Yesterday, the US Department of Justice approved the merger of Alaska Airlines and Virgin America. Alaska has stated that no asset divestitures are required in order to proceed with merger activities, but the DOJ clearance includes, “limited reduction of code-share with American Airlines.”

Note: This post was originally published at 4AM PST on December 7. It was updated at 6PM PST on December 8 to add a bit more clarity on what the impact means on the mileage accrual process.

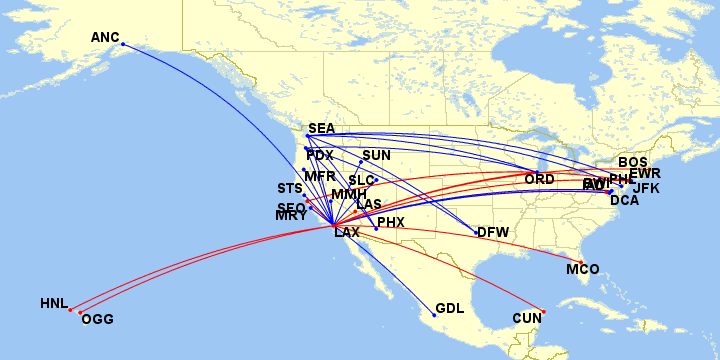

This may seem a bit unclear for travelers who may be impacted by this clause, especially if you live in an American Airlines hub (particularly on the Midwest or West Coast) or an Alaska Airlines hub and fly on routes that are served by both carriers (such as Portland to Chicago or Los Angeles Washington National (DCA) or Seattle to Phoenix). There are a lot more overlapping routes between the two carriers than may immediately come to mind.

Per a Security and Exchange Commission Filing from Alaska on December 6, there are, in total, 45 markets “where Alaska loses existing codeshare revenue,” and the net impact will be, “between $15 and 20 million.”

Breaking this figure down, Alaska sub-categorizes the overlapping routes to fall into 3 categories:

| Category | Rule |

|---|---|

| Routes flown by Alaska and/or Virgin as well as American (i.e. LAX to SEA) | AA and AS are not allowed to market each others' flights on non-stop overlap markets |

| Routes flown exclusively by Alaska and/or Virgin from American hubs (i.e. ORD to ANC) | AA cannot sell AS flights from AA hubs and vice versa |

| Routes flown by American between LAX and other American Airlines hubs (i.e. LAX to ORD) | AS cannot sell AA flights from LAX to AA's other hubs |

What are the Specific Routes that Will be Impacted?

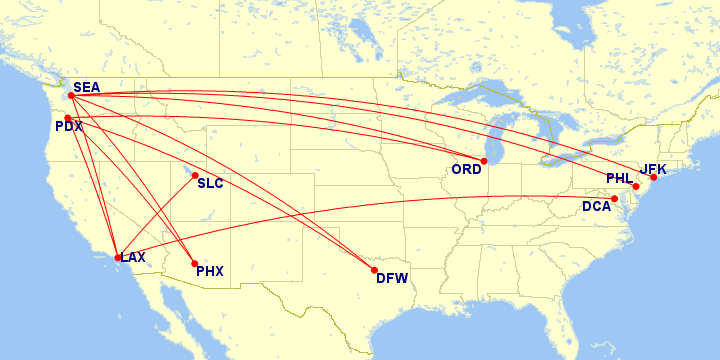

Digging into some data, I discovered that on a standalone basis, American and Alaska do not overlap on that many individual routes. The vast majority of them are hub-to-hub routes from one airline to the other, such as Seattle to Philadelphia. There are even fewer of them that code-share (for example, both American and Alaska operate to San Jose del Cabo from LAX, but do not pursue a reciprocal code-share). The list of “code-shared” flights on overlapping routes are listed below:

Code-share routes served by both Alaska Airlines and American Airlines (Dec. 2016):

- Chicago O’Hare to Portland

- Chicago O’Hare to Seattle

- Dallas/Ft. Worth to Portland

- Dallas/Ft. Worth to Seattle

- Los Angeles to Washington Reagan

- Los Angeles to Portland

- Los Angeles to Seattle

- Los Angeles to Salt Lake City

- New York JFK to Seattle

- Phoenix to Portland

- Phoenix to Seattle

- Philadelphia to Seattle

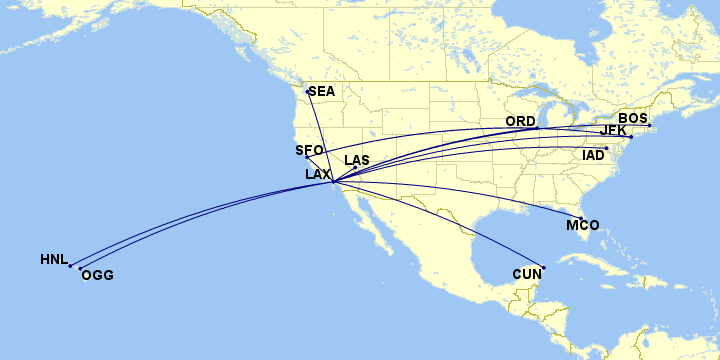

In fact, the real point of contention is the list of routes that Virgin America will bring to the network, particularly out of LAX, given that there are thirteen routes that Alaska will acquire from Virgin which overlap with American. Of these, eleven are from LAX and two are from SFO:

Los Angeles to

- Boston

- Cancun

- Chicago O’Hare

- Honolulu

- Kahului

- Las Vegas

- New York JFK

- Orlando

- San Francisco

- Seattle

- Washington Dulles

San Francisco to

- Chicago O’Hare

- New York JFK

To sum it all up, under the previous rules between American and Alaska, for the the exhaustive list of overlap markets, American and Alaska passengers could book on either carrier and earn frequent flier privileges on their preferred account. Alaska would earn code-share revenue on an American flight if it was booked as an Alaska-marketed flight. Under the new rules, Alaska will no longer earn code-share revenue in this manner because it will not be able to market the American-operated flight on it website or distribution system.

