Several credit cards offer some kind of special bonus if you spend a certain amount in a calendar year. This post isn’t meant to detail all of them, but I’ll say that Megan and I were aiming for three this year and have successfully hit them all:

- Spend $30,000 on the British Airways Visa to earn a free companion ticket good for paid or award travel

- Spend $30,000 on the Amex Premier Rewards Gold card to earn 15,000 bonus Membership Rewards points

- Spend $40,000 on the Hyatt Visa card to earn an additional 10 nights and 5 stay credits toward Diamond elite status

There are some of you, I’m sure, who can use manufactured spend to hit an annual spend threshold of $40,000 in two months. All it takes are two Bluebird cards for you and your spouse and a 50% success rate in convincing your parents to let you use theirs. But manufactured spend is not my focus, so I use it only occasionally. The bigger factor this year was our wedding expenses. If we relied only on regular expenses, we might not charge more than $25,000 to our cards in an entire year — not enough to satisfy any one of the bonus thresholds I mentioned let alone all three.

(No, our wedding did not cost $100,000. We used a combination of regular spend, wedding spend, and manufactured spend to reach these goals.)

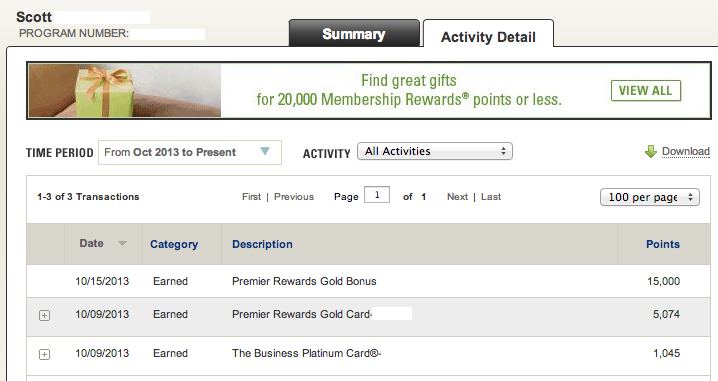

American Express makes it very easy to track how much you’ve been spending and whether you’ve earned your bonuses. After logging in to your account summary, just select “Year to Date” from the “Time Period” menu at the top to view all transactions. It summarizes the numbers and even provides a net total less returns. To the right, you can find a Membership Rewards earning summary. Click on that and go to the “Details” page to see that your bonus was awarded properly.

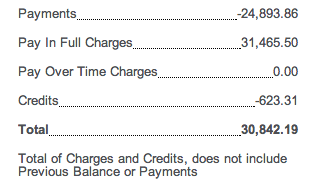

Chase is more difficult. They don’t summarize these numbers for the year, but you can download a spreadsheet with all your transactions. I open this in Excel and use the “Sort” feature to organize it by the type of transaction: Purchase, Return, Payment, etc. I don’t even bother looking at the purchases and returns. Since I pay off my balance in full each month, and I wouldn’t be paying for returns, I only look at the Payment numbers.

This was easier in the beginning of the year than looking up each statement individually. However, I later realized that when you download your account summary from Chase it only gives you the most recent six months. For some reason I thought I had $8,000 more to go on my Hyatt Visa and never seemed to be getting any closer. In fact I had overshot the target by $5,000. So you may want to look at your account statements anyway.

The bigger problem was that Chase did not properly credit my Gold Passport account for the night and stay credit, and it took me a little digging to figure out exactly how it was doing it.

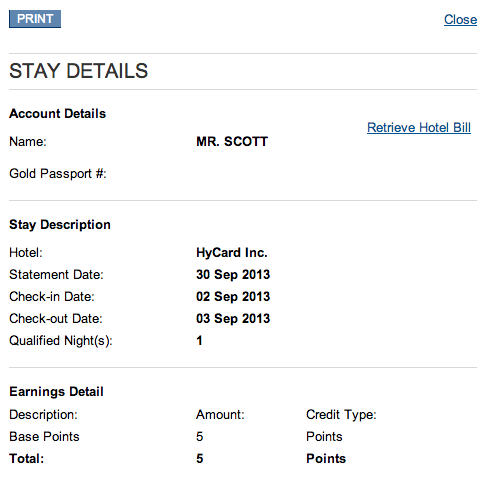

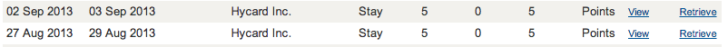

It turns out that Chase can’t just add nights and stays to your account. They need to somehow be listed like any other hotel stay. If you look at your Gold Passport account summary online it will list all transactions along with the name of the originating property, like the Andaz Maui or Grand Hyatt Tampa. For points earned through credit card spend, it lists it as HyCard Inc.

Chase just creates a “fake” stay at the HyCard Inc. hotel when it awards stay and night credit. To create multiple nights, it increases the length of the stay, say from September 3 to September 6 (3 nights). To create multiple stays, it repeats this process, and you get a measly 5 points each time, too. A second stay from September 6 to September 8 would earn a total of 5 nights, 2 stays, and 10 points. This worked fine when Chase awarded me 2 stays and 5 nights for clearing the first $20,000 spend threshold, but it provided only partial credit for the second threshold at $40,000, missing an extra stay of 2 nights.

Hyatt’s Gold Passport desk is not responsible for fixing this issue. You’ll need to call Chase, and in my case I had to explain to the phone representative exactly how their system was processing these. He wanted to send me back to Hyatt because he can’t see my Gold Passport account statement. But after I gave him line-by-line information on the dates for these fake stays, he was able to follow along and put in a request to get me the extra 2 nights and 1 stay that I’m missing.

Since Hyatt is running a promotion right now that offers bonus points for ever 5 nights, I hope these might qualify for that, too! But he did say that it could take one or two billing statements to show up, which gets us toward the end of the year. I’d rather get this taken care of as soon as possible to avoid any complications receiving my Diamond status.