Many initially praised Alaska Airlines’ 2025 Mileage Plan updates, but the reality is far from customer-friendly. The new program prioritizes regional flyers over global travelers, making it more challenging for those who frequently fly to Europe, South America, and beyond. Despite its efforts to become a global airline through the Hawaiian Airlines merger, Alaska is becoming increasingly insular, pushing away loyal travelers who rely on its partner network.

Reduced Partner Mileage Rates

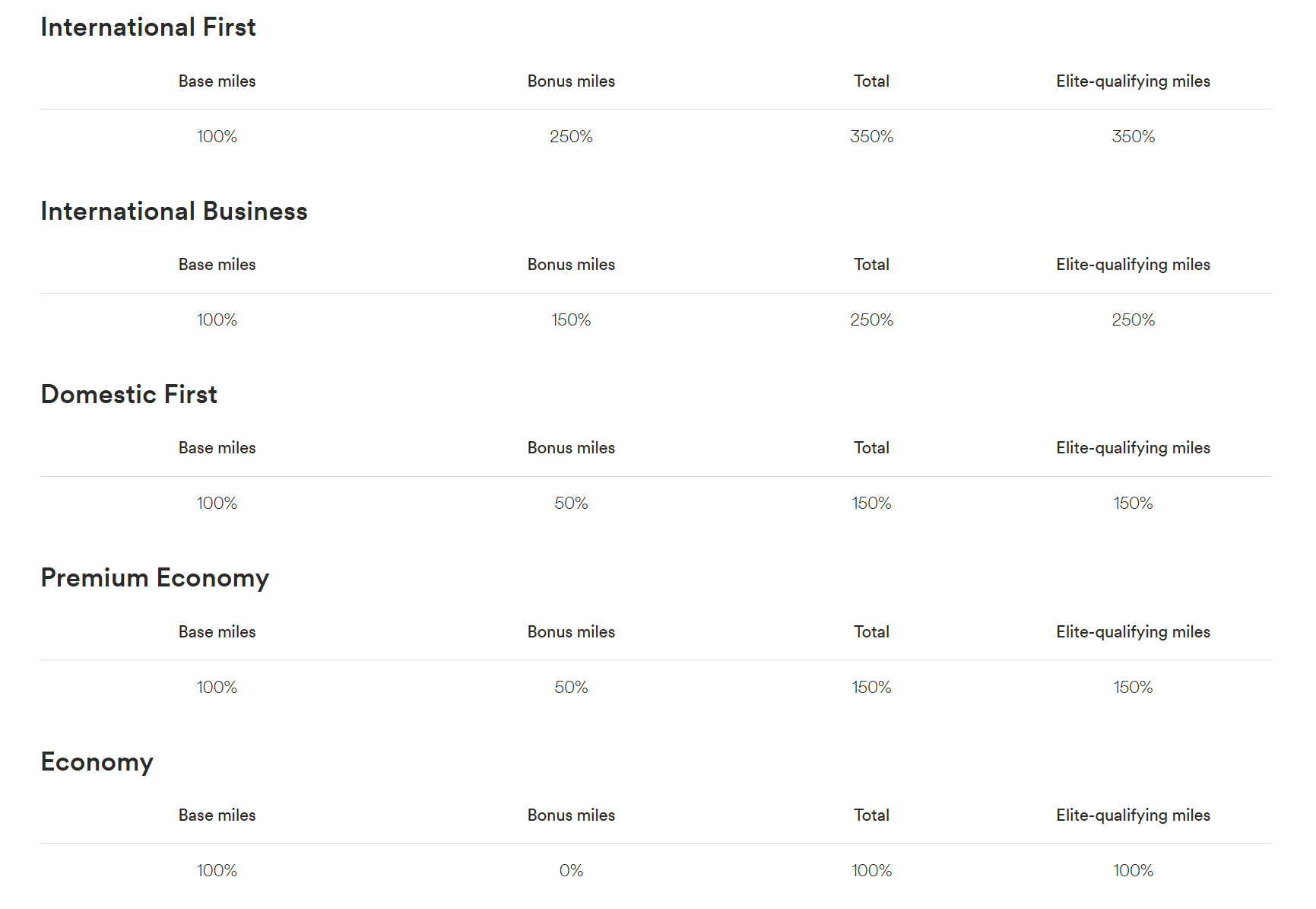

The revamped Mileage Plan program now requires and incentivizes travelers to book all flights—whether on Alaska or a partner airline—through Alaska’s website. If you book through Alaska’s channels, you can earn full mileage at a higher rate. However, if you book directly through a partner airline or any other platform, your mileage earnings are significantly reduced.

Alaska claims these changes simplify partner mileage accrual, but in reality, they introduce more complexity. Key information is scattered across multiple web pages, making it difficult for travelers to understand their earnings.

| Booked Via Alaska | Booked Elsewhere | |

| Intl’ First | 350% | 150% |

| Intl’ Business | 250% | 125% |

| Domestic First | 150% | – |

| Premium Economy | 150% | 100% |

| Economy | 100% | 50% |

| Discount Econ | 100% | 25% |

Booking via Alaska Airlines: Earns 100% of miles flown. Premium fares booked through Alaska Earn both more elite qualifying miles and redeemable miles.

Booking via a partner airline: Most economy fares earn only 25% of miles flown, as Alaska categorizes 90% of economy fare classes as “discount economy.” Curious to know what fare class your partner flight is considered? Check out this page

Alaska Doesn’t Sell Most Partner Flights

The mileage reduction wouldn’t be as problematic if Alaska Airlines actually sold a majority of its partner flights. However, Alaska lacks codeshares with many Oneworld partners and does not offer sales outside of the U.S. and select other countries. This limitation makes it difficult for global travelers to remain loyal to the airline.

Here are just a few examples of recent booking challenges:

- BUD-SEA: Only Aer Lingus is available; no access to British Airways, Finnair, Iberia, or American Airlines one-stop connections.

- FRA-SEA: Only Aer Lingus is offered, despite Condor flying the route daily.

- SEA-PPT: Available for booking, but not in reverse.

