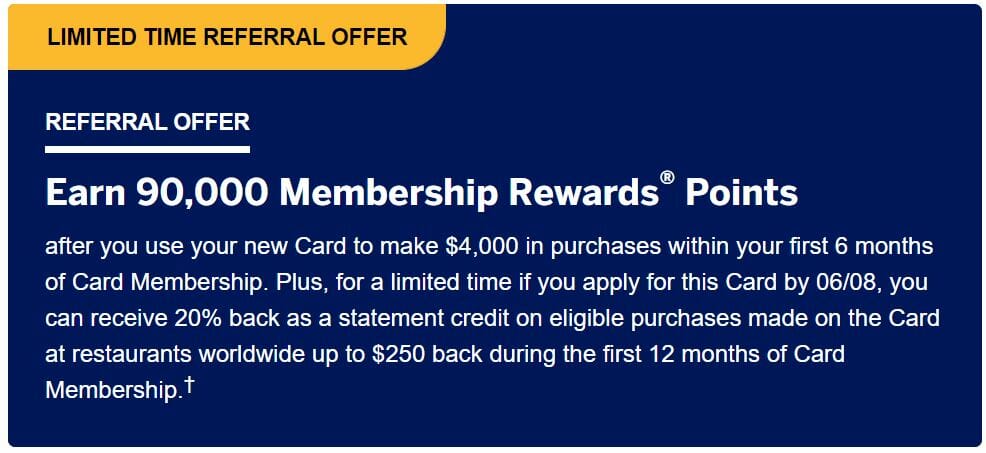

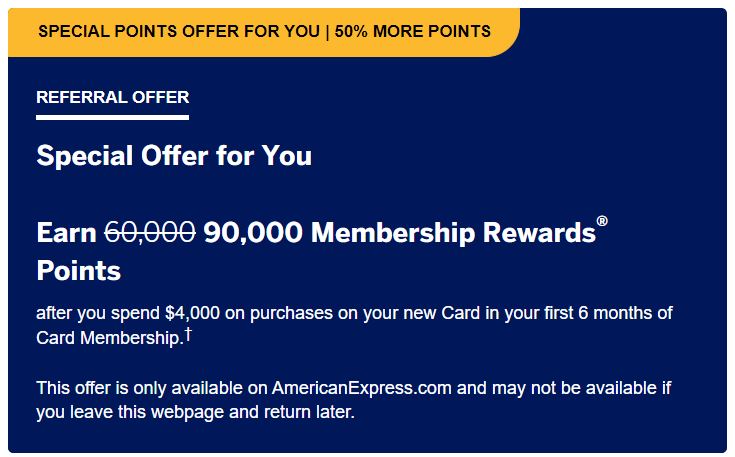

The American Express Gold card is my go to card for spending at restaurants and grocery stores. This happens to be where I spend the majority of my cash, travel aside. This card has quickly became a staple in my wallet and now it can be in your wallet too, with a limited time bonus of $90,000 membership rewards points after spending just $4,000 over 6 months! This limited time bonus is 30,000 more points than the typical sign up bonus and is only available for a limited time.

The Amex Gold card does have a $250 annual fee, yet between the bonus points and and annual credits, this can easily be offset. There’s $240 in annual credits between the dining and uber monthly credits. Plus, this card earns points fast! Utilized them to transfer to over 15 airline and hotel partners. Your next hotel stay or business class award flight can be free.

Earn Membership Reward Points Fast

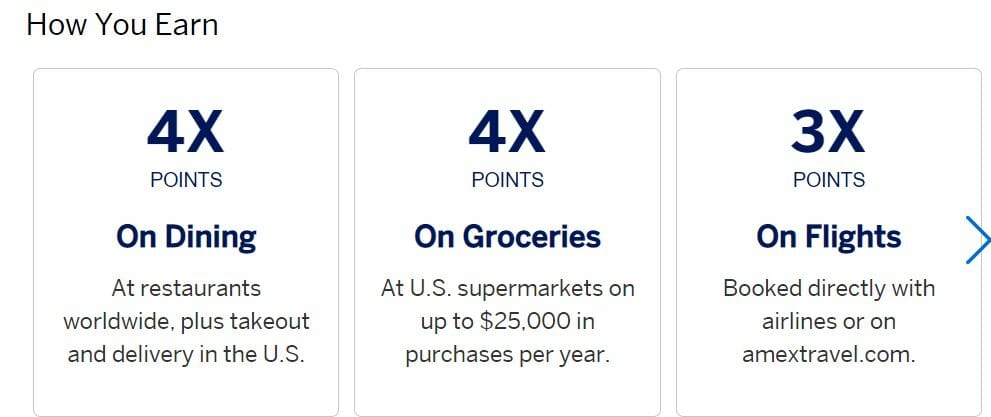

The American Express Gold Card offers a generous rewards program, allowing cardholders to earn 4 Membership Rewards points for every dollar spent at restaurants worldwide. The gold card offers one of the highest bonuses in the industry for restaurant spend. Do note that bars and clubs do not count towards restaurant spend.

