Update: yes. And they’re all negative.

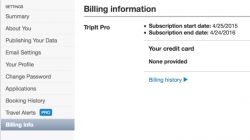

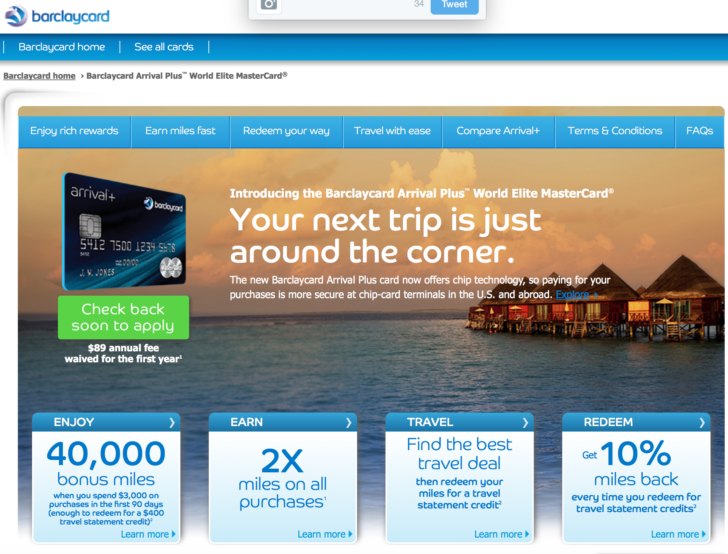

I was helping a friend decide which credit cards to apply for today, and suggested the Barclaycard Arrival Plus card. It has a great bonus (40,000 points, which are worth $444 toward travel), earns a fantastic return on everyday spending (2X points, which ends up coming out to 2.2% back toward travel), and even has great benefits like a free TripIt Pro subscription, actual Chip-and-Pin functionality, and no foreign transaction fees.

However, my friend messaged me saying that he wasn’t able to apply for the card. I checked out the card’s landing page and saw that Barclaycard is asking customers to “Check back soon to apply.”

I thought that this was maybe a site-wide issue for Barclaycard but other cards, like the Lufthansa Miles & More card, are still open for applications. In addition, as of 3:20pm eastern (give or take a leap second), I can’t seem to find either the Arrival or Arrival Plus on the page with all of Barclaycard’s products.

Could this mean that there are changes in store for the Barclaycard Arrival Plus? I can think of some possible changes (Note: this is all pure afternoon speculation while I’m at work counting down the hours to a holiday weekend)

Possible Negative Changes

- Loss of the 10% rebate? In practice, the Arrival Plus earns a 2.22% toward travel-related purchases. If I spend $10,000, I earn 20,000 points (2X). I can redeem those 20,000 points for $200 toward my balance. At the end of the transaction, I get 10% of the points back, or 2,000 points that are worth $20 toward a future transaction.

- An increase in the annual fee? The fee is waived for the first year, and $89/year after that. I actually love this card so much that I don’t mind paying the annual fee, and you can even redeem 8,900 points for the fee (and get an 890-point rebate). Other cards, like the Chase Sapphire Preferred or American Express Premier Rewards Gold cards, have higher annual fees ranging from $95 to $195. We just saw American Express raise the annual fee of their Starwood Preferred Guest card from $65 to $95, and the card is good enough that the annual fee hike is actually justified.

- The card will cease to exit – I don’t even want to think of this possibly happening, as this card is my go-to card for a lot of everyday transactions (and I’m sure it’s the same for many others).

Possible Positive Changes

- Increased travel benefits? For example, when I book a ticket using Flexpoints from my US Bank FlexPerks Visa, I get a $25 credit toward ancillary fees, like checked bags or buy-on-board food. It’d be cool if the Arrival Plus added a statement credit for things like air travel.

- Ability to transfer points to partners? Points like Chase Ultimate Rewards, American Express Membership Rewards, and Citi ThankYou Points can transfer to airline and hotel partners. Citi was the latest program to add this functionality. It’d be interesting to see if Barclaycard would do this, and what partners they would be.

Possible Neutral Changes

- The card is currently a World Elite MasterCard, and they might change to a Visa Signature product. In my book, those are pretty much the same thing to me, as most places accept both and the various Visa/MC-specific promotions are fairly even.

- DJ posted in the comments below that this could be positive if a change in payment network makes it a new card product that current cardholders can get for a second bonus. We saw this when the Chase Ink cards switched from Mastercard to Visa.

What do you all think? Are there changes coming to the card, and if so, what might they be? It could be just a website error, although I don’t see that being the reason if other cards are okay. I’ll keep tabs on this and update as needed.