But Scott encouraged me to post today as usual, so I’m moving ahead. However, if you haven’t read Scott’s post yet, you should. It’s a perfect tribute to his father, to their relationship, and to the importance of remembering that “life is a journey best shared with others.”

From the desk of the Devil’s Advocate…

There’s been a great disturbance in the Force.

We’ve seen the closure or extreme limitation in multiple methods of manufactured spend. Bluebird, Serve, Citibank, Buxx cards, gift cards. We’ve taken so many hits lately that even Cam Newton is starting to feel bad for us.

So many MS methods have gotten killed recently that some people have begun speculating this is more than just coincidence. Why have so many techniques that lasted for years suddenly died in such a brief period of time?

A current of thought has begun to percolate in some corners of the community — is the federal government cracking down on financial institutions?

The Conventional Wisdom is that this is a fringe theory. Manufactured spend techniques are generally legal (unless you’re Tahsir) and the government has more important things to worry about. But is it possible that MS is getting caught up in the same net with money laundering methods? Are banks being put under a microscope for their prepaid products, or simply cutting back on those prepaid products in order to mollify government officials?

Is manufactured spend getting squeezed by Uncle Sam?

Let’s look at the evidence.

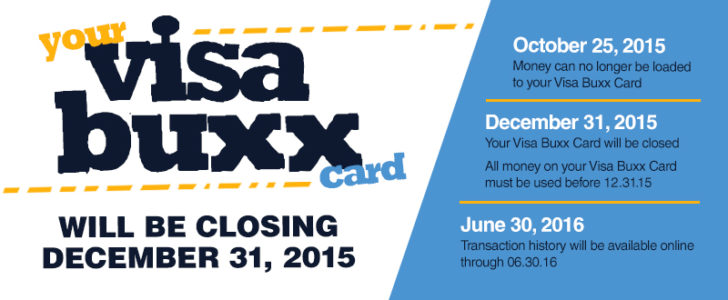

The first ball to drop was in December, when US Bank officially discontinued their Visa Buxx products and shut down all their Buxx cards. The program had been running for over 5 years and was a manufactured spender’s dream. But of course, MS methods come and go. This wasn’t the first time a popular technique ran its course, and while it was disappointing, most people reacted as usual by giving thanks for many years of low cost points and moving on to the next method.

But right after the start of the year, Nationwide came out with their own announcement. While they were not shutting down their Buxx program, they would begin limiting loads to $200 maximum at a time. This was a little more disconcerting, since it meant the last remaining Buxx option was no longer any better than buying a $500 gift card with a $5.95 fee.

However, the Nationwide announcement was quickly overshadowed when three days later Amex shocked the community by shutting down thousands of Bluebird and Serve cards for “unusual usage patterns.” Not unsurprisingly, it seemed the vast majority of those “unusual usage patterns” had to do with loading gift cards to Bluebird and Serve. Though a few survived the Bird Apocalypse, the shutdown of so many users at once got the Spidey sense tingling.

On top of it all, the availability of high-value gift cards has been quickly narrowing. Within the last month most if not all Safeway stores have pulled variable gift cards from their racks, leaving only fixed-value cards of $100 or less. And online gift card sellers such as giftcardmall.com and incentivecardlab.com are now routinely cancelling orders for multiple gift cards before they even have a chance to ship.

That’s a lot of shutdowns, all within the last 3 months.

The Feds are stepping up anti-fraud enforcement.

In January the New York Times described a new Treasury Department effort to scrutinize buyers of high-end real estate in an effort to stop their use as an avenue for money laundering. While that particular focus was on ultra-rich people hiding cash, the story also noted that the FBI has recently created a new unit to focus on money laundering.

Banks have been in the spotlight of anti-fraud enforcement efforts in recent years, especially since the War on Terror and the Great Recession. But the near ubiquitousness of prepaid products in today’s day and age have made it easier than ever for anonymous money to slosh through the system. So it’s not unreasonable to assume that law enforcement officials are simply fed up with trying to track this mountain of cash and are putting pressure on financial institutions to tighten things up.