What about the Non-Overlap Markets?

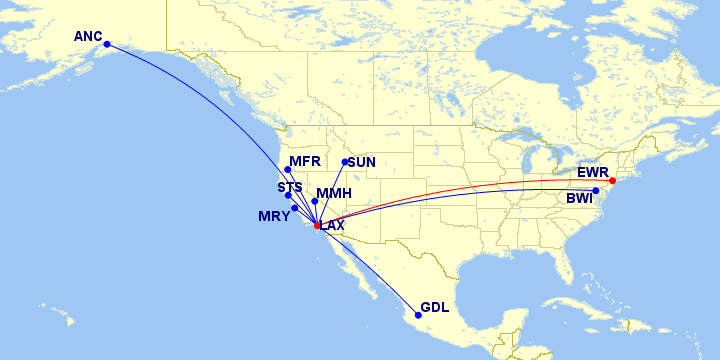

This is where it gets a bit more confusing, as Alaska states that there are, “9 markets operated by Alaska or Virgin from American’s hubs,” and “3 markets operated by AA between LAX and other hubs” that qualify as non-overlap markets, but will still be included as part of the code-share withdrawals.

For example, per the SEC statement, Alaska says that, “An AA customer who wanted to fly from Norfolk, VA to Seattle, could previously fly AA from ORF to DCA and then connect onto SEA on Alaska, and Alaska would earn code-share revenue on the DCA-SEA leg.” Now that AA will no longer be able to sell the DCA-SEA leg, Alaska will lose this code-share revenue. However, Alaska will still be able to sell this itinerary directly to customers, but the revenue portion would be split between American (on the ORF-DCA leg) and Alaska (on the DCA-SEA leg).

Narrowing down the list, the easiest place to start is to isolate the American Airlines hubs which have Alaska AND Virgin service. The list is as follows:

- Chicago O’Hare

- Dallas/Ft. Worth

- Los Angeles

- New York JFK

- New York La-Guardia

- Philadelphia

- Phoenix

- Washington Reagan

Then, we isolate the ones that have “non-overlap” flights between American and Alaska/Virgin and as it turns out, they are all out of Los Angeles. The first eight are operated on Alaska, while the final one (Newark) is offered in Virgin, which sums up to nine.

- Anchorage

- Baltimore,

- Guadalajara

- Medford

- Sun Valley

- Santa Rosa

- Mammoth Lakes

- Monterrey

- Newark

Finally, the last categorization involved 3 markets operated by AA between LAX and AA’s other hubs that were considered non-overlap.

This one is a bit more puzzling to me since American offers several flights between LAX and its other hubs, and carries the Alaska code on all of them (Charlotte, Chicago O’Hare, Dallas/Ft. Worth, Miami, New York JFK, Phoenix and Philadelphia). As an example, Alaska listed that a customer who wanted to fly from Santa Rosa, CA to Charlotte would previously be able to fly Alaska to LAX, then American to Charlotte, and Alaska earned passenger revenue on the first leg. Now, this itinerary would no longer be sold on Alaska, which means that Alaska can no longer earn the code-share revenue if purchased THROUGH Alaska, but if they did so on American, then Alaska would still be able to earn the code-share revenue on the first leg?

Clear as mud, right?

The “New” Code-share Rules, Bottom Line

All-in-all, this list may evolve over time (and may have some inaccuracies) but you can get a pretty good gist of how American and Alaska/Virgin have isolated the categories of their impacted code-share routes and how those will be changing. I fully expect that the airlines will do their due diligence in making it clear as to how the customers will see sales, marketing and frequent flier accruals evolve as part of the DOJ mandate.

My take on the whole situation? I think it is pretty stupid and will just lead to flier confusion. If we separate out the minutia detail, as I isolated above, the so-called, “fly-in-the-ointment” here was NOT the existing code-share agreements between Alaska and American, but rather the contributions that Virgin America would bring to the table once the merger consummated, barring any independent variables (such the rare possibilities of Alaska and American discontinuing their code-share or Alaska trimming Virgin America’s LAX hub).

However, one thing to remember is that this does not mean that the ability to earn reciprocal frequent flier miles on one airline, by flying the other airline, is going away. This simply means that the ability to sell each others’ flights, and earn the revenue from being able to do so, is becoming more limited in scope for each carrier.

Furthermore, Virgin America’s weekly operations out of LAX is roughly a quarter of what American currently offers. The vast majority of Virgin America’s cities offered from LAX are served on a 2-daily or less frequency schedule. If anything, the DOJ could have possibly been a bit more relaxed on the constraints and focused on certain markets from LAX (such as JFK, SFO and SEA) rather than apply a broad brush to include markets like LAX-CUN which is offered 4x per week on Virgin.

At any rate, Alaska seems to be content with the outcome of the merger terms and the divestitures. Personally speaking, I think they could have been more aggressive, but I’m also not a litigator. If you want to read more about the SEC Filing, click here.