A year ago, I was on a mileage run from Austin to San Juan, which, ironically, had a long layover in my hometown airport at Dallas/Ft. Worth. I decided to check out this elusive club called the Centurion Lounge by American Express, located at Terminal D.

It being a slow day of weekend travel in early December, the lounge attendants granted me a free one-day pass and I entered into the lounge to help myself to the hot food items and bar service while mulling over the benefits of the card.

Being DFW-based, I thought that the immediate perk of the lounge, which is billed at an annual $450 fee. While hefty, I did some mental calculations, consulted a few friends and family members, and decided to sign up.

One year later, the benefits of the card have exceeded the costs greatly, and I consider the card to have paid for itself easily within months. Here is why:

The Lounge Access Alone Is a HUGE Perk

Even if you are not based in any of the cities with airports offering the AMEX Centurion Lounge, it is quite likely that you will be traveling to one of them or through one of them on a layover. This year, in addition to visiting the Dallas/Ft. Worth location, I have visited six out of the seven U.S. Centurion Lounges, and truth be told, I had only planned on traveling to one of them at the time that I signed up for the card. Today, the lounges are located at Dallas/Ft. Worth, Seattle, San Francisco, New York LaGuardia, Miami, Houston and Las Vegas. In 2016, my travels took me through all of those locations, sometimes on multiple visits throughout the year, except for Las Vegas.

During layovers in Miami and San Francisco, I was impacted by irregular operations, which led to missed connections and subsequently, being stranded at both airports for longer-than-desirable periods. Thanks to the lounge, I pretty much never went hungry, and used the shower facilities in both locations to freshen up. The showers generally do not have a long wait time in most locations. I took one after arriving into SFO from a long journey to Malaysia and China last spring, and again in Houston after a 10-hour flight from London.

The hot food and beverage items easily outshine options located in any other U.S.-based clubs run by U.S. carriers. Generally, each of the individual clubs feature dishes by local celebrity chefs unique to each city, which is a great way to sample regional fare without leaving the airport! Even though the major carriers such as American, Delta and United are improving their clubs, they generally charge for premium drinks, for example. At the AMEX lounges, craft cocktails are complimentary (although I always tip the bartenders generously).

There are other perks, too: if you are flying on a Delta flight, you can use the Delta SkyClubs by showing your AMEX Platinum Card and your Delta boarding pass. This also works at Alaska Airlines Boardrooms if you are flying on Alaska. The only challenges is, though, that additional guests are subject to the $29 day-pass (as I just recently discovered at LaGuardia). Conversely, the AMEX Centurion lounge allows members to bring up to two guests, for free.

Finally, on international travel, AMEX Platinum cardholders have access to Priority Pass lounges. There are supposedly thousands of Priority Pass Clubs around the world, but I haven’t had a chance to venture too far into this area this year. That being said, once you sign up for the card, you are prompted to the external instructions on how to become a Priority Pass member and receive email updates, log-into the app (which is sleek and has a great interface!) and plan ahead.

I kept track of the number of times I visited the AMEX Lounges (and other lounges) between signing up in mid-December and today. In total, I visited the AMEX Lounge exclusively, approximately 11 times, and brought family members as guests on 3 of those occasions. If we assume that a standard airport meal costs $15, that amounts to 15 x 14 = $210 in hypothetical expenses incurred.

You Get $200 in Credits Every Calendar Year

This is another reason why signing up for the card NOW will be immensely valuable, because you can redeem this credit before December 31, 2016 and again starting January 1, 2017 for the next calendar year. I will be honest, I did not discover this until early 2016, hence forfeiting an additional $200 in credits I could have earned (amateur hour, I know!) but on the flip side, I also discovered that these credits CAN be applied towards booking airline tickets. Initially, I thought that the $200 annual credit only goes towards fees incurred (such as bag fees, wifi, in-flight purchases, etc) but in actuality, it can be used to purchase gift card vouchers on your preferred airline, and then AMEX eventually reimburses those fees to you.

CAVEAT: When signing up for the card, you must select a preferred airline, and you are only permitted to change this selection once per year. I highly recommend knowing what your preferred airline is in advance before committing to the card, and then from there, checking FlyerTalk to make sure you are up-to-date on whether or not the Gift Voucher purchase situation is still working with your preferred airline. The gurus at FlyerTalk have dedicated threads for each airline where you can do your research to make sure that the Gift Card redemption works.

