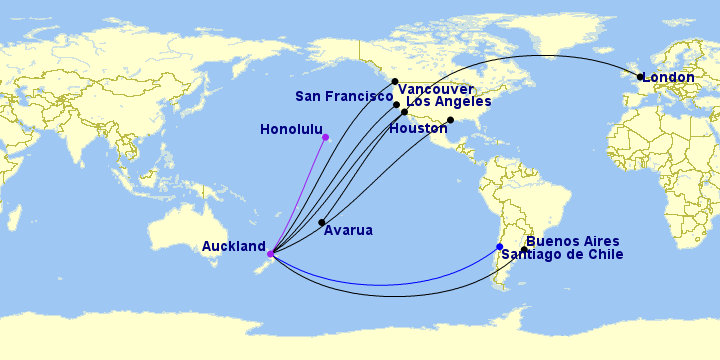

Air New Zealand will launch two new transpacific routes to the U.S. and Argentina in the second half of FY 2015 with nonstop service from its Auckland hub to Houston and Buenos Aires. This will be NZ’s first foray into Latin America and first time serving Houston. The carrier presently offers service to Honolulu, Los Angeles, San Francisco and Vancouver in North America.

Strong profitability record and renewed fleet enable expansion to the Americas region

Though New Zealand’s geographic positioning as an end-of-line country is sub-optimal for serving as a major connecting hub between high-traffic countries, it is the predominant carrier for passenger flows between North America and New Zealand, accounting for approximately 91.69% of the overall market share between the two regions as of April 2015. Its sole competitor to North America, Hawaiian Airlines, operates nonstop between Honolulu and Auckland, although Hawaiian still compete for connecting traffic between the U.S. mainland and Oceania over the Islands.

Auckland is also used as a connection point for transit traffic beyond New Zealand, including the Southwest Pacific Islands and Australia. These traits contrast with the market share dynamics between the North America and Australia, which is more fragmented among multiple competitors, including Qantas, Delta, United, Air Canada, Virgin Australia, Jetstar Airways and Hawaiian.

Air New Zealand operates 4 weekly flights to Honolulu on 767s, 5 weekly flights to Vancouver on 777-200ERs, daily flights to San Francisco on 777-200/300ERs, 17 weekly flights on 777-200/300ERs to Los Angeles, 7 of which continue onto London Heathrow, and 1 weekly flight between Los Angeles and Rarotonga, Cook Islands. LAN operates 7 weekly flights between Santiago and Auckland on 787-800s which continue onto Sydney, and Hawaiian offers 3 weekly flights on Airbus A330-200s to Honolulu from Auckland. Houston will be initially be offered 5 times weekly, and Buenos Aires will be offered 3 times weekly, both on 777-200ERs.

Argentina sees restoration of nonstop service to Oceania after nearly two years without a nonstop

Air New Zealand’s Buenos Aires service is scheduled to launch on December 1, 2015, initially with a thrice weekly service on Boeing 777-200ER aircraft. Ticket sales commenced on March 25, 2015.

NZ030 AKL1920 – 1500EZE 777 257

NZ031 EZE2359 – 0530+2AKL 777 257

NZ plans to launch a new partnership with Argentina’s flag carrier, Aerolineas Argentinas, which pulled its own flight between Argentina and the South Pacific in March 2014.

Aerolineas had previously offered a nonstop service between Buenos Aires and Sydney, with a technical stop in Auckland each way, from 1980 through 2012 before eliminating the Auckland stop and focusing solely on Sydney. Even with the operational savings of closing its Auckland station, Aerolineas withdrew from Oceania entirely in March 2014 as Argentina’s economic woes and Aerolineas’ own internal strifes rendered the route unviable. Qantas had also operated a nonstop Buenos Aires to Sydney flight between 2008 and 2012, but transferred its South American gateway to Santiago, Chile as it was better suited for connections being a OneWorld alliance hub for LAN Airlines.

Though Argentina – New Zealand is not a large local market at the moment, Air New Zealand believes there is potential for further growth given burgeoning economic, trade and tourism ties between the countries. As the route climbs towards maturity, there will be a major emphasis on carrying 6th freedom traffic beyond New Zealand from Auckland.

An early morning arrival into Auckland on Thursdays, Sundays and Tuesdays facilitates connections to Sydney, Queenstown, Brisbane, Christchurch, Wellington, Gold Coast, Wellington, Rotorua, Melbourne, Tokyo, Apia, Adelaide, Tauranga, Cairns and Rarotonga. NZ also offers a robust inbound schedule between 16:00 and 18:00 from the same lineup of markets.

However, even with an Aerolineas partnership, feed from other Latin American cities in the Southern Cone will be more limited on the Buenos Aires end. ANZ’s mid afternoon arrival is less than ideal given that no Aerolineas flights depart until 7pm, and schedules are limited to Lima, Salvador, Rio de Janeiro and Belo Horizonte. Inbound connections are slightly more robust with connections available from Montevideo, Asuncion, Cordoba, Rosario, Iguazu, El Calafate and Mendoza. A vast portion of Aerolineas’ flights depart from Aeroparque Jorge Newberry airport in Downtown Buenos Aires as opposed to the predominantly intercontinental Ezeiza airport a bit further away from the city, which ANZ will be operating to.

