In October, there was speculation that the American Express Platinum card would lose its partnership with American Airlines for Admirals Club access. For some reason, American Airlines wasn’t showing up as a partner on certain areas of the American Express website.

Turns out that speculation was true, albeit a bit premature. Many American Express Platinum card members just received e-mails that we will be losing access privileges for not just the American Airlines Admirals Clubs, but also the US Airways Clubs on March 22, 2014.

Drastically affects value of American Express Platinum Card

This is a pretty big blow to the value of the Platinum Card. I just became Executive Platinum on American and planned to keep my American Express Platinum solely for lounge access at American Airlines clubs (and US Airways clubs that stick around).

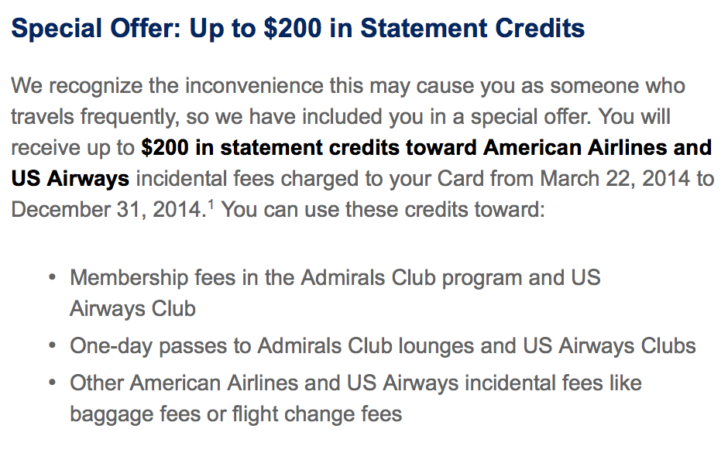

In lieu of lounge access, American Express is offering anywhere from $200 to $500 in statement credits on American Airlines and/or US Airways from March 22, 2014 until the end of the year (in addition to the usual $200 airline fee credit). My e-mail offered me $200:

I got my American Express Platinum card during the 100,000-point bonus early in January 2013, so my $450 fee is due around the middle of January 2014. American Express pro-rates annual fees, so I’m guessing I would have to pay 3 months of fee in order to make it to the time period where I could purchase $200 in American Airlines gift cards. Three months of the fee is about $113, which makes sense to pay if I get the $200 credits instantly. From there, I’ll have to decide what to do about the American Express Platinum card and about lounge access.

The card still gets access to Delta Sky Clubs but I’m trying to slowly wean myself off Delta. In addition, you’d still get Priority Pass Select membership which currently has US Airways Club access, though I wouldn’t be surprised if US Airways excludes Priority Pass Select members from free access just as the new United Clubs have.

The only reason to keep the American Express Platinum card would be for Centurion Lounge access, which is currently in Las Vegas and Dallas/Fort Worth airports, with locations coming to San Francisco and New York-LaGuardia. Unfortunately, none of these are airports where I transit on most trips (weird, with 40,000 American Airlines domestic flight miles in the past 3 months, I transited DFW just once).

I just can’t justify paying a net $250/year ($450 fee minus the usual $200 airline fee credit) for SkyClub access when flying Delta and maybe transiting through airports with Centurion Lounges.

Affects Value of Citi Executive AAdvantage Mastercard

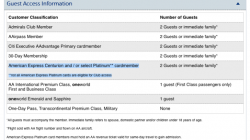

Even though I’ve started flying American Airlines, I never considered getting the Citi Executive AAdvantage Mastercard because of its $450 fee, most of it going toward Admirals Club access which I had with the American Express Platinum Card. However, this would be the only credit card to have Admirals Club access come spring 2014.

The regular affiliate channels currently have a 30,000-mile bonus, but there is a public 60,000-mile bonus for spending $5,000 in 3 months. This 60,000-mile bonus sure takes the sting out of a $450 fee that is not waived for the first year.

The card also comes with the opportunity to spend $40,000 in a calendar year to get 10,000 Elite Qualifying Miles. While stingier than Delta and US Airways’ spending threshold for elite miles, it’s still worth considering if I have the card. Spending the $40,000 on a 2% cash back card like the Barclay Arrival would net $800-$880 in cash back, which could then be used for an extra trip somewhere that earns Elite Qualifying Miles (as well as Redeemable Miles). Spending $40,000 on the Citi would net you 40,000 redeemable miles + 10,000 elite miles.