In addition, earn 4 Membership Rewards points per dollar spent at U.S. supermarkets. Each year, you can earn up to 100,000 Membership Rewards points by going grocery story shopping. After you spend $25,000 per calendar year, then 1 point per dollar is continued to be earned at grocery store. Grocery stores are not only great for food shopping, but purchasing gift cards. Think, earn 4 points per dollar on Amazon, but buying amazon gift cards at grocery stores. Target, Walmart, Auto zone, the list goes on! You can utilize the purchase of gift cards at grocery stores to maximize your earning potential.

Apply for your amex gold card here.

Finally, cardholders can earn 3 Membership Rewards points per dollar spent on flights booked directly with airlines or on amextravel.com. This is a fantastic value. I personally use my American Express Platinum for air travel, earning 5 points per dollar. Yet with the lower annual fee, 3x points is great earn rate.

Additional Card benefits & Credits

The Gold card comes with a slew of credits and benefits. These include a dining credit, uber credit, and a ton of American Express standard benefits such as purchase protections and more.

Each month, you can each a $10 dining credit. $120 value for the year. Just spend $10 or more at Grubhub, The Cheesecake Factory, Goldbelly, Wine.com, Milk Bar and select Shake Shack locations and a $10 statement credit is automatically applied.

Like the $10 monthly dining credit, there’s a similar credit for Uber. Enjoy up to $120 in Uber Cash annually with your Gold Card. Just add your gold card to your Uber account and you’ll automatically get $10 in Uber Cash credit each month. This credit can be utilized for Uber Eats orders or Uber rides in the U.S. Just be sure to use it each month as credits do not roll over.

I also love this card because it opens up access to the American Express Fine Hotels & Resorts program. the FHR program offers exclusive benefits at over 1,000 luxury hotels worldwide. These benefits includes early check-in, late check-out, $100 resort credit, and more. This program is very similar to Hyatt Prive, but only available to American Express Card holders.

Finally, the card comes with a ton of other benefits which are common with American Express cards. Such as travel insurance, exclusive Amex offers, rental car CDW insurance, the hotel collection, and most importantly zero foreign transaction fees.

Membership Reward Transfer Partners

Why does 90,000 points matter? Not only can you redeem them for cash value towards an award, but better yet you can transfer them directly to several airline partners. See the chart below for hotel and airline transfer rates. Most airlines transfer at a 1:1 rate and are instant.

| Amex Airline Transfer Partner | Min Transfer | Transfer Ratio (Amex > Partner) |

Transfer Time |

|---|---|---|---|

| AeroMexico | 1,000 | 1:1.6 (KM not MI) | Almost instant |

| Air Canada | 1,000 | 1:1 | Almost Instant |

| Alitalia | 1,000 | 1:1 | Almost Instant |

| Aer Lingus | 1,000 | 1:1 | Almost Instant |

| ANA | 1,000 | 1:1 | 3 days |

| Avianca LifeMiles | 1,000 | 1:1 | Almost instant |

| British Airways | 1,000 | 1:1 | Almost Instant |

| Cathay Pacific | 1,000 | 1:1 | Up to 1 Week |

| Delta Air Lines | 1,000 | 1:1 | Almost Instant |

| Emirates | 1,000 | 1:1 | Almost Instant |

| Etihad Airways | 1,000 | 1:1 | Almost Instant |

| Flying Blue Air France/KLM | 1,000 | 1:1 | Almost Instant |

| Hawaiian | 1,000 | 1:1 | Almost Instant |

| Iberia | 1,000 | 1:1 | 1-3 days |

| JetBlue | 250 | 1:0.8 | Almost Instant |

| Qantas | 500 | 1:1 | Almost Instant |

| Singapore Airlines | 1,000 | 1:1 | 1-2 days |

| Virgin Atlantic | 1,000 | 1:1 | 1-2 days |

Hotel transfer partners are below

| Amex Hotel Transfer Partner | Min Transfer | Transfer Ratio (Amex > Partner) |

Transfer Time |

|---|---|---|---|

| Choice Privileges | 1,000 | 1:1 | Almost Instant |

| Hilton Honors | 1,000 | 1:2 | Almost Instant |

| Marriott Bonvoy | 1,000 | 1:1 | Almost Instant |

90,000 points can be utilized for multiple nights at hotels. Save on your dream vacation by NOT paying for your hotel. Or utilize these points for a business class ticket. With these points you can travel further, for less!

Bottom Line

The American Express Gold Card offers a variety of rewards and benefits, including dining, travel and shopping benefits, that can be very valuable for those who dine out frequently and travel often. However, the annual fee of $250 should be considered before applying for the card. If you can find value in credits, then this card is for you. There’s few cards that earn more than 2 points at supermarkets and restaurants, and this is one of my favorite.