freedom operators such as Air Canada Rouge and WestJet also offer connectivity through transborder hubs in Canada, although WestJet is only seasonal and requires a double connection via Toronto and St. John’s, Newfoundland.

Aer Lingus is the dominant carrier in the U.S. – Ireland market with roughly 70% of total market-share in high season (although this tends to fluctuate and can fall as low as 50% in the low season) while United is the largest US player with roughly 18% market share in high season. United offers year-round service from Dublin to Washington Dulles and Newark, and summer-seasonal service to Chicago. Delta flies year-round to New York JFK from Dublin, and seasonally to Atlanta, while American flies year-round to Philadelphia from Dublin and seasonally to New York JFK, Charlotte and Chicago. From Shannon, United operates year-round to Newark, and seasonally to Chicago, and both Delta and American operate seasonal service to New York JFK and Philadelphia, respectively.

Future of Aer Lingus – JetBlue codeshare uncertain, next: OneWorld entry?

Even with its US expansion, Aer Lingus may not continue its codeshare relationship with JetBlue moving forward now that it is owned by IAG. American Airlines, which offers a Joint Venture agreement with IAG, ended its interline and reciprocal frequent flier agreement with JetBlue in early 2014. The relationship, which was already fairly loose, between the two carriers had served its purpose until American’s merger with US Airways, which enabled the carrier to regain a stronger position in the Northeast and therefore rendered the benefits of the agreement fairly moot.

In a similar vein, Aer Lingus will likely deflect from its codeshare agreement with JetBlue in favor of routing passengers on fellow OneWorld partners. Currently, Aer Lingus and JetBlue customers can book a single itinerary connecting from Ireland through New York JFK and Boston to roughly 30 cities in the U.S. and Puerto Rico, according to Aer Lingus’ website. The two carriers do not permit reciprocal frequent flier accrual on each others’ flights, but passengers traveling to Ireland on a JetBlue itinerary can have their luggage checked all the way to Dublin or Shannon, via JFK or Boston. It is unclear if this is permitted on the return journey, although it is possible given that Dublin and Shannon both have pre-clearance facilities.

Despite this, the impact of ending the Aer Lingus – JetBlue codeshare will likely be minimized by the gains through OneWorld hubs now that Aer Lingus is part of IAG. With the exception of select Puerto Rican markets, virtually all of the cities in the current codeshare agreements can be serviced over OneWorld hubs in Chicago, Charlotte, Philadelphia, New York JFK and Boston, which are all connected to Dublin via American Airlines or Aer Lingus.

It is not certain when Aer Lingus intends to re-join OneWorld, nor what plans Aer Lingus plans to undertake with regards to its other airline agreements with United, KLM and Etihad. What is clear is that in the evolving mosaic of airline alliances, agreements, ownership structures and network developments, once again, the hands have been switched over and nearly ten years later, Aer Lingus is once again playing in the same backyard. This time, it has matured and worked out several of the kinks, and will be a solid contributor to the OneWorld joint venture alliance.