If it does, you should be able to see AMEX refund the amounts of your purchases on your statement within a few days. I know that at my designated, “preferred carrier,” the secret, in early 2016, was to purchase two gift cards in $100 increments, whereas with others, it was 4 purchases of $50. Both work, and both can be used to purchase airline tickets.

That right there adds an additional $200 worth of benefits to the card.

Sign-up Bonuses Can Pay for a Premium Long-Haul Trip

AMEX was offering a 40,000 sign-up bonus for $3000 worth of purchases within 3 months of signing up for the card. These points, in addition to points earned by every day purchases, can be converted to a variety of purposes, such as frequent flier points, shopping or paying for purchases.

In my case, the points from the sign-up bonus permitted me to buy a First Class ticket on Delta from Dallas/Ft. Worth to London Heathrow, via Detroit, with the Detroit to London sector operated by Virgin Atlantic in Upper Class.

While AMEX currently is not offering any sign-up bonuses, they are offering 5X points for flights booked with AMEX Travel or directly with airlines. This is a big boost, and one that sets the card ahead of its major competitors such as the Chase Sapphire Preferred or Chase Sapphire Reserve cards, which offer 2x points and 3x points per dollar, respectively.

Finally, AMEX offers provide incredible deals, on a seasonal basis, for bonus points on certain purchases with various businesses. During the holidays, for example, AMEX offers double, triple or even quadruple points for purchases with retail stores such as Best Buy, Target, Groupon and Home Depot.

Another caveat, however: if you do choose to transfer your points to a partner airline or hotel, the selections of carriers that AMEX partners with is limited. As such, even though Delta is not my “preferred carrier,” I do have to transfer all of the AMEX points I earn to Delta’s SkyMiles program, which I am fine with.

TSA PreCheck Will Expire Sooner than You Expect

I signed up for Global Entry and TSA PreCheck in February 2013. As such, I am a little over a year away from losing this benefit before I have to sign-up for it again.

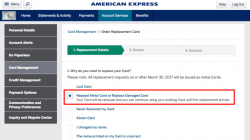

Thanks to the AMEX card, I can have this expense covered, and therefore not incur the fee. If you choose to add additional members to your AMEX Card (you can add up to three for an additional $175) then you can apply this fee to one of the members, assuming they either don’t have the Global Entry or TSA PreCheck perk yet, or theirs is expiring soon. Please note: ALWAYS sign up for Global Entry, which automatically grandfathers you into TSA PreCheck. Do not sign up for TSA PreCheck alone, as you will not be given Global Entry.

Get Gold Status with Hotels and Rental Cars

I’ll be the first to admit, I know next to nothing about hotel and rental car loyalty programs, but I finally took baby steps this year when I was able to enjoy loyalty status with the AMEX Platinum Card. As a member, you automatically receive Starwood Gold Status, Hilton Honors Gold Status, and elite Status with Avis, Hertz and Enterprise. Woah.

Again, I inadvertently had a lot of stays this year with Starwood hotels as part of my Masters program. As a Gold Member with Starwood, I was able to earn 3 Starpoints for every U.S. Dollar spent on stays, upgrade to a junior suite, receive a complimentary beverage, free internet, a free welcome gift, late check-out and a chance to draw from the, “Gold Bowl” upon check-in.

I also rent cars quite often when I travel, and now I have Hertz Gold, Avis Preferred and Enterprise Emerald status, all thanks to the card. The card also provides rental insurance and damage protection.

Boingo!

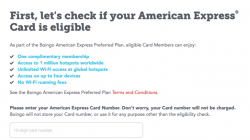

Finally, the card comes with a FREE Boingo Wifi membership account, which permits you to sign-into locations with Boingo WiFi and enjoy premium membership, without having to pay extra. This has been hugely helpful in airports like Chicago Midway, which sets restrictions on complimentary access to just 30 minutes. I have been delayed at Midway enough times to warrant the need for moAre than 30 minutes during my travels this year.

Bottom Line: Treat Yourself to the AmEx Platinum Card this Holiday

A year-in, I can proudly say that this card has been a HUGELY valuable investment, and provided more benefits than I imagined when I first signed up. I am not one to recommend credit cards unless I know that the payoffs are worthwhile, and I am also a bit of a scatter-traveler who has rather fragmented loyalty patterns.

If you are someone who wants versatility, while also providing some nice perks and benefits in situations like irregular operations, this is a card to have. So, treat yourself this holiday season (and get a few extra bucks to spend on travel for 2017)!