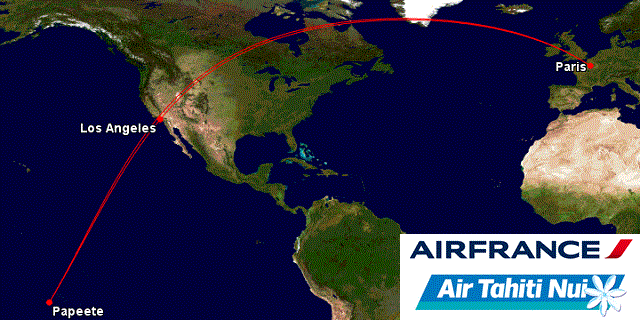

P2P: Polynesia to Paris

I’ve always been fascinated by the rare and unique routing between Tahiti and France by ways of Los Angeles, serviced on the two flag carriers of France and French Polynesia: Air France and Air Tahiti Nui, respectively. The two carriers currently compete on the nearly 10,000 NM route from Papeete F’aaa International airport (PPT) to Paris Charles de Gaulle International (CDG), with both carriers operating bi-directionally with a stoppover in Los Angeles each way.

Air France currently operates 10 weekly services between LAX and Paris, 7 of which are flown daily on an Airbus A380, and the remaining 3 on a thrice-weekly Boeing 777-200ER service that continues onward from LAX to Papeete. All 10 of these weekly services are covered under the existing antitrust immunized alliance between Air France, KLM, Delta and Alitalia across the Atlantic Ocean.

Air France current schedule: Paris to Los Angeles (+ Papeete)

AF066 10:30 CDG 13:05 LAX 388 D

AF065 15:45 LAX 11:35 (+1) CDG 388 D

AF076 19:10 CDG 21:40 LAX 23:45 PPT 05:00 (+1) 772 x1357

AF077 07:00 PPT 18:50 LAX 21:20 CDG 17:00 (+1) 772 x1246

Meanwhile, Air Tahiti Nui currently flies 9 weekly flights between Papeete and Los Angeles, of which 5 continue onward from LAX to Paris.

Air Tahiti Nui current schedule: Papeete to Los Angeles (+Paris)

TN102 23:15 PPT 10:25 (+1) LAX 343 4w (schedule changes frequently)

TN 101 23:40 LAX 05:10 (+1) PPT 343 4w (schedule changes frequently)

TN008 23:30 PPT 10:40 (+1) LAX 13:10 CDG 09:20 (+1) 343 x24

TN007 11:30 CDG 14:30 LAX 16:30 22:00 PPT 343 x35

Evading profitability

Despite cultural ties between the two countries, both Air France and Air Tahiti Nui are loss-making carriers, and the Papeete – Paris flights are especially problematic from a profitability standpoint. Tahiti has taken a huge hit in tourism traffic: annual passenger visitors in 2012 numbered just above 160,000, representing a 40% decline from its peak of 260,000 back in 2001 – all thanks to the global financial crisis. Tourism comprises roughly 25% of Tahiti’s Gross Domestic Product.

Meanwhile, Europe continues to suffer from its own economic woes, rendering it less likely for foreign tourists to venture beyond the confines of the continent to distant territories.

As such, both airlines have been affected by this double whammy. Last fall, I wrote an entry about how Air France was considering axing its Tahiti flights, citing that it has been “chronically losing money” on the Los Angeles to Papeete services for the past seven years.

For Air Tahiti Nui, the problem child appears to be the Los Angeles to Paris flight. Taken together, both of these individual route difficulties make practical sense given that, in context, both are targeting France to French Polynesia traffic, which appears to be weaker in comparison to the individualized US to Tahiti and US to France traffic units.

However, renewed hope may be on the horizon. In April, Air Tahiti Nui applied for a new alliance agreement with Air France to create a joint codeshare on the Paris CDG-Los Angeles route, seeking anti-trust immunity that would allow them to coordinate their services and flight schedules between the two city pairs. The antitrust application will bundle Air Tahiti Nui into the existing antitrust immunised alliance between Air France, KLM, Delta and Alitalia to form the centrepiece of the proposed metal neutral alliance and revenue sharing on the Los Angeles-Paris route and for codesharing beyond Paris CDG.

Air Tahiti Nui will also boost its weekly frequencies between Papeete to Los Angeles from nine to fourteen in the peak southern hemisphere winter, with seven of those services continuing onto Paris. The carrier is also revamping its in-flight product, although TN’s long-haul fleet is comprised entirely of Airbus A340-300s, a relatively fuel-inefficient aircraft, so it seems questionable as to whether any significant revenue gains from a new product will offset cost challenge on its high-CASM planes.

Puzzle pieces still missing

It sounds to me like a very, “if you can’t beat ’em, join ’em” approach to stifle the bleeding on a major glamor route for two competing carriers. Obviously, coordination and cooperation is likely the best alternative path given that they are the only direct competitors on these services, but of course, each are in need of major game-changer, and a “one-size-fits-all” strategy may not be in the best interests for both participants.

Air Tahiti Nui has essentially never turned a single profit since its founding in 1996. It is majority owned by the French Polynesian Government, and operates a small handful of key trunk routes from its Papeete base to Tokyo, Auckland and Paris (via LAX). It already has a codeshare agreement in place with American Airlines on 19 routes from LAX, and moving towards joining the metal-neutral North Atlantic JV is a step in the right direction.

Air France-KLM, meanwhile, posted a EUR 530 million operating loss for Q1 2013, and remains financially the weakest of the European Big 3 (AF-KL, Lufthansa Group and International Airlines Group). Labor cost and productivity, as well as profitability on its medium-haul routes, continue to pose major challenges for AF. In a nutshell, its problems are far more macro than TN’s.

Understandably, the commercial, political and cultural links between the two countries substantiate the business case for a JV or loose partnership of some sort, but to me, the benefits seem very lopsided towards Air Tahiti Nui. It is significantly smaller than Air France, and basically depending heavily on the JV to fix the economics of the LAX-CDG sector by tapping into Air Frances’ customer base out of Charles de Gaulle to improve traffic flow and (hopefully) drive up yields. It is a solid near-term plan to help get TN back on its feet, and then hopefully move towards a longer-term sustainability plan and get some confidence under its belt.

But where I struggle the most is determining what advantage Air France will gain from this? Codesharing with Air Tahiti Nui will not add much value to fix its troubled LAX-PPT flight. As I discussed in my post last fall, Air France has a cabin crew base at Papeete dedicated solely to flying the LAX-PPT route. The costs of maintaining this crew base are exhorbitantly high for a thrice weekly service. Pilots that fly this route are based out of Paris, and working this route can require an up to 9-day rotation, which is a lot of time spent away from their base back in France.

Understandably, however, the livelihood of many Tahitian families employed by Air France on the island depend on this route staying open, and Air France is in a very tough position in having to work through a commercial agreement with its labor force on the Islands to come to a win-win solution without upsetting the political relations between the two countries.

All-in-all, it’s hard to imagine that there is long-term viability with these routes. My guess would be that Air France may want to really reconsider flying LAX-PPT on its own metal. However, it seems difficult to believe that outcome may not arise without a few painful decisions.