From the desk of the Devil’s Advocate…

Conventional Wisdomers in the points and miles community universally sing the praises of the three major flexible miles currencies – Chase Ultimate Rewards, American Express Membership Rewards, and Starwood Preferred Guest (SPG) Starpoints. And with good reason, as these points tend to give you the most options for redeeming with various airline and hotel partners, which protects you from sudden devaluations in any one program.

But it’s not all joy and happiness in the flexible points world, and not everyone is willing to admit it.

So today we’re starting a three-part series focusing exclusively on the downsides of these three flexible loyalty programs. Next week we’ll cover SPG’s Starpoints and in the final week we’ll take on the current granddaddy of them all, the Chase Ultimate Rewards program.

Today though, American Express is on deck. So here’s why Membership Rewards points are just so darn awful…

Lots and Lots of Airline Partners, But Not a Single Good One

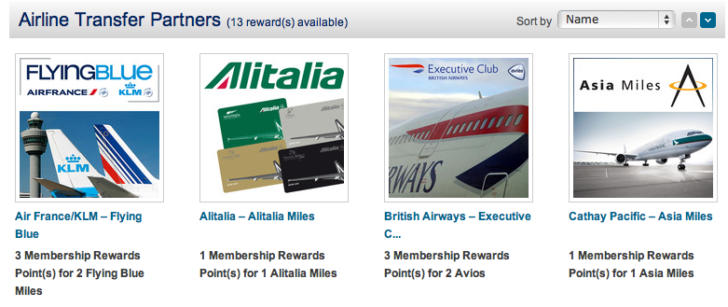

The airline partners of Membership Rewards change from time to time, but right now they have upwards of 17 airline partners. That’s more than Chase but less than SPG, which means one might consider their roster somewhat middle of the road.

But let’s take a close look at the quality of these partners. First off, the major U.S. domestic carrier partner is Delta. That’s right, Delta. As in Delta Air Lines. As in Delta Air Lines SkyMiles. As in Delta Air Lines SkyMiles that will be even more useless 5 months from now when they add two more tiers to their already convoluted redemption chart.

I think it’s fair to say that when it comes to mileage currencies, Delta isn’t impressing anyone.

AmEx also has Frontier Airlines as a partner. I was recently confronted with an orphaned 1,000 Frontier EarlyReturns miles that were going to expire if I didn’t have some activity in my account within 30 days. The good news is that I discovered I could extend that expiration date by transferring 1,000 Membership Rewards points into my Frontier account. The bad news is that would leave me with… 2,000 Frontier miles. I think you already know the end to this story (spoiler alert: I let the 1,000 Frontier miles expire.)

What about international partners? AmEx has British Airways as a partner. Great. So does Chase and SPG. Who else? Virgin Atlantic. That’s good. Except so does Chase and SPG. Sensing a trend here?

Then there’s El Al. If you think El Al is a good choice for an airline, I suggest you look over some of the many posts on the subject by our friend Dan over at dansdeals.com. Dan recently congratulated El Al for bringing their business class cabins up to 1994 standards by upgrading their seat design to a “bed-like” seat.

Hmmmm, you know what else is a “bed-like” seat? An Ikea futon. Anyone want to fly from the U.S. to Israel on an Ikea futon?

Ahhhh, but wait! AmEx Membership Rewards has Singapore Airlines, and Singapore has their infamous Suites Class. That’s an excellent redemption opportunity. Clearly American Express has a “sweet” partner right there.

Except that SPG also has Singapore as a partner. And Chase just added them too. And then so did Citibank Thank You. Yeah, you heard me… Citibank Thank You points can now be transferred for the same premium Singapore Suites and at the same 1:1 transfer ratio as Membership Rewards. Aren’t these are the same Thank You points people were trading for Magic The Gathering cards just a few months ago? At this rate it’s just a matter of time before 12 stars at Starbucks gets you halfway to a business class redemption on Singapore’s fifth freedom flight between New York and Frankfurt.

Most of the rest of the Membership Rewards airline partners (such as Air France, ANA, Aeroplan) charge stupid fuel surcharges on most of their flights, which makes them mostly useless for those of us who are so cheap that we don’t even want to pay a few hundred dollars for a premium redemption. Because why should we? We spent a lot of time traipsing to WalMart and fighting with that horrible ATM kiosk! We earned that free business class seat!

Useless Hotel Partners

OK, so the airline partners aren’t all that great. What about the hotel partners? Well, we’ve basically got three options on that front – Best Western, Choice, and Hilton. (Yes, also SPG, but we’ll get to that in a moment.)

I will be the first to admit that I don’t think I’ve stayed in a Best Western since 1982, and only then because Dad thought the breakfast buffet would be a “great deal” (spoiler alert: he was mistaken). On the other hand, I’m not particularly familiar with Choice Hotels. All I know about them is that Wikipedia claims they have over 7,000 properties, but I can’t remember ever seeing a single one.

And while Hilton is still a quality hotel chain, keep in mind that 50,000 Hilton points won’t even get you a Magic The Gathering card at this point. Not even a Vulshok Berserker.

Compare these three Membership Rewards hotel choices to the three main choices of Ultimate Rewards, which are Hyatt, Marriott, and IHG. Something tells me AmEx needs to start reconsidering their hotel partner contracts.

Your Transfer Ratios Are Weak, Old Man!

“But you’ve purposely left out a few of the bright spots on the Membership Rewards partners list,” complain the Conventional Wisdomers. “You can transfer your points to SPG, which is an excellent partner. Or smaller domestic carriers like Virgin America or JetBlue. There’s value to be had there.”

Sure, there’s value there, if you don’t mind losing 2/3rds of your points in the process. Because Membership Rewards points transfer to SPG at a 3:1 ratio. Uggghhhhh. Virgin America isn’t much better at a 2:1 ratio, and JetBlue comes in at a 5:4 ratio, which I have to assume was only implemented to make those of us who were terrible at high school algebra feel bad about ourselves.

Compare those ratios to Ultimate Rewards which doesn’t have a single partner that transfers at anything less than a 1:1 ratio, and SPG which is also almost entirely at 1:1 except for a few random partners that no one really cares about. Yes, if you were wondering, I’m including United in that “few random partners that no one really cares about” comment.

The Devil’s Advocate says Membership Rewards ain’t all peaches and cream anymore.

There’s obviously some positives about Membership Rewards that we’re purposely leaving out here because this is specifically a look at the negatives of the program. But when I sat down to write this post, I honestly thought it’d be harder to find so many negatives. It turns out that a deeper look shows a lot of ground has been lost over time. Membership Rewards used to be something special, but now others have caught up and even surpassed it as a flexible mileage currency. American Express has some work to do if they want their program to be an industry leader again.

But don’t think there’s complete safety in the other two programs either. We’ll leave that discussion for next week. In the meantime, remember to not put all your points in one currency basket…

Devil’s Advocate is a weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by sending an email to dvlsadvcate@gmail.com.