Houston secures another foreign flag route voided by United

Long speculated, the Houston to Auckland route will also go live in December 2015 and will operate 5 time per week nonstop between the two cities. ANZ will also deploy a 777-200ER to IAH, a Star Alliance hub and the largest domestic base for United Airlines.

United was supposed to launch a nonstop Houston – Auckland flight in 2012, but cancelled the route purportedly after Houston Hobby airport was granted the rights to open a Federal Inspection Services facility to permit Southwest Airlines to operate international flights from Hobby. Though likely an over-exaggeration on United’s part, the tendency has been for Houston to attract more foreign carriers to operate long-haul services to IAH over its predominant airline.

For example, Houston only offers 1 daily nonstop flight to Asia on its hub airline, United, to Tokyo Narita whereas American Airlines will offer 6 daily flights to five Asian markets from Dallas/Ft. Worth this summer (two to Tokyo Narita, and one each to Seoul Incheon, Shanghai, Beijing and Hong Kong). However, Houston will also receive a daily nonstop flight to Tokyo on United JV partner All Nippon Airways, as well as receive a new nonstop service to Taipei, Taiwan on Star Alliance partner EVA Airways, in addition to daily service on Air China to Beijing, Singapore Airlines to Singapore (via Moscow) and Korean Air to Seoul. Dallas/Ft. Worth only receives service to the Asia/Pacific region on two foreign flag carriers: 5 weekly flights to Seoul on Korean Air and 6 weekly flights to Sydney on Qantas.

In its official press release regarding the new flight to Houston, Air New Zealand remarked that it intends to codeshare with United on the route and they will carry each others’ codes from points beyond Houston to key USA destinations as well as Mexico, Central America and the Caribbean on United and from Auckland to points beyond on Air New Zealand. This further underscores the likelihood that United abandoned its own plans to serve Auckland merely because it lost interest in operating the route rather than as a result of the outcome of the FIS dilemma with Hobby airport. The irony of the whole debacle is that the route will come to fruition around the same time as the opening of the FIS facilities, even though there has been over 3 years of lead time to allow the route to mature (5 if including back to the original date in Summer 2010 when pre-merger Continental first announced intentions to serve Houston – Auckland with a 787).

Although new to Houston, Air New Zealand previously served Texas via DFW

Air New Zealand previously flew to Dallas/Ft. Worth International airport in the 1980s operating a weekly Auckland – Papeete – Dallas/Ft. Worth – London Gatwick flight on a 747-200. The inaugural flight began on October 28, 1987, and lasted through October 29, 1998 before the Papeete stoppover was replaced by Honolulu, and continued until March 21, 1990 when the Dallas/Ft. Worth station was pulled altogether.

Interestingly, the flight numbers TE 001/002 were used for its Dallas/Ft. Worth flights, as the IATA code for ANZs intercontinental routes during that time were TE, tracing back to its history of being Tasman Empire Airways Limited.

Air New Zealand is pragmatic about shaping its long-haul network: IAH and EZE are logical enhancements

The Star Alliance carrier, which posted its third year of profitability for the full fiscal year ending 30-June 2014, has made some surgical additions (and some subtractions) to its long-haul route network over the past few years, capitalizing on key growth opportunities and expanding partnerships with foreign carriers while also exiting under-performing markets. ANZ withdrew from Auckland – Osaka as well as London Heathrow – Hong Kong in 2013/2014, but recommencing Singapore through a JV with Singapore Airlines.

Unlike other Star Alliance carriers, which tend to frown down upon purusing extra-marital relations outside of Star, Air New Zealand has forged ties with the likes of Cathay Pacific, Virgin Atlantic, Virgin Australia, Etihad and numerous smaller airlines based in the South Pacific. In ANZ’s defense, such partnerships are designed in place to augment its fortitude as an end-of-line carrier while also muting territorial conflicts and overcapacity from hungry competitors. Star Alliance vocalists Lufthansa and Air Canada, for instance, would much rather have Air New Zealand codeshare with Etihad on trans-tasman routes from New Zealand to Australia as opposed to Auckland – Singapore or Auckland – Hong Kong (which carriers codes on United, Lufthansa, Turkish, ANA, Asiana, Singapore, Thai and paradoxically, Cathay Pacific).

As Air New Zealand continues its “growth mode,” by no means modest for a carrier of its size, it may gradually send its more fuel efficient aircraft on long-haul routes as it receives more 787-900 series. The carrier will have 3 through the end of 2015, with 9 additional frames delivered through 2020. Meanwhile, its 777-200ER fleet will stay constant at 8 frames as well as its 777-300ER fleet at 7 frames through 2020. ANZ will also retire its 5 remaining 767-300ERs by 2018.