Alaska Airlines is doing some soul searching on how to proceed with its mainline fleet. Fresh from the Airlines’ fourth-quarter 2019 earnings call, there are some clues on fleet direction.

Alaska’s Current Fleet

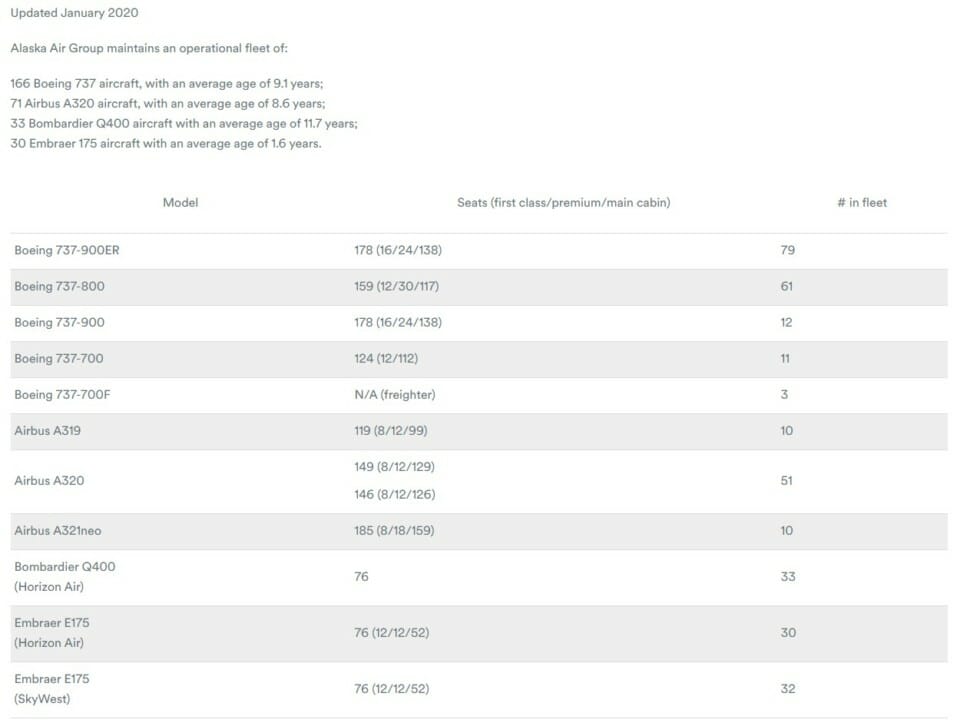

As of January 1, 2020, the Alaska Airlines fleet consists of 237 mainline jets (737 and A320 series) and 63 regional aircraft (jet and turboprop). Alaska Airlines has another 32 E175 jets operated by Sky West Airlines under a capacity-purchase agreement. Here is their current fleet:

The Current Order Book

Like many other airlines, Alaska has Boeing 737MAX aircraft that have yet to be delivered. The number of outstanding 737MAX deliveries stands at 32.

Some of these aircraft are completed and undelivered pending FAA recertification. Boeing had orders for 183 737MAX aircraft canceled last year which will move up delivery slots for Alaska Airlines. Boeing had a horrible 2019 regarding orders and cancelations, you can read that story here. Boeing needs orders badly. They finished their 2019 order book at negative 87 orders. Alaska could stick with Boeing and order more 737MAX aircraft at a discount for Boeing to get the orders.

A Bigger Aircraft In The Future For Alaska?

Until a week ago, Boeing was working on a new aircraft that has been referred to by several names:

- Boeing 797,

- MMA – Middle of the market aircraft and

- NMA – New market aircraft.

These are all same names for the same aircraft. One of the problems plaguing Boeing is they have no aircraft positioned between the 787 and the 737. This aircraft is also key for hundreds of Boeing 757 and 767 replacement aircraft.

The 797 would have been built in two configurations:

- Boeing 797-6 seating 228 passengers with a range of 4,500 nautical miles and

- Boeing 797-7 seating 267 passengers with a range of 4,200 nautical miles.