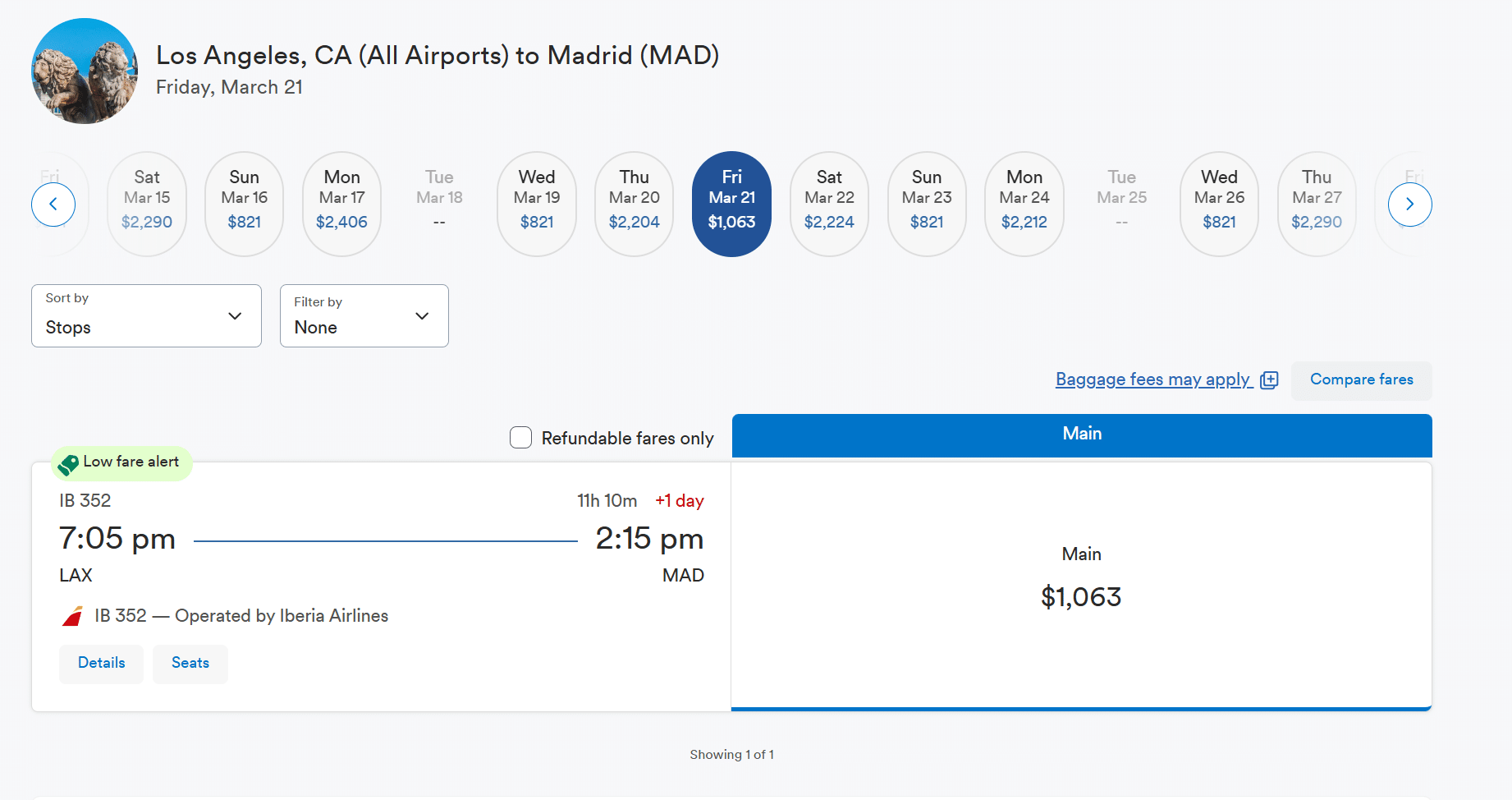

- LAX-MAD: Limited options—some days Iberia is available, others only Aer Lingus, and only in economy class.

LAX/SFO to HKG: No Cathay Pacific options, despite its direct route. Only Starlux and Japan Airlines appear.

- SEA-KEF: Only Icelandair is available, despite viable British Airways and Finnair connections.