One drawback of the Citi Executive Mastercard is that it doesn’t include my favorite benefit of the regular Citi AAdvantage cards — the 10% return on miles redeemed (up to 10,000 miles back per year). That means you’d have to carry both cards to be able to get all the benefits.

On the other hand, the Barclay US Airways Mastercard adds 10,000 Preferred Qualifying Miles to your account when you hit $25,000 in spending in a calendar year (the terms explicitly state that these elite miles are not redeemable miles). This is a much more agreeable threshold to me, and US Airways elite miles will likely combine with American Airlines elite miles at the end of 2014 …. which reminds me, I need to get this card again before it goes away.

Consider Buying Admirals Club Membership

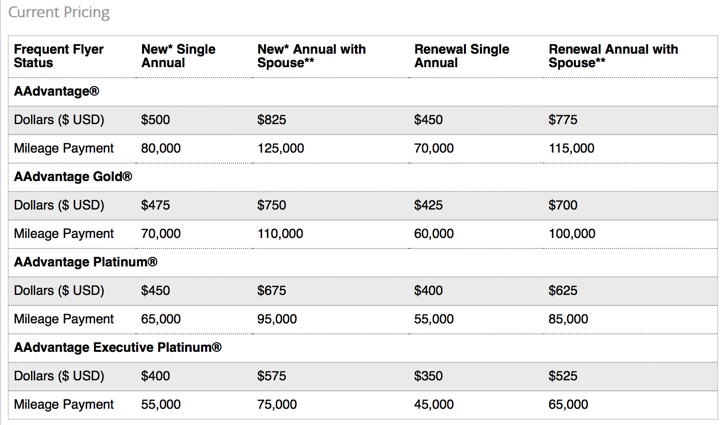

Buying an Admirals Club membership starts at $450/year for general members, $425/year for AAdvantage Gold, $400/year for AAdvantage Platinum, and $350/year for Executive Platinums. There is a $50 initiation fee the first year, so the first year would cost anywhere from $400-$500. There are mileage payment options, but they are generally horrible (much lower than 1 cent per mile value).

One downside to the Citi Executive AAdvantage card is that you cannot add authorized users who in turn get Admirals Club privileges. Before I had my own American Express Platinum, I was the authorized user on one that still got me lounge access. It cost an additional $175 for 3 additional users, but it was worth it in my opinion.

However, if you’re an Executive Platinum who also wants your spouse to also have access when they’re not with you, it would be an additional $175 on the membership as well.

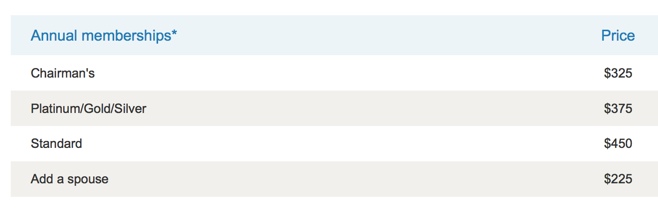

I’m curious to see when US Airways Club members will get reciprocal lounge access at Admirals Clubs, because US Airways charges less for their club memberships for certain status levels.

These prices don’t include the $50 initiation fee. An Executive Platinum has to pay $400 for a new membership, while a US Chairman pays $375. However, the savings are washed away if you want to add a spouse. General members pay the same amount initially, but adding a spouse is cheaper on US Airways.

In general, I’m steering away from this option to buy Admirals Club membership, but that may change in the future.

Move to Canada?

I say this tongue heavily in cheek, just because many frequent flyer devaluations have spurred “mass relocation to Canada” (like the Premier/Medallion Qualifying Dollar exemptions for non-US residents).

Many American Express Platinum cards abroad, including those in Canada and the UK, offer Cathay Pacific’s Marco Polo Gold membership. This is OneWorld Sapphire and would get you access to Admirals Clubs on domestic US itineraries. Unfortunately, the benefit is only for primary cardholders, so I can’t ask a random Canadian to add me as an authorized user.

As for getting a foreign OneWorld Sapphire membership, it’s tougher than “lifetime” Star Gold with Aegean. You’d likely save money by just buying a club membership than mileage running for miles on OneWorld partners to get lounge access.

In short … a big loss.

The value of the American Express Platinum Card will be drastically reduced come March 22nd, and the alternative options just don’t seem that enticing to me. The $200 statement credit ($500 for some) may be a quick stop-gap measure, but the card surely isn’t worth $450/year if lounge access capabilities are severely reduced. That said, I have some faith in American Express that they will figure something out to make up for this loss.