The Choices program I talked about on Tuesday allows you to exchange redeemable miles for Premier Qualifying Miles (at a rate of 10 to 1…) but there are two credit cards that let you earn PQMs outright in addition to the normal redeemable miles. The catch? Neither card is offered anymore. Only existing cardholders are grandfathered in.

But sometimes people need a little reminding of the power they hold in their wallets, especially if you’ve been considering “upgrading” your card to one of the new replacements. Be careful. Converting an old, grandfathered card into a new card type is a one-way street, and you will never be able to get that old benefit again.

These two cards I’m talking about are the Presidential Plus card offered by the pre-merger Continental Airlines (now replaced with the MileagePlus Club card) and the Mileage Plus Select card offered by the pre-merger United Airlines (now replaced with the MileagePlus Explorer card). The Club card is decent as far as it goes. The Explorer card, in my opinion, is all the same stuff you get as a low-level Premier Silver member. Is that a good sign for the card, or a bad sign for Silver elites? Either way, it’s a bad sign for top-tier elites who get minimal benefits from the Explorer card. The Select card, however, continues to be valuable to me as a 1K.

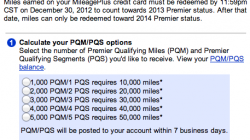

Up to 5,000 PQMs with Mileage Plus Select after $5,000 spend

These two cards provide Premier Qualifying Miles in different ways. The Select card is easy. For every dollar spent at United.com, you’ll earn 3 redeemable miles. You’ll also earn 1 PQM, up to a cap of 5,000 each year (for $5,000 spent). If you are a lower elite, that’s 20% of the way to Silver. If you are a 1K, that’s only 5%, but still nice when you reach the end of the year and maybe haven’t touched it yet.

I buy a lot of my flights with my Sapphire Preferred card, or sometimes a prepaid AmEx. Others like to use a Premier Rewards Gold card. Those are all good options because you can earn either 2.14 or 5 Ultimate Rewards points in the first two cases or 3 Membership Rewards points in the third case, and even though 2.14 is less than 3 United miles, they’re more flexible.

For this reason, I hadn’t really used my Mileage Plus Select card at all this year until I was booking tickets for Christmas and realized that, despite my mileage runs, I was still about 1,100 miles short of 1K. It turned out that even though our return leg on Swiss from the international portion of SMD4 was booked in Y, we would not be earning the 50% bonus PQM, just the normal 100%. My calculations were ruined.

I didn’t want to do any more mileage runs, and besides, I usually do a mileage run to earn 6,000 or 7,000 miles, not 1,000. Buying them through Premier Accelerator would cost at least $130. At that moment, I remembered my Select card and put the Christmas tickets on that instead. They were $1,300 for the pair, and since I was well under the 5,000 PQM annual cap, I knew I would quickly earn the remaining PQMs without any unnecessary expense.

[Update: I’ve heard that there’s also a bonus of 5,000 additional PQM when you spend $35,000. I’m not sure that’s worth it for me, but maybe for you. Call Chase to confirm since finding posted benefits on cards no longer offered can be tough.]

1,000 Flex PQMs with Presidential Plus after every $5,000 spend

The Presidential Plus card earned fewer miles than the current MileagePlus Club card that replaced it. Only 1 redeemable mile per dollar in contrast to 1.5 miles per dollar from the United Club. However, the Presidential Plus also earned 1,000 Flex PQM for every $5,000 spent. And you could use them whenever you wanted (hence the word “flex”). And there was no expiration. And there was no cap. In theory, you could build up a treasure trove and buy yourself elite status without flying.

[Bear with me. I was not a Continental customer before the merger, but this is my best understanding of how the card worked.]

The new United implemented some changes everyone just loved… Although people could still earn Flex PQMs and redeem them when they chose, they would expire after 39 months, and they were capped at only 5,000 per year ($25,000 in spend). Furthermore, they could not be redeemed toward 1K status. You could only achieve the Premier Platinum tier that normally requires 75K miles. [Update: I’ve heard that there’s no cap on the Flex PQMs you can earn, but they do expire and can only be used to reach Premier Platinum status.]

I can understand the last change, at least. This was a Continental product, and Continental’s OnePass program maxed out at Platinum. On the other hand, we’ve all noticed that upgrades for Platinum members have become more difficult now that there is a higher Premier 1K tier. Heck, it’s even become harder for some 1Ks. If you are a person who normally achieves top-tier status, or if that’s just your goal, then the major benefit of the Presidential Platinum card just became useless. If you only want access to the United Club, you could do that with a MileagePlus Club credit card instead and earn more redeemable miles, too.

But for those who are satisfied with Platinum or could never reach Premier 1K, then these 5,000 PQMs each year are still nice. And you can at least build them up over a year or two to use them all at once. Combined with the Select card, you could even earn enough to redeem for Premier Silver status once every four years!

What if you redeem some Flex PQMs while you’re still under the 75K limit, but then earn more PQMs through travel that put you at a total of 100K? Is this a workaround to get Premier 1K anyway? The answer seems to be “no.” If you want Premier 1K status, you need to earn 100K PQMs excluding the Flex PQMs you redeemed earlier. They will not be returned to your account, so redeem them wisely and only when you’re certain you’ll need them.

Conclusion

People who hold a Presidential Plus card probably have already researched this decision and figured out if it makes more sense to keep it or switch to a MileagePlus Club card. But those who have the Select card might sometimes forget. I do. I’m very loyal to it, and it was the first travel rewards card I ever applied for. But new products since that time have replaced it in my wallet. All I’m saying is, don’t close it, and don’t forget to bring it out in those desperate times when you’re one breath short of the finish line.