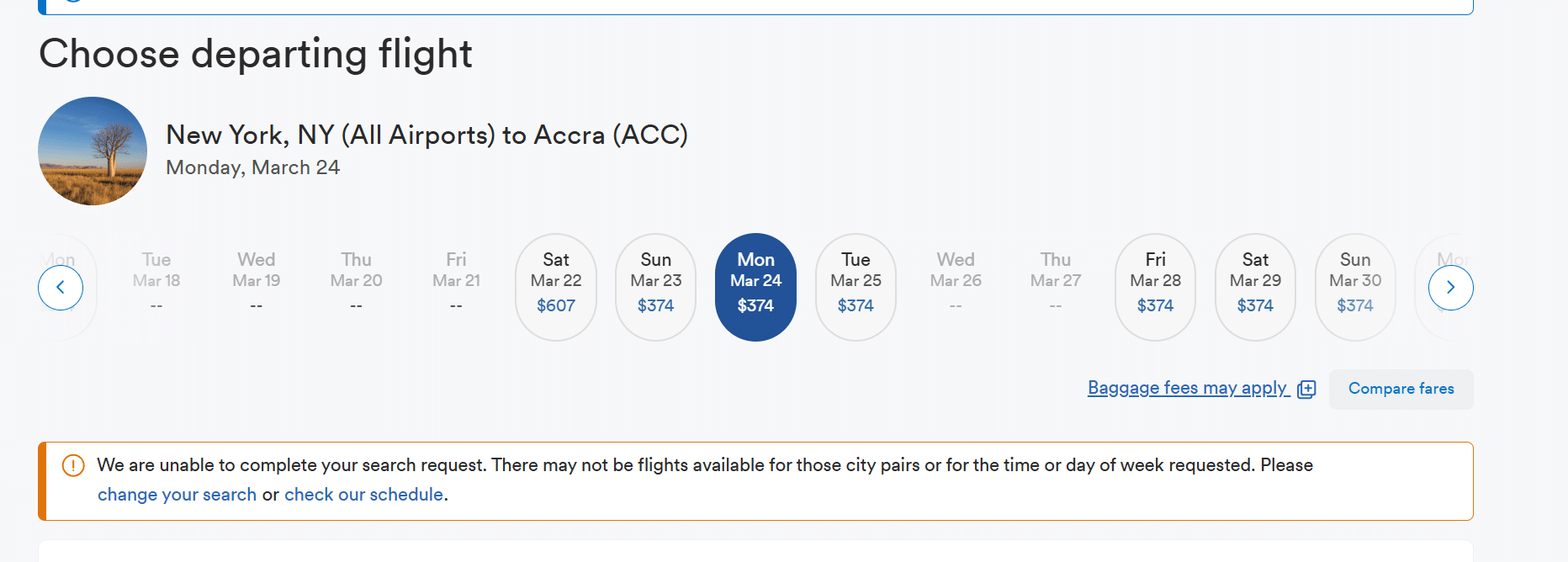

- USA to Africa: Purchasing codeshare tickets via European partners or Qatar Airways is nearly impossible. Even when a price is shown, it often errors out.

Intra-Europe, Asia, or Africa: Nearly impossible to book partner flights through Alaska or only 1 option which doesn’t even make sense.

Inflated Pricing & Corporate Traveler Impact

Even when flights are available, Alaska frequently inflates partner fares by 20-30%, sometimes even doubling the cost compared to booking directly with the partner airline. This makes it impractical for travelers to book through Alaska just for a marginal mileage boost.

Corporate travelers are also feeling the squeeze. Alaska’s new upgrade policy favors those booking through corporate travel portals, placing them ahead of leisure travelers on upgrade lists. However, corporate travelers are often required to book through third-party sites. If a traveler flies Seattle to Philadelphia on Alaska, then connects to Rome on American Airlines, they will earn significantly fewer miles on the PHL-FCO segment simply because it wasn’t booked through Alaska.

Bottom Line

As Alaska Airlines attempts to position itself as a global carrier following its Hawaiian Airlines acquisition, it is simultaneously alienating travelers who fly beyond the Western U.S. and Hawaii. Global alliances no longer hold the same value, and Alaska is actively diminishing its partnerships and frustrating frequent flyers in an attempt to drive sales to its own channels. However, Alaska’sIT infrastructure is not prepared for this shift, making it nearly impossible to book partner flights effectively.

Alaska Airlines has missed the mark, and its leadership—CEO Ben Minicucci and Vice President of Loyalty, Alliances, and Sales Brett Catlin—have made it clear that those who fly further are not a priority for the airline. Earning miles and status is now harder via Alaska Airlines.

LAX/SFO to HKG: No Cathay Pacific options, despite its direct route. Only Starlux and Japan Airlines appear.

LAX/SFO to HKG: No Cathay Pacific options, despite its direct route. Only Starlux and Japan Airlines appear. Intra-Europe, Asia, or Africa: Nearly impossible to book partner flights through Alaska or only 1 option which doesn’t even make sense.

Intra-Europe, Asia, or Africa: Nearly impossible to book partner flights through Alaska or only 1 option which doesn’t even make sense.