The time could not come sooner for American Airlines to phase in its reconfigured Boeing 777-200ER variants into long-haul service, and fortunately, a launch date has been officially set for June 12, 2014. According to Lucky at Boarding Area, the inaugural flight will be AA 0945/0940 from Dallas/Ft. Worth to Santiago de Chile International airport (SCL).

A route such as DFW to SCL is a prime example of a long-haul American Airlines flight that merits a 2-cabin configuration on one of its 777s, but not the 3-class cabin variant.

Market conditions have eroded the need for AA to offer a true First Class on the 772s

Since entering the American Airlines fleet in 1999, the AA 777-200s have featured 16 First Class seats, 37 business class seats, and 194 economy class seats.

However, undoubtedly, the economics of commercial aviation has transformed into a completely different operating model since then. In today’s environment, American has found itself at a major disadvantage by offering as many premium cabin seats on its second-largest widebody aircraft as it currently does. The reduction in global premium travel has decreased the need to offer two distinguished premium cabins on as many long-haul routes as in the past. Instead, the approach has taken on a new focus: offer a truly premium business class product, with elements of First, and also offer a premium economy class cabin with some elements of business class.

Continental was the first carrier to adopt the BusinessFirst-style approach, by hybridizing their First and Business class cabin into one model, and United was the first to offer an enhanced Economy class product via EconomyPlus, with 4 inches of extra legroom. Both of these approaches have produced wildly successful results with favorable consumer uptake, and much more adequately reflect the needs of today’s marketplace.

Approximately 7.7% of American’s international seats on offer, for the current week, are in a First Class cabin (according to CAPA). This figure is higher than that of Delta (5.8%), United (5.5%) and US Airways (5.1%). The gap between American and its peers may also be even wider given that CAPA’s numerical data includes First Class seats offered on the narrow and widebody fleets of these four carriers. Moreover, US Airways and Delta do not offer a First Class product on long-haul, widebody flights to Europe, Asia, Latin America and Oceania.

It’s also important to note that American’s 7.7% figure is relatively high given its smaller size compared to Delta and United, which both merged with larger competitors Northwest Airlines and Continental, respectively, over the past six years.

The re-vamped 777s will vastly improve the economics on some long-haul routes

American currently operates 47 777-200ERs across its entire fleet, with no further aircraft ordered for future delivery. Within the context of its ongoing fleet replacement efforts, specifically receiving more 777-300ER variants and retiring its 767-300 aircraft, as well as receiving Airbus A330-200/300 series frames from its merger with US Airways, the 2-cabin 777-200 will be ripe for upgrading existing routes, opening up new routes, or improving the economics of existing routes.

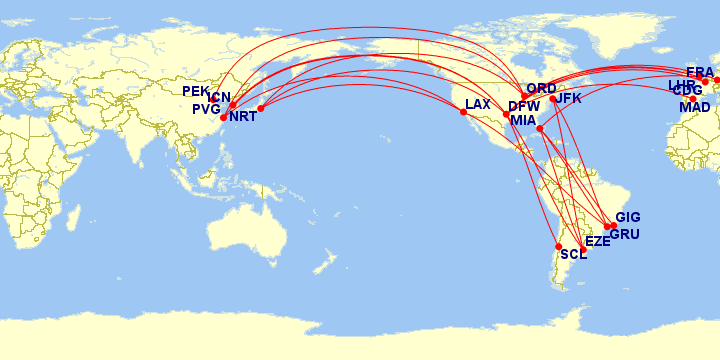

Currently, American’s 777s are deployed on all of its transpacific routes to Asia (Dallas/Ft. Worth to Tokyo Narita, Seoul Incheon and eventually Shanghai, Chicago O’Hare to Tokyo Narita, Shanghai and Beijing, and Los Angeles to Tokyo Narita and Shanghai). American will operate its first transpacific route with a non-777-200ER when it launches Dallas/Ft. Worth to Hong Kong this summer, utilizing its newest 777-300ER aircraft.

To Latin America, American sends the 777-200ER to select markets in the deep Southern Cone (Dallas/Ft. Worth to Buenos Aires and Santiago, Los Angeles to Sao Paulo, Miami to Buenos Aires, Sao Paulo and seasonally to Rio de Janiero, and from New York JFK to Buenos Aires and Sao Paulo).

Across the Atlantic, American utilizes the 777 primarily to London Heathrow on a year-round basis, and to other markets on a summer-seasonal basis (Dallas/Ft. Worth to London, Frankfurt, Paris and Madrid, Chicago to London and Miami to London).

American 777-200ER routes, seasonal and year-round

A fair number of American’s current 777 routes are in desperate need of the elimination of First Class, in particular, non-Tokyo routes in Asia as well as non-London routes in Europe. American’s new routes from Dallas/Ft. Worth to Seoul and Shanghai will have a much easier time reaching maturity with a higher-density aircraft than one with the former layout.

Interestingly, American chose to send the first new 777 to Santiago, a route that performs well for the carrier largely due to cargo contracts. Notably, DFW-SCL was the last route on which American operated its MD-11s until they were retired in October 2001, before replacing it with a 767-300ER up until recently. The substitution of the new 2-class layout, even despite the fact that June is the start of the slower summer winter season in South America, is an indication that the Dallas – Santiago route merits a larger-gauge aircraft on a year-round, likely for freight purposes, but was previously unviable using a 777-200ER with the 3-cabin layout.

Two cabin planes may enable American to up-gauge or re-enter certain routes

The 2-cabin 777s may also permit American to up-gauge certain routes utilizing the 767, such as a few routes from New York or Miami to deep South America, New York or Miami to Europe, or even on a few pre-merger US Airways transatlantic routes from Charlotte or Philadelphia to Europe and possibly Asia. Having recently exited the New York – Tokyo nonstop market, American could possibly plug in the gap in the Northeast/mid-Atlantic by adding a nonstop Philadelphia to Tokyo route on a 2-class bird, capturing good connections from the Eastern seaboard.

Additionally, it may allow American to explore routes that were previously unviable under a 3-class 777 configuration, but work well for a 2-class combination on a Boeing. It’s plausible that American may re-consider some of its former routes to the BRIC countries, namely Moscow and Delhi, or possibly add new service to large, ethnic or emerging markets such as Israel, or Nigeria. Further expansion to Asian markets, especially interior China (if it materializes) will likely be better contenders for the 787, but either way, the changes ahead will deliver strong dividends to American’s bottom line, from a product, revenue and cost perspective.