It’s the holiday season, which means gifts! Lots and lots of gifts. In fact, I think it’s important to note that we have arrived at a point in the history of the United States where, regardless of your faith, creed, or political beliefs, December means one thing above all else… free stuff!

In my case, holiday gifts always include a retention offer from Barclaycard for my American AAdvantage Aviator card. Since my annual membership fee posts in January, a preemptive bonus offer inevitably appears by e-mail or snail mail right around the holiday season, whether I’ve asked for it or not.

Normally, the offer is decent enough that it’s worth keeping the card for another year, though I usually call and get an annual fee waiver on top of the bonus miles as well.

Yet this year, I’m honestly not sure if I should bother.

American miles have devalued pretty drastically in the last 12 months. But it’s more than that. It’s award availability. It’s opportunity cost (whatever that oft-used phrase means). It’s a general malaise with American’s deteriorating loyalty program (and frankly all non-flexible travel loyalty programs). It’s all to the point that I’m seriously considering skipping this year’s Aviator bonus offer entirely.

Am I crazy? Like a fox? Or just crazy?

What’s the offer?

If you think I’m about to complain about my bonus offer this year, I promise I’m not. It’s the standard offer I get every year. If you’ve got an American Aviator card of your own, you’ve probably gotten it yourself right around the time your annual fee is due. It’s this one…

It’s a pretty generous offer — 15,000 American AAdvantage miles for $1,500 in spend over 3 months, on top of the usual 1 mile per dollar spent. That’s effectively a return of 11x on the entire $1,500 in spend. Other than the annoyance of having to keep track of the $500 per month requirement, that’s not a terribly great burden. So it’s pretty easy to pick up these miles just through normal natural spend.

(There are a few other versions of this offer running around, and you might get one of the lesser ones such as $1,500 for only 5,000 extra miles. But to my knowledge, this 15,000 mile version is the most prominent one.)

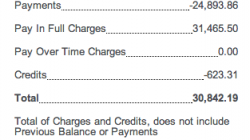

Now, if we’re going to look at this completely objectively, we should include in our calculations the $95 annual fee that is imminent for the vast majority of folks who receive this offer. I’ve had good luck calling to get it waived every year, even while also taking this bonus offer, but that’s not a guarantee.

So if we value the extra 15,000 American miles at 1.7 cents per mile (which is how Our Fearless Leader Scott currently values American miles) and then subtract the $95 annual fee, we get a net value of $160 in miles. Short of any credit card signup bonus spends we might be working on, that’s probably better than we could do with that $1,500 on any other card.

And yet, is it worth it?

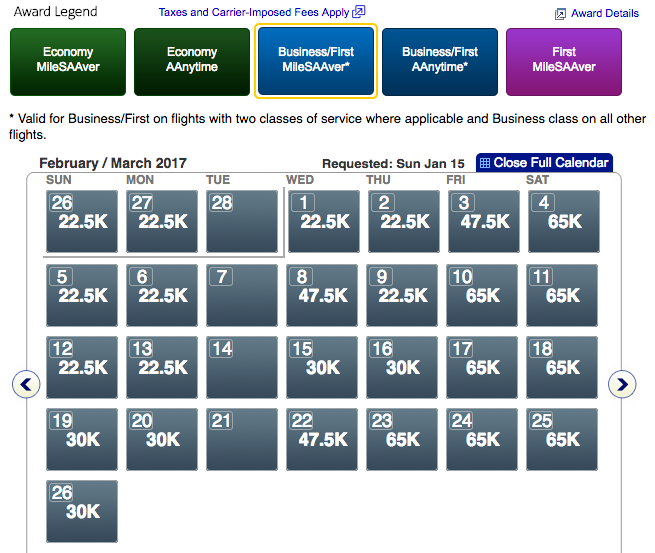

I currently have about 250,000 American AAdvantage miles in my account, and you will probably not be surprised to learn that I’m sitting on all those miles because it’s become practically impossible to actually use them.

In the last 6-12 months, American award space has been atrocious. I mean, embarrassingly appalling. Particularly in premium classes, but even in economy class it’s just awful. On some routes, even in the winter months with the lowest demand, there is literally nothing available at Saver level.

I’m aware that airlines are doing well and flights are full, which means less award space in general. But United space isn’t anywhere this bad. And I never thought I’d say this, but Delta space isn’t anywhere near this bad either. That’s right, SkyPesos space.

So put aside that 1.7 cents per mile valuation, or the effective 11x bonus spend multiplier, or even just the joy of seeing an extra 15,000 miles land in your account. None of it matters if you can’t use the damn miles.

There’s also a new Aviator card coming.

Back in July, American announced a new credit card agreement which will allow Barclaycard to begin issuing new American Aviator credit cards as soon as next month. Barclaycard has been known in the past to allow customers to hold multiple copies of the same card, but in recent years they’ve tightened up on that policy. So what better time than now to cancel my existing American Aviator card, skip the annual fee, and pick up a brand new Aviator card with a brand new signup bonus in January?

Before the original Barclaycard agreement with US Airways died due to the American merger, Barclaycard routinely offered 50,000 miles as a signup bonus. Given that signup bonuses have only gone up in the time since then, it’s highly likely that we’ll see at least that much as a new signup bonus next month, and it could be even higher.

Of course, you could argue that if 15,000 American miles are useless, then 50,000 are 3.33 times as useless. Quite frankly, if you did make that argument, I would probably concede the point.

Regardless, if you do still value American miles, then having more of them is better. You’ll do better spending your $1,500 on a new signup bonus than an old retention bonus.

Will the Devil’s Advocate take those 15,000 extra miles?

Let’s see… I’ve got a $10,000 spend I need to meet on my upgraded Amex Business Platinum for 50,000 bonus points, each of which will be worth a guaranteed 2 cents on any flight. I’ve got bonus offers from Citibank for extra ThankYou points, which are also guaranteed to be worth 1.6 cents per point on any American flight until July 2017 (and I don’t have to worry about non-existent availability). And I’ll probably sign up for a few more cards before the end of the year, which will mean I’ll have to finish those signup bonus spends as well.

Guess where my $1,500 isn’t going?

Yes, American, I know you’ve been hearing these complaints for months now. It’s easy to stick your head in the sand and maintain that eventually your customers will accept the new AAdvantage. But you’re whistling Dixie.

Your airline is an operational disaster. Your flights are routinely delayed or cancelled. You refuse to update your flight status times even when it’s perfectly clear to everyone with half a brain that a flight isn’t going to leave on time. Your agents are upgrading people out of order just so they can meet your arbitrary D+0 deadline, which is still not getting you even close to Delta’s on time performance level and is ticking off your elite customers in the process.

Honestly, the only thing that kept people like me loyal to American was the loyalty program. (See how it’s in the name, American? Loyalty program?) But the situation has gotten so awful that despite the fact I’m only 7,000 miles away from requalifying for Executive Platinum status for 2017, I might flat out skip it anyway. At the very least, I can guarantee I will not bother even trying to requalify for 2017. Because why would I?

But don’t worry, American. I’m sure eventually Delta will do something awful to their own loyalty program again and we can go back to hating them instead. Though at least their flights run on time.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Is It Worth Buying Elite Status? The Answer May Surprise You! (No, really, it might.)

- Why The New “World of Hyatt” Elite Program Is A Major Enhancement

- These 5 Credit Cards Are Turning Into The Only Ones You’ll Ever Need

Find the entire collection of Devil’s Advocate posts here.