Three years ago, Alaska expressed some interest in the 797 according to an article in the Seattle Times. Here is an excerpt from that article:

“At an ISTAT panel discussion, John Kirby, vice president of capacity planning at Alaska Airlines, expressed potential interest in buying such a plane.”

Alaska could certainly justify utilizing the 797 on its high-density destinations like:

- Honolulu (HNL),

- New York (JFK),

- Orlando (MCO),

- Seattle (SEA),

- San Francisco (SFO) and

- Los Angeles (LAX).

Last week, new Boeing CEO, David Calhoun canceled the 797 project for now, you can read that story here. Calhoun wants the 797 project to start over from the beginning with a new market study before the 797 goes back to the drawing board.

Insights From The Earnings Call

Alaska Airlines had there 2019 year-end earnings call two days ago. In that call, there were some telling signs on which way Alaska is thinking about going. Here are a few excerpts:

Shane Tackett — Executive Vice President of Planning and Strategy, Alaska Airline

Another important area of focus is our long-term fleet plan. We have an opportunity to replace 61 A319 and A320 aircraft with larger gauge, more efficient assets. Either MAX nines and 10s or Airbus 321neos, all of which would give us the ability to generate more revenue while lowering unit costs. The economics of up gauging over the next several years are compelling and we are looking forward to finalizing plans to do this as one of our main 2020 objectives. The ultimate timing of a fleet transition will be balanced to smooth incremental training costs, especially of moving to a single fleet and will also be done in a manner that ensures we can meet our free cash flow and capital return goals. We’ll have more on this topic in the quarters to come.

Nathaniel Pieper — Senior Vice President of Fleet, Finance and Alliances

Hey, Jose, it’s Nat Pieper again. I think what we’ve been focused on is really defining our fleet requirements for the next five to 10 years, covering our replacement needs and covering growth. Shane mentioned the 61 A319s and 320s that we currently operate, and those are the airplanes that are the primary candidates for replacement. We’re looking at the MAX9 and the MAX10, looking at the A321neo and there’s going to be upgauge benefits for us with that, better cost performance, better revenue performance. Boeing’s challenges with the MAX did cause us to rework the sequencing of events in some of our timing, but we’re confident that over the next six to nine months, we are going to come with a good decision for Alaska. Later this quarter, we’re going to start the acquisition process, we’ll work it through the summer and we’re confident will come up with an answer in the third quarter, fourth quarter of this year.

Brandon Pedersen — Executive Vice President of Finance and Chief Financial Officer

Yes. The growth is 100% mainline, the regional is shrinking just a little bit. And then we do have some levers to pull, whether it’s paint lines, mod lines or some other things that we really don’t want to, but if we needed to, we might be able to squeeze some more out, possibly Airbus lease extensions as well.

Andrew Harrison — Executive Vice President and Chief Commercial Officer, Alaska Airlines

Yes. And on the question about the options for E175, we’ve done a bunch of regional growth recently, we’re going to focus on mainline, fleet plan over the next several months and then by the end of the year miles, we do plan to make some decisions about what we want to do with the regional fleet over a five to 10 year period as well.

My Take On The Fleetplan

I would rather see Alaska phase out their 797-700s (11 in the fleet) and older 737-800s due to their age. These Aircraft are at least 20 years old and are in serious need of interior modernization. I understand that the Airbus aircraft are first on the chopping block because Virgin America acquired most of its aircraft on lease. Some of these leased aircraft are nearing the end of their lease contracts. Alaska may have to extend the lease on some aircraft due to undelivered 737MAX aircraft.

Alaska has 32 undelivered 737MAX aircraft on the order book and should receive some of these this year depending on the FAA recertification process.

I personally prefer the Airbus aircraft as they have a wider fuselage. I suspect that Alaska will try to wheel and deal with Boeing to obtain new aircraft at a bargain-basement price.

What do think? Should new mainline aircraft orders go to Boeing, Airbus or both?