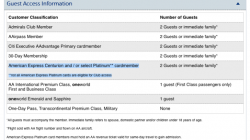

I noticed on the American Airlines Admirals Club page that the Citi Prestige card now get Admirals Club access for the card holder as well as 2 guests. Per the page, the rules regarding access:

Citi Prestige Card holder must present a stand-by ticket or boarding pass (other than a non-revenue ticket or boarding pass for airline employee travel), showing an American, American Eagle Airlines, Inc., or an American Connection carrier flight number, valid for travel on such flight and departing within 12 hours of the Admirals Club visit (or, in the case of a visit at an arrival airport, with respect to such a flight that arrived no more than 12 hours prior to the visit.)

This is similar to the previous American Express Platinum access rules, which ended over the weekend (in fact, the URL still has “#amex” on it, and I was curious how fast American would change their website). However, any mention of US Airways lounges and flights is left out, which is rather odd considering the whole merger thing.

The current most popular way to gain lounge access is to apply for the Citi Executive AAdvantage card, which has a 100,000-mile bonus after spending $10,000 in 3 months and is churnable. While that card’s fee is $450, a $200 statement credit makes it a $250 fee for the first year. It provides Admirals Club and US Airways Club access for the primary cardholder only, and you don’t need to be flying American or US Airways the same day.

So is the Citi Prestige card worth an application? We don’t have a link, but the best offer I could find has a 30,000 Thank You Point bonus after spending $2,000 in 90 days (let us know if you know of a better offer — Citi often has better signup bonuses in branch, but I don’t have a Citi branch near me right now). The card has a $450 fee, which is the same as the Citi Executive card. Some details:

- $450 annual fee (not waived first year) – if you are a CitiGold checking account holder, you may be able to pay only $350 for this card.

- $200 annual airline fee credit – this is similar to the American Express Platinum credit, but Citi’s terms specifically say that the charges must be $100 or less. You could potentially buy a cheap airline ticket or $100 gift cards. While it’s the same monetary value as the Executive $200 statement credit, it’s harder to take advantage of. However, you do get a credit each year, unlike the Citi Executive card.

- $100 Global Entry fee waiver – not only would you have access to the Global Entry program, but you would get Pre-Check as well. I’ve had several experiences with Global Entry this year and love being able to get through immigration and customs within 5 minutes, even if everyone else has a long line.

- Authorized users cost $50 each – this potentially means that you could add family members to your account so that they could receive American Airlines club access. I reached out to AA (both on twitter and through e-mail) and so far, I only received a response from the twitter agents that the lounge benefit is meant for Citi Prestige primary cardholders. I can’t see any written T&C of that anywhere, nor can I figure out how they’ll figure out who is a primary cardholder and who’s an authorized cardholder.

- Flight points – if you use your Citi Prestige card to book flights (with cash), you earn flight points equal to the number of miles you flew on your trips. Once you spend an equivalent amount on your Citi Prestige card, those flight points get converted to Thank You Points, so you could easily double the rewards earned per dollar.

- 33% bonus when using points for airline tickets and 60% bonus when using points for American/US Airways flights – the Premier card recently dropped their bonus from 33% to 25%, so a $400 ticket now costs 32,000 Thank You points with the Premier instead of 30,076 Thank You Points with the Prestige. But if you hold the Prestige and are booking on American or US Airways, you’d only need 25,000 Thank You Points. If you have a large stash of Thank You points and book a lot of American or US Airways flights, this could be a great points-saving benefit.

- 2 points per dollar on dining – this is the only bonus category on the card, which matches the Chase Sapphire Preferred at 2.14x. However, the Citi Thank You Preferred card earns 3x points and the old Citi Forward card that doesn’t take signups earn 5x points on dining.

- Annual economy class companion ticket – this is good for any domestic or international ticket booked through Spirit Incentives. You still have to pay taxes, fees, and potentially fuel surcharges on the 2nd ticket, but it can be a benefit that pays off the annual fee if you use it correctly. While it’s not for business/first class, I think it’s something more people might be able to use. The major restriction is that the airfare you book has to be on the cheapest airline possible for that route, so you can’t selectively book it for an airline where you earn miles or can use systemwide upgrades.

- No foreign transaction fees

I think this is a great added benefit for existing Citi Prestige cardholders, but I think that if you’re looking for a card that has American Airlines lounge access, the Citi Executive American Airlines card has a better signup bonus and similar first year cost. Since it’s churnable, I’m saving my Citi credit card applications for that card.

I’ll also point out that this FlyerTalk thread mentioned the new access rules pretty early, and as such, has a bit of discussion already on it.