I’m generally not a believer in the idea that the government is an all-knowing and all-encompassing entity out to get us. But given the timing of all these shutdowns, maybe it’s not completely crazy to think that the Feds are pushing banks to get their house in order.

Except there’s a simpler explanation.

Of course, that’s just one theory. And while it could be that manufactured spend has gotten caught up in the government’s web, it’s not the only possibility. In fact, when we take a closer look at how these shutdowns unfolded, it doesn’t seem like such a nebulous pattern at all.

Let’s go back and start with the US Bank Buxx cards…

The reason this shutdown wasn’t terribly surprising in the first place was because everyone knew it was coming. US Bank had stopped accepting new Buxx customers well over a year ago, so there was no chance they were going to continue to service existing customers indefinitely.

Also, it’s important to note that US Bank announced the Buxx closure all the way back in September. So even though the shutdown actually occurred in December, it’s a bit of a stretch to link it to the later shutdowns in January.

What about the new Nationwide Buxx limits? Well, once US Bank killed their Buxx cards, most MS folks who had been using them made their way to the only remaining Buxx option. Undoubtedly Nationwide quickly found themselves with a whole bunch of new unprofitable customers, and they probably knew exactly why. It only makes sense that they would choose to cull out those who were only cycling money around. It’s fair to assume that Nationwide’s actions were a result of US Bank’s, not any edict by government officials.

Then there’s Bluebird and Serve. In the weeks before the shutdowns, Amex announced they would be laying off over 100 people directly employed in the St. Petersburg office that created Serve. And it became clear soon thereafter that Amex was scaling back its attempts to bring prepaid cards to the underbanked.

Why? Because quite simply, they weren’t making any money. Or as one analyst put it, “If Serve had been successful, Amex would have been out like a peacock bragging about it. The fact they kept so quiet for so long is, in itself, an indication these products never caught on.”

Finally, the newer restrictions on gift card purchases may very well be due to concerns about fraud. But it’s more likely to be the vendors themselves who are worried rather than the government. Since prepaid gift cards are often used as a conduit by criminals who steal credit cards, and vendors are usually the ones left holding the bag, it’s not unreasonable to guess that orders with large numbers of gift cards aren’t going to be accepted as regularly as before.

And for some stores to simply do away with large-denomination gift cards is just an easier (and more profitable) way to solve the problem than the restrictions many stores have implemented requiring the purchase of gift cards with cash only.

The Devil’s Advocate thinks it’s unlikely the evil government is at fault.

There are still plenty of potential manufactured spend techniques that are alive and kicking. The problem is in most cases they’re too expensive to be worthwhile. That fact alone should indicate the recent shutdowns have little to do with government interference. It’s not a coincidence that expensive options continue to exist while the cheaper ones are gone.

So before we go blaming Uncle Sam for the loss of our points machines, we should probably look at that other cause of all that is good and evil — the almighty dollar. It’s the more likely reason for banks to shut down our game. The FBI has better things to do.

Though just because you’re paranoid doesn’t mean they’re not watching you…

Devil’s Advocate is a bi-weekly series that deliberately argues a contrarian view on travel and loyalty programs. Sometimes the Devil’s Advocate truly believes in the counterargument. Other times he takes the opposing position just to see if the original argument holds water. But his main objective is to engage in friendly debate with the miles and points community to determine if today’s conventional wisdom is valid. You can suggest future topics by following him on Twitter @dvlsadvcate or sending an e-mail to dvlsadvcate@gmail.com.Recent Posts by the Devil’s Advocate:

- Are Ultimate Rewards Best Used for Buying Airfare Now?

- The Best Way to Load Your Amex Bluebird and Serve Survivors

- Targeting Conventional Wisdom in 2015 (and 3 Predictions for 2016)

Find the entire collection of Devil’s Advocate posts here.