All good things come to an end. Or they’re replaced by something better.

Travel loyalty programs are one of the greatest marketing inventions of modern times. From the first mileage-based frequent flyer program launched by Texas Air in 1979 to today’s programs that boast of tens of millions of members, travel loyalty programs have grown massively and become hugely profitable over the last few decades.

But of course, whenever someone has a good idea, it’s only a short while before others copy it. Then after a while, the alternate versions become even better than the original and eventually the original either adapts or is driven out of business. (However, this is not guaranteed, as I am still patiently waiting for someone to improve on the “Groucho Glasses” concept.)

There have been many negative changes to the vast majority of airline and hotel programs over the last several years, mostly via devaluations, though other aspects of the programs such as availability and elite status have suffered too. In the meantime, banks who found themselves held hostage to ever increasing airline and hotel point costs have invested heavily in their own proprietary reward programs.

So, the question now looms… are the airlines and hotels close to falling off the cliff? Have they made so many cuts that one more step will mean customers fleeing en masse to bank programs that offer higher fixed value redemptions with guaranteed availability?

Rather than killing the golden goose, are the airlines and hotels letting banks steal her away?

The value of airline and hotel points are only getting worse.

While they haven’t taken the plunge yet, the Big 3 legacy airlines are inching closer and closer to fixed-value redemption programs. Delta has removed their award charts so that an uneducated consumer (which is, unfortunately, most of them) doesn’t even know how much a trip should cost anymore. It costs whatever the computer says it costs, which means we’re just a simple IT tweak away from those redemption prices being able to float freely with the current airfare.

The smaller airlines abandoned award charts long ago. Southwest, JetBlue, and Virgin America all use some modified form of a fixed-redemption system, where the value of points fluctuates slightly but never outside a fairly small range. None of those points are worth even 2 cents each, which means you shouldn’t bother with any of their credit cards except for getting the signup bonuses, since you can do better with a 2% cashback card. The only time you should be collecting Southwest, JetBlue, or Virgin America miles is when you’re actually flying those airlines (or maybe trying to grab a Southwest companion pass).

Hotel programs are even worse. With the exception of Starwood and Hyatt, points at the major hotel chains are often not even worth 1 cent per point. Is it any surprise we’ve been seeing signup bonuses for hotel cards go through the roof lately? IHG at 80,000 points? Marriott at 87,500 points? Hilton at 100,000 points? Who would want these cards other than for the signup bonuses and possibly a few bonus categories?

On top of all that, you can’t even earn hotel points or elite status nowadays when booking via an online travel agency. The airlines haven’t made that change just yet since their commissions to OTA’s aren’t usually as significant as hotels, but you can bet they’ve thought about it.

Meanwhile, the banks are improving.

While a good chunk of the value of flexible bank reward currencies comes from the transferability of points to airlines and hotels, all the major banks have also worked over the last few years on improving the value of booking travel directly with their points.

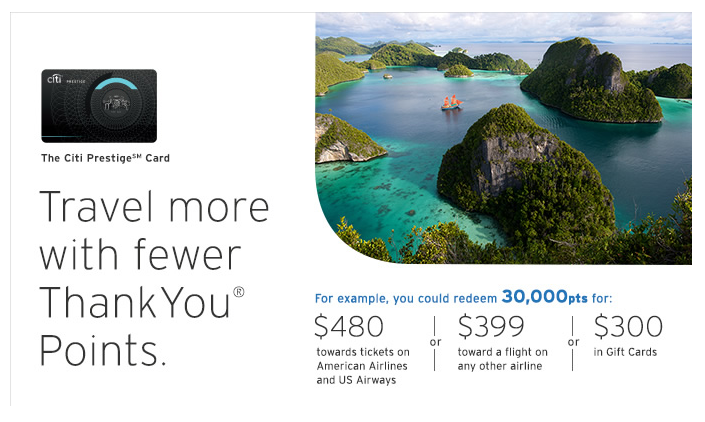

Citibank has offered up to 1.6 cents per point when booking American travel with their Citi Prestige card, and even though that will end in July 2017, ThankYou points will still be worth 1.25 cents per point for airline flights.

Over a year ago Amex launched a benefit on their Business Platinum card that offers a 30% rebate when paying for travel directly with points. You have to choose one specific airline per year for that particular rebate, but when booking that way, you’re getting over 1.4 cents per point in value.

Chase Ultimate Rewards have long been worth 1.25 cents per point when redeemed directly on travel. That’s just gotten even better with the Chase Sapphire Reserve card, which we’ll talk about in a moment.

And of course, the major complaint about frequent flyer programs has always been the lack of availability. Bank programs that allow direct redemptions do away with that problem entirely. You can always get any flight, and always at the same per point price.

Revenue-based redemptions will be the death knell.

Though bank rewards points are usually maximized by transferring them for premium redemptions, many “regular” folks prefer to use their points to go visit the family in Iowa for the holidays, which means transferability isn’t as vital. And the recent launch of the Chase Sapphire Reserve has brought this dichotomy into sharp focus.

With the new Reserve card, Ultimate Rewards can be redeemed directly for travel at a guaranteed value of 1.5 cents per point. On the other hand, Southwest (which is a Chase transfer partner) has a fixed-value redemption system where their Rapid Rewards points are worth 70 to 80 points per dollar, which comes out to 1.43 cents per point at best. (Yes, there are more complicated mathematics when you add in the fees, but let’s keep things simple for the purposes of this post).

So if you can redeem Ultimate Rewards directly for 1.5 cents per point, but you can only get 1.43 cents per point by transferring to Southwest, why would you ever transfer them?

And taking the analysis even further, is it ever worth transferring a flexible bank currency to a hotel chain like Hilton or Marriott or IHG when their points are usually worth less than 1 cent each at best? Wouldn’t you be better off just booking directly with the bank points?

Finally, if you’re transferring a bank currency to a hotel or airline worth less than 1.5 cents per point, does a simple Capital One Venture Rewards card make more sense at that point, or even a 2% cashback card? That portion of the analysis depends on which bonus categories you tend to spend your money on, but the point is that the airline or hotel currency has now become the least valuable of all these options.

The Devil’s Advocate believes that airlines and hotels are playing with fire.

The rumors are that Delta desperately wants to switch to a revenue-based redemption program. If they do and the rest of the legacy airlines follow (as they always seem to), they will be handing their future loyalty profits directly to the banks. Because if you can only get 1 cent per point in value for your Delta SkyMiles, there’ll never be a good reason to collect Delta SkyMiles ever again.

As it stands, the only thing preventing the wholesale abandonment of travel loyalty programs is the possibility of redeeming for high end premium experiences. Even for the guy who only travels once or twice a year and who might never actually go to Europe in first class, the idea that he one day could still drives his behavior. But if you make that possibility cost a billion miles, you’ve killed his fantasy.

A few years ago our fearless Travel Codex leader Scott argued that you should never pay with points, and I responded that at times paying with points could make sense. Since then, the argument in favor of redeeming for travel directly with bank points has only gotten stronger with each devaluation. So if the airlines and hotels are purposely trying to cut off their noses to spite their faces, it seems they’re right on track to accomplish their goal.

At least there’ll finally be a new use for those Groucho glasses.

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- The Future Already Looks Bleak For The Chase Sapphire Reserve

- The Ritz-Carlton Visa Still Ain’t All That

- Even After The Citi Prestige Devaluation, Is It Still Worth Keeping?

Find the entire collection of Devil’s Advocate posts here.