United Choices is a program to give you ways to redeem your United miles for other, more valuable benefits. Not necessarily at a good rate of return, but still things that are more valuable and especially to those who have more miles than what they know what to do with. I’m really not sure if this is the correct name for the program, but United Choices is as good as anything since that’s the URL address where you can learn more about the different options.

The one catch is that you can only redeem miles earned through spend on a co-branded United credit card. You also have to have the miles in your MileagePlus account. But… (and this is an important “but”) it doesn’t matter if you cash out your MileagePlus account and then build it back. The tally of miles earned through United credit card spend remains.

What it basically says is, you’ve earned 50,000 (or whatever) miles through credit card spend. You may use 50,000 of the miles in your MileagePlus account toward this program. If you don’t have those miles, you obviously can’t spend them. If you have many more, you are still capped at 50,000.

But let’s say you have 50,000 earned through a United credit card and have 100,000 total in your Mileage Plus account because you earned some more through travel. Then you redeem all 100,000 for some award flights. Then you earn another 50,000 back through travel. Your Choices balance remains intact, and you can now use them again. It isn’t until you spend your miles through the Choices program that the balance ever decreases. It’s sort of an invisible accounting system with a vague resemblance to the Flight Points balance in the Citi ThankYou Rewards program.

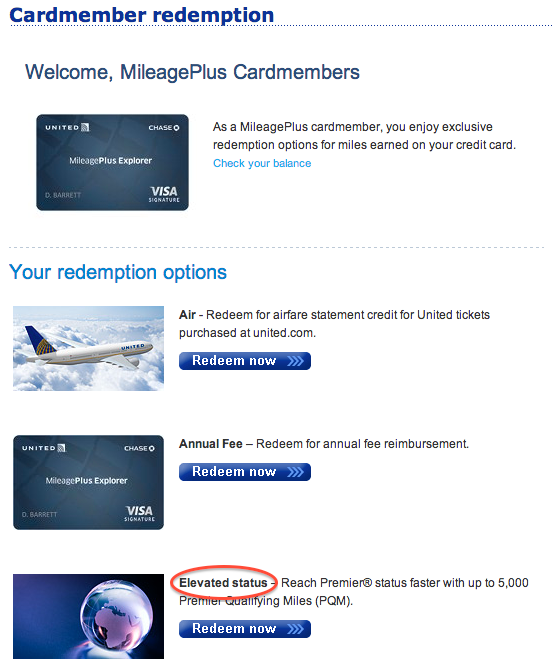

You can use your miles earned through the Choices program to pay for three things: a credit toward the cost of United revenue flights, a credit toward your credit card’s annual fee, or a conversion into Premier Qualifying Miles (basically a credit toward the cost of buying them).

A credit toward the cost of revenue flights works just like using ThankYou points or Ultimate Rewards points to pay for a ticket through the Chase or Citi travel agencies. The flights will still earn redeemable and elite qualifying miles. But since it’s a United program, you’ll only be able to redeem for United flights. Frankly, I think this is a bad deal unless its a really cheap flight that doesn’t have award space. Usually you can expect about 1 cent per mile. A good award redemption can range from 2 to 10 cents per mile. As for a credit toward the credit card’s annual fee, check back later today when I explain that in more detail.

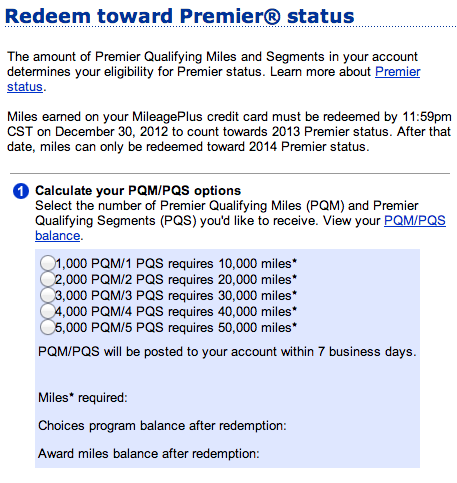

The real value to some people is the opportunity to exchange their redeemable miles through the Choices program for Premier Qualifying Miles. If you have lots of RDM and not a lot of spare cash, this may make more sense than the Premier Accelerator program I described yesterday. The catch is you can only buy up to 5,000 PQM. Premier Accelerator has no cap but charges very high prices.

A few people confuse the Choices program with Flex EQMs from the old Presidential Plus credit card. This was Continental’s version of the United MileagePlus Club Visa before the merger and offered the chance to accrue elite qualifying miles that could be redeemed when you knew you would fall short.

People who already have this card have been grandfathered in, but new people cannot apply. And although they have been grandfathered, Flex EQMs cannot be used to earn Premier 1K status. They can only be used to earn up to 75,000 elite qualifying miles per year, the threshold for Premier Platinum. There is no restriction on using the Choices program to earn Premier 1K, and it is offered to all United credit card holders. This is why Choices is potentially more valuable, but you could combine it with Flex EQMs if you have that option and only want Platinum status.

Don’t forget that several United credit cards earn multiple miles per dollar spent. It isn’t like you need some huge amount of spend to earn enough to use the Choices program. The United Club card earns 2 miles on United purchases and 1.5 miles for every dollar on everything else. The United Select (another card no longer offered, but grandfathered for some) earns 3 miles for every dollar on United purchases. The United Explorer card earns 2 miles per dollar on United purchases. I have 40,000 miles in the Choices program, and I’m really not a heavy spender with either of my two United credit cards.

The cost is 10,000 redeemable miles for every 1,000 Premier Qualifying Miles, with a cap of 50K for 5K. That sounds like a horrible ratio, even though redeemable miles are easy to get. If you value your miles at 2 cents each, it’s just like paying 20 cents per mile, which is comparable to Premier Accelerator. But it works for some people.

Think of it as the bonus for spending $33,334 on a United Club Visa, although you won’t have any miles left after redeeming them. Yes, that’s a lot of money. Hilton wants you to spend $40,000 a year on their cards to earn Diamond status, and this is only getting you 5% of the way toward top-tier status on United. But those of you who specialize in racking up spend on credit cards may find a way to make this work. If you have a lot of reimbursable United travel and have a United Select card to pay for it, then it’s only $16,667 of spend.

Sadly, I don’t see the new United offering many new credit cards that come close to the benefits they used to provide. I am glad at least that the Choices program remains an option for those who hold both new and old United credit cards.