“Airlines are crazy.”

That’s what my dad said after booking his trip to New Zealand, something he’s been talking about for over a year. He likes visiting new places, but the problem is he doesn’t like flying all that much. For some people there’s no way to make it comfortable, and spending 13 days in the land of Middle Earth didn’t seem worth the punishment of spending 13 hours each way in a metal tube — even if it does have lie-flat seats.

But this story isn’t about my dad’s distaste for commercial air travel (he loves flying his own plane). It’s about how he saved over $1,000 by booking his tickets through the American Express International Airline Program, an oft overlooked benefit of the Amex Platinum Card.

Megan recently upgraded her Amex Premier Rewards Gold card to the Platinum Card because I plan to cancel my Business Platinum Card. The annual fee is slightly higher on the business card, and it’s more expensive to add additional cardholders. It’s only $175 to add a total of three additional cardmembers to the consumer version, so I’ll still have all the same Platinum Card benefits through Megan, and we gave a card to my dad, too. (The one benefit that does not carry over to additional cardmembers is the $200 airline fee credit, which is exclusive to the primary cardmember.)

You see, my dad has some miles, but he insists on flying non-stop to New Zealand. Ain’t gonna happen as far as award flights are concerned, so he decided to pay for business class. It was pure luck that Megan upgraded her card right around the same time.

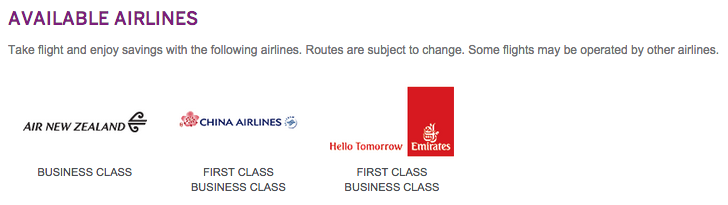

His eventual itinerary is non-stop from San Francisco to Auckland, onward to Christchurch, and then an open jaw returning from Auckland to San Francisco. The cheapest business class fare I could find on Air New Zealand for this exact route was $6,204 — and even if I made it less less convenient with a few domestic connections flying out of Los Angeles it would still be over $5,000 per person. A reasonable price to New Zealand, but we could still do better.

The International Airline benefit requires that one passenger — the primary cardmember — purchase a fully refundable business or first class ticket. That means it’s going to cost much more than the discounted $6,204 I found. But the second passenger only pays the taxes and fees, including any fuel surcharges. In the end he paid a total of $9,110.60 — $8,229.80 for himself and $880.80 for his girlfriend. Add on $39 for Amex’s reservation fee.

He easily saved over $1,000 off the cheapest option and got fully refundable tickets in case he changes his plans. Going by what he would have paid for the non-stop flights he actually reserved, the savings are nearly $3,330. He can even change the return itinerary after he reaches his destination in New Zealand.

Airfare is well known to be hard to predict, and calculating it by hand requires a little practice. So you can understand my dad’s disbelief — “Airlines are crazy” — when he not only saved a few thousand dollars but also got a more flexible ticket. Why? Because someone else in the family has a shiny plastic card. He could reimburse Megan for the annual fee and still come out ahead. (No, we won’t ask him to do that.)

This benefit doesn’t catch the attention of most people who read points and miles blogs because it still involves a huge cost. Most of us don’t have $10,000 to spend on airfare. I started this particular blog talking about how I could earn Premier 1K status with United Airlines for $4,000. That was my bill for the entire year, not a single trip. But my dad works hard and can afford this purchase. I know some other readers can, too. I remember one who mentioned that he often books these tickets for work, and it’s an inexpensive way for his wife to tag along.

I don’t mind writing about this benefit because this blog isn’t about traveling at the lowest cost possible. It’s about traveling in the best way possible. That’s something everyone can learn to do, and it varies with your own habits and tolerance for the different antics each strategy involves. I have a co-worker who takes only a few trips a year for work. He doesn’t join loyalty programs because he doesn’t see the value, but that’s money left on the table. Someone else might use a credit card that earns only 1% cash back and has an annual fee when there are plenty of 2% cash back cards with no annual fee. Some of the big bloggers can probably afford to buy their own tickets, but they still have fun earning and burning miles.

My dad was going to fly one way or another and pay close to five figures. At least this way he has a little extra to splurge on a hotel — maybe even one booked through the Amex Fine Hotels and Resorts program that offers free breakfast plus a few other amenities. Regardless of your budget or your trip, there’s no reason to pay any more than you have to.